Investing in Dividend Aristocrat stocks can be a sound strategy for investors seeking consistent income and stability in their portfolios. These companies have a track record of increasing their dividends for at least 25 consecutive years, which reflects their financial stability and commitment to returning value to shareholders.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

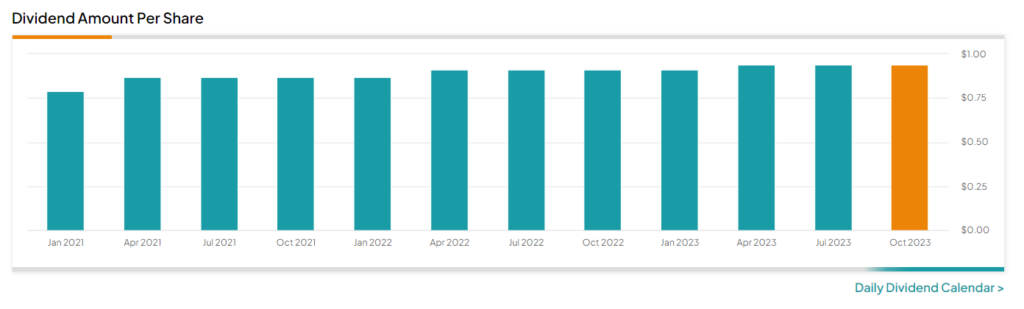

Consumer staples powerhouse Procter & Gamble (NYSE:PG) is one such company with an impressive history of raising dividends for the past 67 years. Furthermore, PG offers a dividend yield of 2.47%, surpassing the sector average of 2.13%. Let’s take a closer look at the stock.

Here’s What Makes PG Stock Worth Considering

During economic downturns, companies in the consumer goods sector, like P&G, tend to show resilience. This is backed by the company’s ability to maintain a steady demand for its household products, which include items from globally recognized brands like Gillette, Pampers, and Tide, among others.

In addition, PG remains focused on adapting to changing consumer preferences, which helps it sustain a competitive edge in the market. Furthermore, P&G’s financial strength is reflected in its consistent revenue growth and robust balance sheet.

In the fiscal first quarter, P&G delivered a robust performance as net sales reached $21.9 billion, marking a substantial 6% year-over-year increase. This growth was primarily due to a 7% surge in prices and a favorable product mix, partially offset by a 1% drop in shipment volumes.

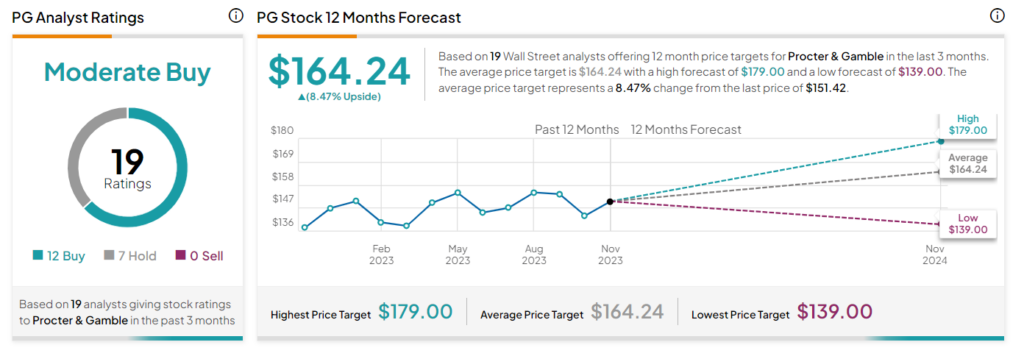

Citing bright prospects ahead for Procter & Gamble, Jefferies analyst Steven Desanctis initiated coverage of the stock earlier this week with a Buy rating and a $177 price target. The analyst anticipates sustained top-and bottom-line growth, surpassing industry peers over the next four years. Additionally, Desanctis expects easing supply chains and inflationary pressures to support sequential growth in margins, thereby positioning the company for better performance.

Is PG a Good Stock to Buy Now?

Analysts are cautiously optimistic about PG stock, with a Moderate Buy consensus rating based on 12 Buys and seven Holds. The average PG price target of $164.24 implies an upside potential of 8.5% from current levels.

Ending Thoughts

Procter & Gamble seems to be a reliable choice for investors looking for consistent income based on its uninterrupted dividend payments and steady growth. Further, analysts remain optimistic about the stock’s prospects.