Recently, Procter & Gamble (NYSE:PG) announced its 68th consecutive dividend increase along with its Fiscal Q3 results. Renowned for its portfolio of 65 household-name brands, the consumer staples titan upheld its long-standing tradition of growing dividends annually. In fact, P&G’s latest dividend hike marked a reacceleration from previous rates. Its Q3 report also included notable developments in earnings growth. Yet, the stock’s unjustifiably rich valuation forces me to remain neutral on PG stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

P&G’s Accelerating Dividend Hike Is Commendable

P&G’s most recent dividend hike broke a gloomy trend of underwhelming dividend increases. This April’s dividend boost was by 7%, marking a reacceleration compared to the lackluster hikes of 3% and 5% in the two preceding periods.

To a certain extent, it was almost essential for the company to boost the pace of dividend growth. Given the persistent heat of inflation, now hovering around 3.5%, merely matching the pace of dividend growth seen last year would essentially erode investors’ income and overall purchasing power in real terms. And given that P&G is primarily held by income-oriented investors and funds for its reliable dividend, another soft dividend hike would likely deteriorate investor confidence in the stock.

Decent Q3 Report, Including Raised Guidance, Inspires Confidence

P&G’s dividend increase came along with its Fiscal Q3 report, which was decent. While sales figures came in quite soft, P&G’s continuous focus on controlling costs and achieving internal efficiencies increased margins, leading to meaningful earnings growth. Thus, management felt comfortable enough to raise its prior guidance.

In particular, for Fiscal Q3, P&G posted net sales of $20.2 billion, up just 1% compared to last year. While net sales grew by 3% organically, entirely driven by higher pricing, the company faced a foreign exchange headwind of 2%, offsetting much of that increase. There was nothing out of the ordinary here. P&G’s products continued to reflect consumers’ regular purchasing patterns, with the majority of its brands comprising everyday household necessities.

The more interesting developments occurred in the company’s margin profile following cost-control efforts. Specifically, P&G’s core gross margin in Fiscal Q3 rose by 310 basis points year-over-year and by 400 basis points in constant currency.

The gain was powered by a 260 basis point gain from productivity savings, a 130 basis point gain from favorable commodity costs, and a 130 basis point gain from increased pricing. These gains more than offset the 100 basis point headwind caused by an unfavorable product mix and another 20 basis point headwind, mainly from product reinvestments.

At the same time, despite rising rates negatively affecting the profitability of most companies in the space these days, P&G’s favorable credit profile and ongoing debt paydowns led to interest expenses rising by just 5% to $233 million. Hence, the ongoing margin expansion was able to have a significant impact on net earnings, which grew by 11% to $3.75 billion.

Accordingly, management boosted its full-year guidance. While organic sales growth is still expected to be in the range of 4% to 5%, the ongoing margin expansion P&G is undergoing is expected to boost its full-year adjusted EPS growth to a range of 10% to 11% from last year’s EPS of $5.90. This is better than its prior guidance for growth of between 8% to 9%. I believe this is a rather strong development from the consumer staples giant, which also explains management’s decision to reaccelerate dividend growth.

P&G’s Valuation Remains Unjustifiably Rich

Despite P&G’s positive developments in earnings and dividend growth, I continue to find the stock’s valuation unjustifiably rich. Remember that aside from the cost control efforts and favorable commodity price movements (which can easily be reversed) that led to earnings growth, revenue growth has been completely stagnant for years. P&G’s last-12-month revenue growth CAGR (including Q3) over the past 10 years stands at just 0.5%. Even Q3’s organic growth of 3% was entirely due to pricing.

Cost-control efforts can only improve profitability so much. Given the lack of meaningful top-line growth, I believe it will be impossible for P&G to sustain the current pace of earnings growth for a long time. A growth rate in the low-single digits over the medium term sounds more reasonable. But then, it’s very hard to accept that P&G is currently trading at a hefty forward P/E of 23.2x. This is in line with its five-year average, even though interest rates have skyrocketed during this period.

In the meantime, the stock’s yield of just 2.6% is hardly attractive these days when you can earn 5% on your cash with a lower degree of risk attached. The premium can largely be attributed to income-oriented investors holding P&G tight due to its tremendous legacy as a dividend growth stock. But that doesn’t make justifying the ongoing valuation any easier.

Is PG Stock a Buy, According to Analysts?

Wall Street continues to appear more or less unbothered about Procter & Gamble’s valuation, evident in the current sentiment surrounding the stock. Procter & Gamble has gathered a Moderate Buy consensus rating based on 11 Buys and five Holds assigned in the past three months. At $169.60, the average PG stock forecast implies 4.9% upside potential.

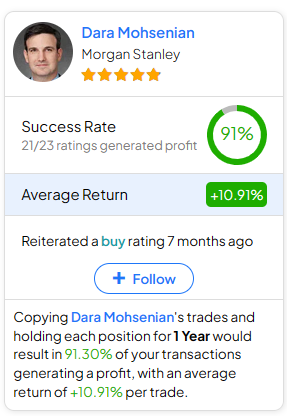

If you’re pondering which analyst holds the key to navigating PG stock trades, look no further than Dara Mohsenian from Morgan Stanley (NYSE:MS). He is the most accurate analyst covering the stock, featuring an average return per rating of 10.91% and a 91% success rate over the past year. Learn more by clicking on the image below.

The Takeaway

Overall, Procter & Gamble’s accelerated dividend hike, coupled with management’s commendable efforts to improve profitability, paints a picture of soundness. However, despite these positive developments, the stock’s rich valuation remains a concern. With stagnant sales growth and uncertainty regarding how long cost-control headways can last, its current valuation appears unjustified. As such, while P&G’s status may continue to attract dividend investors to the stock, I would urge caution against downside potential.