So, internet stocks are having a bit of a rough time, you say? Tell that to Pinterest (PINS).

Against a backdrop of online advertising companies delivering woeful results as businesses reduce advertising spend on account of the struggling economy, bucking the trends seen elsewhere, Pinterest delivered an excellent Q3 showing.

Revenue grew by 8.2% year-over-year to of $685 million, in turn beating Wall Street expectations by $18.37 million. Adj. EPS reached $0.11, coming in 5 cents higher than the $0.06 consensus estimate.

While at 445 million, MAUs (monthly active users) stayed flat, the figure beat the analysts’ forecast of 437.4 million. With the pandemic tailwind gone, MAU trends seem to be going back to seasonal patterns, making ARPU (average revenue per user) an important driver of revenue growth; in the quarter, total ARPU rose by 11% from the same period a year ago.

On the earnings call, the company pointed to the stability among users, especially in sizeable retail and consumer packaged goods (CPG) marketing and for Q4 anticipates revenue will grow mid-single digits year-over-year.

Surveying the print, Baird’s Colin Sebastian believes the display suggests a “positive thesis is playing out.”

“As we’ve outlined in prior reports, and reflected in Q3 results, Pinterest remains in a favorable position vs. social media/display platforms with improving trends in usage, engagement and monetization, limited exposure to privacy-related constraints (IDFA deprecation), and with an app that is ripe for more shopping/e-commerce functionality,” the analyst said. “Emerging from an investment year, we continue to expect a rebound to double-digit growth and margin expansion next year. While we recognize there could be some macro- and seasonal-related wobbles in Q4, our positive thesis is intact.”

As such, Sebastian reiterated and reiterate Outperform rating and in what is becoming an increasingly rare act for internet stocks this earnings season, raised the price target from $30 to $32. The new figure makes room for one-year gains of 46%. (To watch Sebastian’s track record, click here)

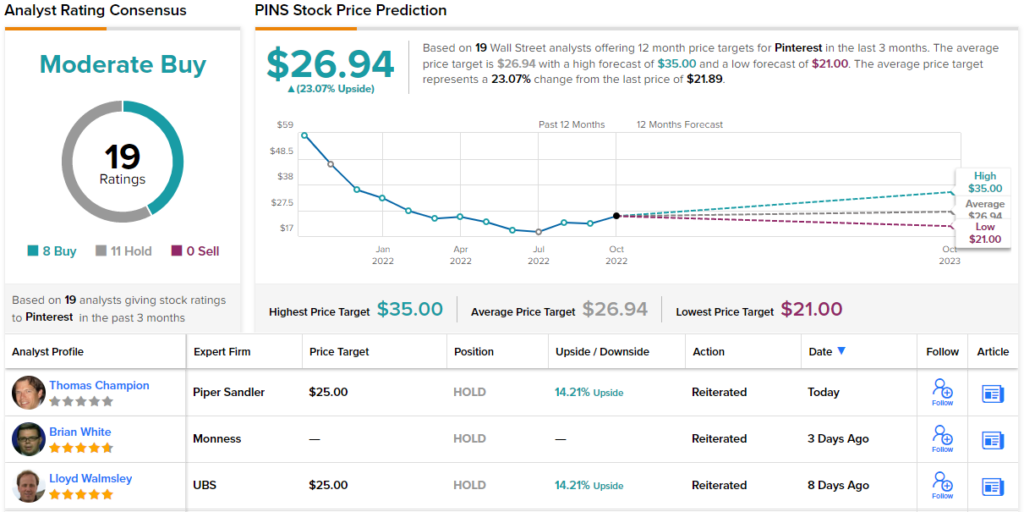

What does the rest of the Street make of Pinterest’s prospects? It’s still a bit of a mixed bag; based on 8 Buys vs. 11 Holds, the stock makes do with a Moderate Buy consensus rating. The average price target stands at $26.94, suggesting shares will appreciate by 23% over the coming months. It will be interesting to wee whether some analysts update their models following the upbeat Q3 display. (See Pinterest stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.