Social media stocks continue to be popular not just among their users, but also among investors. As some social media platforms, such as Meta Platforms (FB), venture into the metaverse, other social media companies are feeling the heat from the rising competition and the effects of the COVID-19 pandemic, seeing a fall in user engagement.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

According to an eMarketer report, the growth in users for social networks in the U.S. is expected to slow to pre-pandemic levels this year. This report states that FB will continue to do well, with users in the U.S. likely ballooning to 180.7 million this year. Social media platforms Pinterest and Snap are likely to come in significantly lower, with 89.6 million and 88.8 million users, respectively.

Using the TipRanks stock comparison tool, let us compare two top social media stocks on this list, Pinterest and Snap, and see what Wall Street analysts are saying about these stocks.

Pinterest (NYSE: PINS)

Yesterday, shares of Pinterest dropped 6.1% to close at $26.74, as there was news that at least seven senior executives have exited the company. The stock of the social media company has been on a downslide in the past month, tanking by 27.6%.

This slide has resulted from the exit of senior executives from the company as well as the year-over-year decline in the company’s monthly average users (MAUs) in the United States by 10%, to 89 million in Q3. Moreover, Pinterest’s global MAUs went up by only 1% year-over-year to 444 million.

For a social media company like PINS, MAU is an important metric as it indicates the level of user engagement.

As of November 2, PINS’ MAUs in the U.S. appeared to be flat at 89 million while global MAUs stood at 447 million. The company stated in its Q3 press release that it remains to be seen how the COVID-19 pandemic and its evolution will impact user engagement. The global MAU growth rate has slowed down for PINS in the past two quarters as, according to the company, “consumer preferences shifted away from our core at-home use cases.”

However, our website data for PINS indicates that when it comes to the total estimated visits by users, in Q4 PINS grew 12.5% year-over-year to 2.3 billion.

Interestingly, even with the declining MAUs in the U.S, PINS has been able to monetize its platform well.

This is indicated by the average revenue per user (ARPU) metric that grew 37% year-over-year globally to $1.41, while in the U.S, it went up 44% year-over-year to $5.55.

For the fourth quarter, PINS is anticipating that its revenues will increase in the “high teens percentage” year-over-year.

The company had admitted in its Q3 letter to shareholders that the pandemic has affected its revenues. While its revenues in Q3 grew 43% year-over-year to $633 million, PINS stated that its revenue momentum has been slowed down by falling demand “in one of our largest verticals, Consumer Packaged Goods (CPG).”

Advertisers, like large CPG and retail advertisers, tend prefer the Pinterest platform to advertise, and these customers have large marketing budgets. The pandemic has tightened these budgets, resulting in a fall in demand.

Meanwhile, the company continues to invest in publishing more short-form video content on its platform through Idea Pins and Creators who can engage with their users by creating content on the platform.

Earlier this month, Wolfe Research analyst Deepak Mathivanan initiated coverage on PINS with a Hold rating and a price target of $45 (68.3% upside) on the stock.

The analyst approved of the “ongoing product transition at the company, which should not only improve the content and engagement on the platform but also provide PINS significant monetization upside long-term.”

However, Mathivanan expected that considering the uncertainty regarding the growth rate for Pinterest’s revenues and MAUs, the stock’s multiples will likely be under pressure.

The analyst added, “We would get more constructive when we see early signs of benefits from some of the recent product initiatives.”

Other analysts on the Street, however, are cautiously optimistic on the stock, with a Moderate Buy consensus rating based on 6 Buys and 15 Holds. The average PINS stock prediction of $50.50 implies upside potential of approximately 88.8% to current levels for this stock.

Snap (NYSE: SNAP)

Shares of Snap have also been a free fall in the past year, down by 41.5%. This slide has largely been driven by the company’s disappointing Q3 results, which resulted in a revenue miss.

The company’s management had indicated on its Q3 earnings call that it expected to face a number of challenges in Q4 “including the iOS platform changes, as well as macro uncertainty driven by supply chain disruption and labor shortages.”

Here, the iOS platform changes refer to the changes that came into effect after the launch of Apple’s (AAPL) iOS 14.5. This resulted in app developers inability to track a user’s Apple’s Identifier For Advertisers (IDFA) if a user opts out of sharing privacy details while downloading an app from AAPL’s app store.

Both SNAP and PINS are expected to announce their Q4 results on February 3.

SNAP anticipates revenues to range between $1,165 million and $1,205 million in Q4 while adjusted EBITDA is projected to range from $135 million to $175 million.

According to RBC analyst Brad Erickson, there has been no progress on how SNAP intends to tackle the IDFA challenge, but quarter-on-quarter, the analyst does not think that SNAP’s revenues are likely to worsen.

Apple’s IDFA is likely to affect SNAP’s top line due to the reduced ability to target its advertising.

Analyst Erickson, however, perceives TikTok, another social media platform, as posing a risk to FB and SNAP. That’s because TikTok is increasingly appealing to small-to-medium businesses (SMBs) “given smaller advertisers desire targeting for their products & services that could be at least partially correlated or directly related to that user-generated, subject-specific content.”

But judging by the users flocking to SNAP, it seems to be doing well. Total estimated visits in calendar Q4 to SNAP jumped 52.5% year-over-year to 121.6 million.

Overall, the analyst was bullish on the stock with a Buy rating and a price target of $54 (88.6% upside) on the stock.

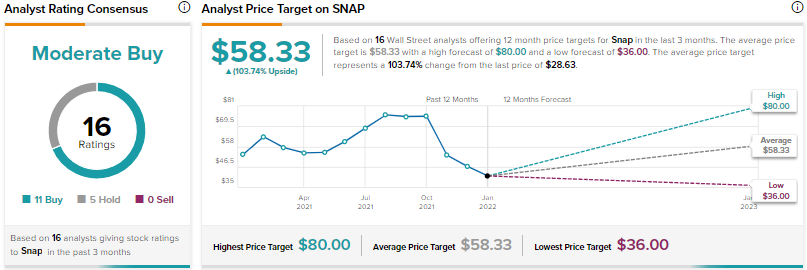

The rest of the analysts on the Street, however, are cautiously optimistic on the stock, with a Moderate Buy consensus rating based on 11 Buys and 5 Holds. The average SNAP stock prediction of $58.33 implies upside potential of approximately 103.7% to current levels for this stock.

Bottom Line

While analysts are cautiously optimistic about both stocks, based on the upside potential over the next 12 months, SNAP seems to be a better Buy.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.