Social media platform Pinterest (NYSE:PINS) is scheduled to announce its second-quarter results after the market close on Tuesday, August 1. Wall Street expects the company’s earnings to improve in the second quarter following a decline in the first quarter.

Q2 Expectations

Pinterest’s revenue grew 5% to $603 million in the first quarter, while adjusted EPS declined 20% to $0.08. Nonetheless, both key metrics came ahead of analysts’ expectations. Social media companies have been under pressure due to a decline in digital ad spending amid macro challenges.

While Meta Platforms’ (NASDAQ:META) Q2 results reflected a recovery in the digital advertising market, rival Snap’s (NYSE:SNAP) sales continued to decline in the second quarter.

Coming to Q2 expectations for Pinterest, analysts expect adjusted EPS to rise 9% year-over-year to $0.12, driven by a 4.6% increase in revenue to $696.4 million.

Ahead of the results, Stifel analyst Mark Kelley raised his price target for Pinterest to $25 from $22 and reiterated a Hold rating on the stock. Kelley made a modest revision to his digital advertising growth forecasts for 2023 and 2024 and said that he is expecting “slightly better results” for ad-based names compared to the revenue outperformance seen in Q1.

Last week, Monness analyst Brian White, who has a Hold rating on the stock, said that he expects Pinterest to meet his Q2 2023 revenue estimate of $709 million and EPS forecast of $0.17, with both estimates being higher than the Street’s expectations.

White expects monthly active users (MAU) to increase 8% year-over-year to 469 million, reflecting a modest improvement from the 7% growth reported in the first quarter. However, the analyst projects global average revenue per user (ARPU) to decline 1% year-over-year to $1.52.

As per TipRanks’ Website Traffic Tool, visits on pinterest.com increased nearly 41% year-over-year in Q2, which reflects healthy trends compared to the prior-year quarter. However, website visits have declined nearly 8% in Q2 compared to the first quarter.

Is Pinterest a Buy, Sell, or Hold?

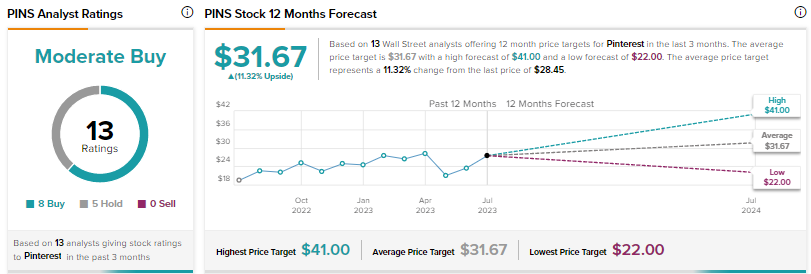

Wall Street’s Moderate Buy consensus rating on Pinterest is based on eight Buys and five Holds. The average price target of $31.67 implies 11.3% upside.

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a 10.66% move on Pinterest earnings. PINS shares have averaged a 2.1% move in the last eight quarters. In particular, the stock plunged about 16% following the Q1 2023 results announcement, as investors were disappointed with the outlook.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Questions or Comments about the article? Write to editor@tipranks.com