Analyzing Pinterest’s (NASDAQ:PINS) recent performance, I am increasingly persuaded that the stock could get sliced in half. While this may sound like a bold statement, a closer evaluation of Pinterest’s poor user growth, challenges in effectively capitalizing on its current user base, and a relentless spree of spending leading to a continuous erosion of its cash reserves collectively suggest that this might be a well-founded critique. Therefore, I remain bearish on PINS stock.

Decelerating User Growth, Declining Revenue Per User

Pinterest’s investment case presents a glaring challenge: its user growth lacks a spark, while there’s also been a recent decline in the average revenue per user (ARPU). The company’s Q2 results echoed these concerns loud and clear. Pinterest managed to tally 465 million global monthly active users (MAUs), reflecting a year-over-year increase of roughly 8%, which may not sound quite concerning, but here’s what you need to consider.

The driving force behind this growth was primarily emerging markets, as Pinterest’s growth engine in mature markets has apparently hit its peak. Case in point, the MAU growth rate in the U.S. & Canada limped along at just 3%. In contrast, Europe saw a 6% uptick, and the rest of the world (RoW) markets surged by a commendable 10%.

Unfortunately, these markets have their limitations when it comes to monetization. The real pot of gold can be found in the U.S. & Canada, where advertisers are willing to open their wallets wide. Let’s put this into perspective: Pinterest’s ARPU for Q2 hit $5.92 in the U.S. and Canada, a far cry from a light $0.91 in Europe and a rock-bottom $0.12 in the RoW.

Simultaneously, despite an improved advertising environment in the first half of 2023 compared to the previous year, Pinterest’s global ARPU dipped by a cent, landing at $1.53, yet another disappointing figure.

Just to provide some context, Meta’s (NASDAQ:META) ARPU grew from $9.82 to $10.63 globally in the same period, illustrating the ongoing improvement in advertiser spending and Pinterest’s failure to attract rising user engagement within its ecosystem versus the competing social media networks/idea-sharing platforms.

Rising Expenses Deter Profitability

Beyond the worrisome signs of decelerating user growth and a monetization struggle, the elephant in the room is Pinterest’s notable challenge regarding its profitability. This concern arises primarily from the seemingly elusive grasp on rising expenses, where management appears to struggle in reining in the outflow.

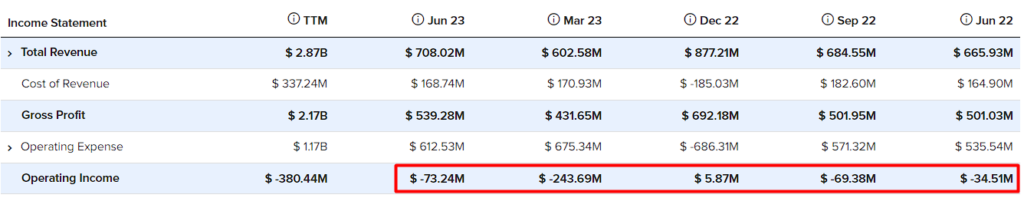

The expenditure surge is evident across the board – from the cost of revenues to R&D expenses, sales and marketing, and administrative costs – culminating in a significant 11.6% escalation, reaching a hefty $781.3 million. This steep rise in expenses, in contrast to revenue growth of a modest 6% to $708.0 million, paints a concerning picture. The result? Operating losses more than doubled, skyrocketing from $34.5 million in Q2 2022 to a staggering $73.2 million in Q2 2023.

This jarring increase is particularly alarming in an environment where every company is striving to bolster profitability. One might argue otherwise and assert that Pinterest’s profitability is on an upward trajectory, citing the adjusted EBITDA margin of 15%, which surpassed last year’s 14%. However, a closer look at Pinterest’s “adjusted” or non-GAAP reconciliations raises eyebrows.

In fact, management’s approach of excluding Pinterest’s stock-based compensation (SBC) levels from the non-GAAP equation seems questionable, as this is a tangible expense borne by shareholders through long-term dilution.

Remarkably, even in the face of underwhelming results, management appears unyielding in controlling SBC, which surged by a significant 44.5% to reach $169.6 million. To me, this signals a lack of interest in protecting shareholder value — a theme investors should want to utterly avoid.

Could Pinterest Stock Get Cut in Half?

Given Pinterest’s ongoing challenges, I wouldn’t be surprised if the market were to price the stock at about half the levels it is currently trading at. Given the lack of meaningful growth, continuous operating losses, and significant dilution taking place, Pinterest’s current valuation makes little sense to me.

Based on Wall Street’s consensus EPS estimate of $0.93 for Fiscal 2023, the stock is trading at a forward P/E of 27.8, which is utterly absurd. This is due to implying significant earnings growth in the current interest rate environment, which the company obviously lacks. Also, note that this estimate is on an “adjusted” basis, excluding special items such as stock-based compensation. This is even more concerning, as this multiple doesn’t even take into account Pinterest’s ongoing dilution.

From my perspective, should Pinterest’s growth continue in the mid-single-digit range, and the company successfully attains a profit margin of 5% to 10% over the medium term, alongside a slight easing of dilution, it’s reasonable to consider valuing Pinterest at a P/E ratio in the low teens, considering the current interest rate landscape.

This assessment even hinges on the assumption of both profitability enhancements and a reduction in stock-based compensation – speculative (and favorable) factors that provide Pinterest with a fair degree of leniency. Given these considerations, it doesn’t seem far-fetched to contemplate a scenario where the stock value undergoes a significant cut, potentially getting halved from its current levels following a valuation multiple compression.

Is PINS Stock a Buy, According to Analysts?

Despite my bearish view, Wall Street’s sentiment on Pinterest has led to a Moderate Buy consensus rating based on 11 Buys and 12 Holds assigned in the past three months. At $31.95, the average Pinterest stock forecast implies 24.3% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell PINS stock, the most profitable analyst covering the stock (on a one-year timeframe) is Mark Mahaney from Evercore ISI, with an average return of 144.41% per rating and a 58% success rate.

Final Thoughts

In a challenging landscape marked by decelerating user growth, dwindling revenue per user, and rising expenses, Pinterest faces an uphill battle. In my view, the market’s current valuation of the stock seems unjustified, given the lackluster performance and the company’s profitability struggles. A potential scenario where the stock undergoes a significant cut, possibly halving its current levels, cannot be dismissed.

Overall, I would urge that prudent investors closely monitor Pinterest’s ability to achieve meaningful growth and address its operational challenges before committing to this volatile stock.