PepsiCo (NASDAQ:PEP) continues to impress, with the company’s organic growth remaining very strong. The food and beverage giant’s brands, which include Pepsi, Lays, Tropicana, Quaker, and other iconic names, experience exceptional demand. Hence, recent strategic price increases have been well-received by the market, leading to a strong boost in its top and bottom-line metrics. In fact, PepsiCo’s improving profitability prospects appear to justify the stock’s seemingly rich valuation. I am bullish on PEP stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Organic Growth Driven by Robust Demand, Pricing Power

PepsiCo’s most recent results shine a spotlight on its exceptional performance, fueled by solid demand for its brands and unwavering pricing strength. In the face of inflation, PepsiCo stands resolute thanks to consumers who are inclined to trim discretionary spending before sacrificing their cherished beverages and snacks. Indeed, PepsiCo adeptly leveraged last year’s inflationary landscape to implement pricing hikes, all the while observing consumers’ demand holding steadfast.

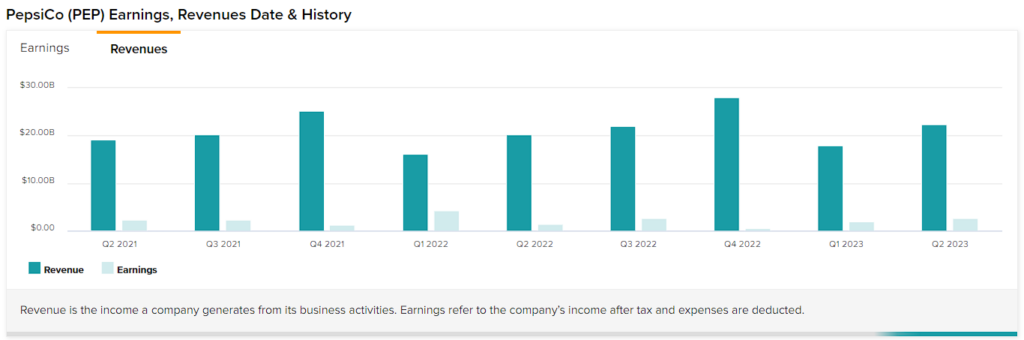

Specifically, PepsiCo’s Q2 revenues grew by 10.4% year-over-year to $22.3 billion. The company’s growth was driven by organic growth of 13%, partially offset by a 2.5% foreign exchange headwind. Seeing a company as mature as PepsiCo posting such vibrant organic growth is incredibly impressive. This is particularly true when taking into account that Q2 marked the seventh consecutive quarter in which PepsiCo has delivered double-digit organic revenue growth.

PepsiCo’s robust organic revenue growth can be primarily attributed to increased prices. On the flip side, the enduring demand for its non-cyclical products, such as oats, underscored its resistance to economic cycles. The competitiveness of the company’s brands was also showcased. Remarkably, despite double-digit price increases, PepsiCo saw only marginal declines of 3% in convenient food volumes and 1% in beverage volumes.

Management expects strong organic growth to persist through the year’s second half. In fact, it boosted its full-year organic growth estimate to 10%, up from 9% previously. Increased confidence can be attributed to some of Pepsico’s emerging markets. Mexico, for instance, is currently experiencing near-all-time-low unemployment, while PepsiCo’s brands are becoming increasingly popular in Asian markets. Europe is also performing strongly, with organic growth in Q2 reaching 19%.

Seemingly Rich Valuation Supported by Strong Profitability

With PepsiCo delivering strong organic growth and its price increases exceeding the growth in costs, the company’s profitability is set to improve substantially this year. The most recent quarter served as a good indicator of this, with the company’s core (adjusted for one-off items) gross margin expanding by 1.32%. Consequently, adjusted operating margins also improved by 0.44%. The combination of higher revenues and margins led to core EPS growth of 15%, which was further boosted by PepsiCo’s share buybacks.

In line with its upward adjustment in revenues, PepsiCo’s management also boosted its core EPS outlook. Management now expects Fiscal Year 2023 core EPS to land at $7.47, up from $7.27 previously. This implies a 10% increase compared to Fiscal 2022’s core EPS of $6.79, up from 7% previously. This translates to a forward PE of 23.5x.

Some investors may argue that this is a rich multiple. This is indicated by shares being under pressure over the past few months. However, you also have to take into account several relevant factors. These include PepsiCo’s double-digit growth, the numerous qualities attached to its iconic brand portfolio, and the company’s unwavering commitment to growing shareholder returns. With regards to the last point, don’t forget that PepsiCo has increased its dividend for 51 consecutive years.

Overall, these factors and the fact that many large caps trade at steep multiples with inferior growth in the current market environment make me comfortable with PepsiCo’s current valuation. A decent example in this case is The Coca-Cola Company (NYSE:KO), which trades at a P/E of 22.7, not far from that of PepsiCo, but its EPS is expected to grow by a much more inferior 6.5% this year.

What is the Target Price for PEP?

Turning to Wall Street, PepsiCo has a Moderate Buy consensus rating based on nine Buys and four Holds assigned in the past three months. At $204.50, the average PepsiCo stock forecast suggests 16.6% upside potential.

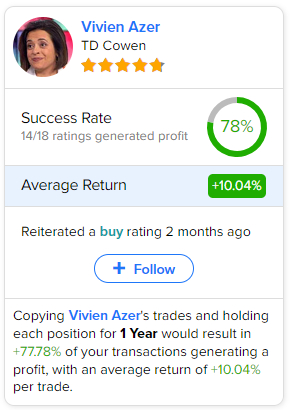

If you’re wondering which analyst you should follow if you want to buy and sell PEP stock, the most profitable analyst covering the stock (on a one-year timeframe) is Vivien Azer from TD Cowen, with an average return of 10.04% per rating and an 78% success rate. Click on the image below to learn more.

Conclusion

In conclusion, PepsiCo’s remarkable organic growth, driven by robust demand and pricing power, is a testament to its resilience in the face of economic challenges. Many of its products include household “essentials”, whose purchasing patterns tend to be highly inelastic, an advantage that has proven to be particularly valuable.

While some may perceive its current valuation as rich, it’s essential to consider the exceptional qualities of its iconic brand portfolio and consistent commitment to growth. In a market where many large caps trade at steep multiples with inferior growth prospects, PepsiCo’s investment case appears particularly appealing, in my view.