Food and beverage giant PepsiCo (NASDAQ:PEP) reported impressive Q3 results despite macroeconomic headwinds. Both revenue and earnings beat analyst’s consensus estimates. Its ability to battle inflationary pressure while posting strong revenue and earnings growth consistently is why Wall Street is hopeful about the stock. Hence, I am also bullish on PepsiCo stock now.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

PepsiCo has been in the business for more than 50 years. Its portfolio includes 16 iconic beverage brands and seven food brands. Consumer stocks, in general, are defensive, implying the demand for their products stays unaffected by economic cycles. This is evident from its most recent Q3-2023 results, released on October 10. Despite concerns that price hikes could affect demand, PepsiCo had a highly-profitable quarter.

PepsiCo’s Q3 Results Smashed Estimates; A Brighter Outlook for 2023

In the third quarter ended September 2023, net revenue increased by 6.7% year-over-year to $23.5 billion, exceeding analysts’ estimate of $23.4 billion. Earnings per share (EPS) stood at $2.24, a whopping 15% increase from the year-ago quarter. EPS also surpassed the consensus estimate of $2.15 per share. Also, average prices increased by 11%, but organic volume dipped 2.5%.

Talking about the results, CEO Ramon Laguarta stated, “We believe that our businesses can continue to perform well in the coming years with category growth normalizing, as we have made numerous investments in our brands, manufacturing capacity, go-to-market systems, supply chain, technology, and people, to execute against our strategic framework and modernize our company.”

Looking ahead, management expects that core constant-currency EPS will grow by 13% this year, up from the 12% previously estimated. PepsiCo reiterated its target of 10% organic revenue growth in Fiscal Year 2023.

Furthermore, management expects the company to meet the upper end of its Fiscal 2024 organic revenue growth target of 4% to 6%, as well as core constant-currency EPS growth in the “high-single-digit percentage.” Pepsico also intends to implement modest price increases next year to tackle rising inflation.

What is PepsiCo Doing Right?

Despite competition and macroeconomic headwinds, PepsiCo has been steadily increasing its revenue and earnings. The company also quickly resumed growth following the global economic slowdown caused by the pandemic. It grew revenue and earnings by 13% and 7%, respectively, in 2021 compared to 2020.

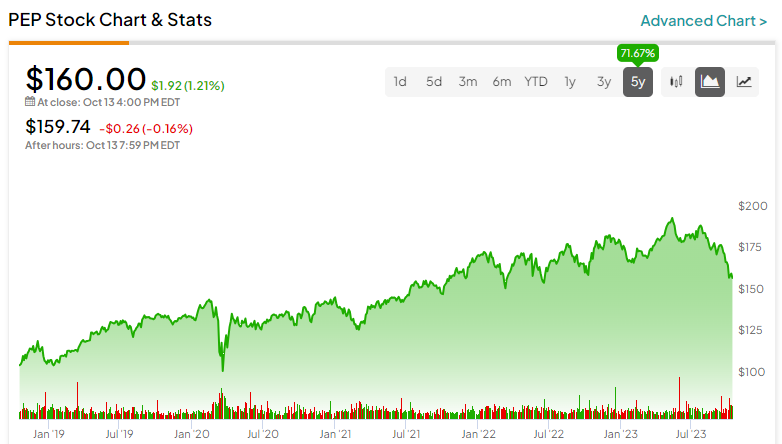

PepsiCo hasn’t seen dramatic growth; instead, it has grown gradually over the years. Looking back, PepsiCo’s revenue has increased at a compound annual growth rate (CAGR) of 6.3% over the last five years. Meanwhile, Coca-Cola’s (NYSE:KO) revenue has increased at a CAGR of 3.5% over the same period.

The popularity of its brands, its diverse portfolio, and the fact that it operates in an industry that can withstand recession-related headwinds have all contributed to its survival and growth thus far. PepsiCo’s strength lies in its innovative marketing strategies that allow it to gain a competitive advantage over rivals. Surprisingly, while advertising expenses increased during the quarter, operating profit margins expanded, highlighting its strength.

Over the years, its consistent growth has fueled dividend payments. In 2022, the company entered the prestigious Dividend Kings group. It’s an elite group of S&P 500 companies that have hiked dividends for more than 50 years. Its dividend yield is 3%, significantly higher than the S&P 500’s (SPX) average yield of 1.4%

Lastly, PEP reported free cash flow of $5.2 billion for the 36 weeks ended September 9, a 31.3% year-over-year increase. A steady increase in earnings and free cash flow supports its sustainable dividend payout of 64%.

Is PepsiCo Stock a Buy, According to Analysts?

PepsiCo’s stock has fallen by 9% year-to-date, underperforming the S&P 500’s gain of 13%. Despite the YTD dip in the stock, analysts remain bullish on PEP stock. TipRanks rates PEP stock as a Moderate Buy based on nine Buys, seven Holds, and no Sell ratings given in the past three months. The average PEP stock price target of $189.13 implies 18.2% upside potential.

Impressed with PepsiCo’s upbeat forecast, Bank of America (NYSE:BAC) analyst Bryan Spillane reiterated his Buy rating on the stock, with a Street-high price target of $210 (implying 31.3% upside potential).

Furthermore, TipRanks has given the stock a ‘Perfect 10’ Smart Score. To determine whether a stock is likely to outperform the market, the TipRanks Smart Score Tool assigns a score between 1 and 10 (10 being the highest), taking into account various market-driven dynamics. Since 2016, stocks with a ‘Perfect 10’ Smart Score on TipRanks have outperformed the S&P 500 Index by a large margin.

The Takeaway

The demand for PepsiCo’s brands, as well as its smart growth strategies, have propelled the firm through numerous recessions and challenging times. The company continues to grow its revenue and earnings while maintaining a payout ratio of around 65%, highlighting the stability of its business. As a result, I agree with Wall Street’s bullish long-term outlook for PepsiCo’s stock.