I am bullish on Plug Power (PLUG) stock. If you truly believe in the future of clean energy, not only in the U.S. but internationally, then this is a great time to consider a long position in Plug Power shares. Sure, there will be speed bumps along the way, but the sustainability movement is here to stay.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Plug Power makes hydrogen fuel cells. There are other companies that do this, but Plug Power is probably the most famous one that specializes in this field and has a stock that’s traded on a major U.S. exchange. The company’s market cap is $9 billion, so it’s not too small but also allows room for rapid growth in the coming years.

As we’ll discover, Plug Power is expanding its market footprint in Europe, where the green energy movement is advancing quickly. Granted, there are issues and hold-ups on Plug Power’s home turf in the U.S. Always remember, though, that politics can impede progress temporarily, but a powerful movement like clean energy can’t be held back forever.

A Political Tug-of-War Creates Problems for Plug Power

There’s no denying that U.S. President Joseph Biden has grand ambitions for the sustainability movement in America. In particular, the Biden administration seeks to reduce U.S. carbon dioxide emissions by around 50% by the end of the 2020s. That’s easier said than done, though, as there’s bound to be pushback from the President’s political opponents in Congress.

It might be assumed that this pushback would come from Republicans in the Senate and House of Representatives. Surprisingly, though, there’s been resistance from a West Virginia Democrat, Senator Joseph Manchin. As Biden and other Democrats seek to pass a broad spending package that includes clean energy initiatives, Manchin’s objections threaten to derail the White House’s grand plans.

Why would Manchin object to green energy spending? Apparently, the senator isn’t in a mood to ramp up government spending right now, particularly in the wake of a red-hot CPI print. To quote Sam Runyon, Manchin’s spokesperson, “Political headlines are of no value to the millions of Americans struggling to afford groceries and gas as inflation soars to 9.1 percent.”

Since the Democrats only have a 50-50 majority in the Senate, Manchin’s vote is crucial. Without his support, Biden’s hopes for further federal climate change spending are put on hold, at least for the time being. Also, Congressional elections are coming up in November, and the Democrats might lose some seats in the Senate. In other words, the clock is ticking.

Upon the announcement that Manchin isn’t currently supporting the White House’s proposal for sustainability spending, traders dumped their Plug Power shares. It was a veritable bloodbath as Plug Power stock slumped nearly 13% on Friday, landing below $16.

Climate Change Legislation Could Still Get Passed

Apparently, investors connected the dots between Plug Power’s business model, as the company builds hydrogen fuel cells mostly for electric vehicles, and the hold-up in further federal spending on clean energy. Did the traders on Wall Street overreact to the news, though?

Headline risk might make you nervous sometimes, but it can also present terrific buying opportunities when traders panic-sell. Here’s a detail of the story that Plug Power’s investors might have missed. Reportedly, Runyon stated that “Senator Manchin has not walked away from the table.” Hence, the senator is apparently open to further discussions about passing further clean energy legislation.

Just consider how swift the relief rally might be if this legislation passes. Bear in mind, that politics is a slow process with a lot of conflicts. Political posturing and wrangling are normal and should be expected. The fact that traders dumped Plug Power stock below $16 shows how headline-sensitive they can be, but they might end up regretting their knee-jerk reaction.

After all, Plug Power’s future revenue won’t come entirely from the U.S. For instance, the company is teaming up with MOL Group to build a massive green hydrogen production facility in Hungary. Furthermore, Plug Power was recently commissioned by hydrogen company H2 Energy Europe to deliver a one-gigawatt electrolyzer in Denmark. On top of all that, Plug Power plans to construct a 35-tons-per-day green hydrogen generation plant at the Belgian Port of Antwerp-Bruges.

Wall Street’s Take

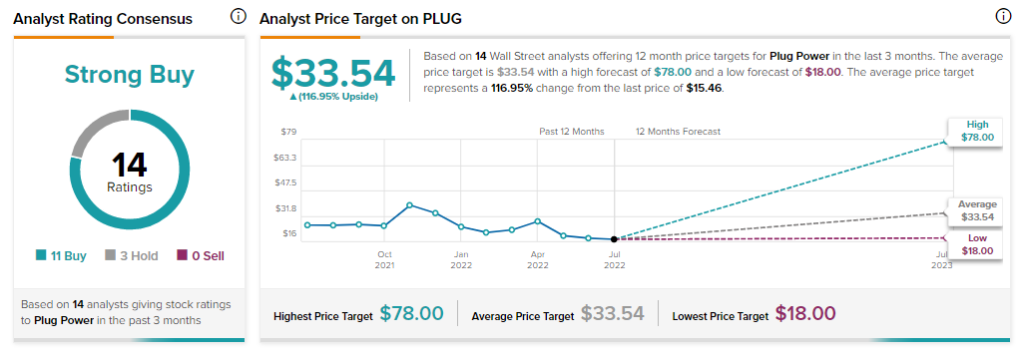

According to TipRanks’ analyst rating consensus, PLUG is a Strong Buy, based on 11 Buy and three Hold ratings. The average Plug Power price target is $33.54, implying 117% upside potential.

Plug Power Stock Could Recover from the Plunge

Sure, it was scary to witness Plug Power stock dive headfirst on Friday. However, Plug Power’s revenue won’t only come from its U.S. business. The company also has a major presence in Europe, where sustainability is a high priority.

Meanwhile, there’s been a hold-up in the White House’s plans for further federal spending on clean energy. However, this isn’t necessarily the end of the story. If the political roadblocks are cleared before the November elections, then Plug Power stock could power its way back up to fresh highs.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue