The market has shunned PayPal (NASDAQ:PYPL) stock for much of 2023. That’s almost inexplicable, as PayPal is fundamentally sound, and there are fresh results to prove this. Without any hesitation, I am bullish on PYPL stock and envision tremendous comeback potential.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

PayPal provides a variety of point-of-sale payment solutions. Not only does PayPal enable convenient transactions across a number of currencies, but the company also just received the U.K.’s approval to offer cryptocurrency services.

Yet, it seems that investors have abandoned PayPal stock because they’re obsessed with the “Magnificent Seven” technology stocks. Today could mark a turning point, however, since the market can only ignore PayPal’s Street-beating results for so long.

New CEO, but the Same Solid Business

PayPal is undergoing a crucial transitional period. That’s because the company recently hired a new chief executive, Alex Chriss.

It’s too early to assess the new CEO’s abilities. Still, Chriss’s confidence is encouraging. He recently stated, “My first 30 days leading PayPal have confirmed my belief in the company’s strong assets and market position.”

Furthermore, PayPal appointed Jamie Miller as the company’s new chief financial officer (CFO), effective November 6. Miller has prior experience at General Electric (NYSE:GE) and Cargill, among other companies.

While I can’t make any judgments on these executives yet, I can at least attest to PayPal’s firm fundamentals. The company’s third-quarter Fiscal Year 2023 earnings results indicate that, nearly all year long, the market has misjudged PayPal.

A crucial metric for PayPal is the company’s total payment volume (TPV). In Q3 2023, PayPal’s TPV grew 15% year-over-year (or 13% on a currency-adjusted basis) to $388 billion. This, according to PayPal, was “driven by Braintree, PayPal branded checkout and Venmo.”

PayPal’s TPV growth indicates that the company hasn’t been devastated by competition from Apple (NASDAQ:AAPL). Sure, Apple offers payment solutions just like PayPal does, but evidently, there’s enough room in the market for both companies to succeed.

PayPal’s Results Put Stock Traders in a Happy Mood

While the market hasn’t generally favored PayPal this year, at least today’s traders are bidding up the PYPL stock price. Of course, they weren’t only looking at PayPal’s TPV.

Stock traders also examined PayPal’s top- and bottom-line results for 2023’s third quarter. As it turned out, there really wasn’t anything bad that investors could object to.

First of all, PayPal’s revenue grew by 8% year-over-year to $7.42 billion, and this outcome beat the consensus estimate by $40 million. Moreover, PayPal reported earnings of $1.30 per share, exceeding the consensus forecast of $1.23 per share.

What about PayPal’s guidance? No worries there, as the company guided for non-GAAP 2023 earnings of approximately $4.98 per share. That’s above analysts’ expectation of $4.92 per share, and it would also represent a significant improvement over Fiscal Year 2022’s earnings of $4.13 per share.

Now, it’s starting to become clear why investors are so pleased with PayPal today. Mizuho analyst Dan Dolev also seemed to be happy with PayPal, as he declared, “Overall results show that core PayPal fundamentals remain solid.”

I fully concur with Dolev’s assessment, and his Buy rating for PayPal is quite reasonable. However, Dolev’s $92 price target for PYPL stock is ambitious, and I won’t assume that the stock will reach that level from its current price. Nonetheless, I share Dolev’s enthusiasm for PayPal’s future.

Is PayPal Stock a Buy, According to Analysts?

On TipRanks, PYPL comes in as a Moderate Buy based on 18 Buys and 11 Hold ratings assigned by analysts in the past three months. The average PayPal stock price target is $80.37, implying 46.7% upside potential.

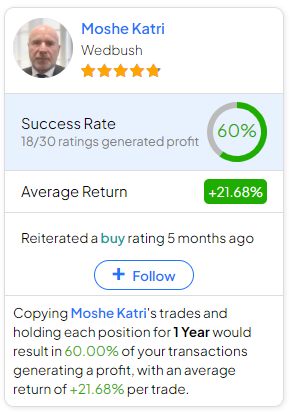

If you’re wondering which analyst you should follow if you want to buy and sell PYPL stock, the most accurate analyst covering the stock (on a one-year timeframe) is Moshe Katri of Wedbush, with an average return of 21.68% per rating and a 60% success rate. Click on the image below to learn more.

Conclusion: Should You Consider PayPal Stock?

I believe PayPal deserves a higher re-rating on Wall Street, especially considering the company’s better-than-anticipated quarterly results. Plus, PayPal’s confident full-year guidance should convince reluctant investors to consider the stock. Today might actually mark a turnaround for PayPal, and I wouldn’t worry too much about the company’s executive-level changes. If you agree with Dolev’s bullish stance, today seems like a great day to think about adding a few shares of PYPL stock to your portfolio.