PayPal (PYPL) has been under considerable pressure for a full year now, now down 74% from its all-time high. The former tech staple turned on investors in a hurry as it began to lose its competitive edge due to a growing number of rivals looking to hop aboard the digital payments bandwagon. Because of this, I am bearish on the stock.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

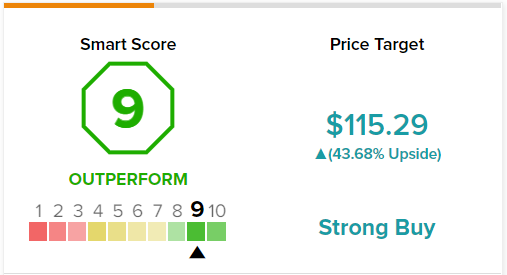

Interestingly, however, PYPL has a 9 out of 10 Smart Score rating on TipRanks. This rating indicates that the stock is likely to outperform the market, going forward.

What’s Behind PayPal’s Epic Decline?

Undoubtedly, investors got too excited in 2021, as the firm benefited from the rush toward digital retailers. With the economy now reopened, many consumers are taking more business to physical retailers, and as an economic slowdown nears, certain consumers may be ready to tighten the purse strings.

It’s not just the environment that’s worked against PayPal. The company’s moat is at risk of eroding at the hands of the competition.

As it turns out, the payments business isn’t all the hard to get into, especially if you’re an established tech behemoth with deep pockets or a disruptive upstart with easy access to credit. Until PayPal can separate itself from the pack, pressure on the stock may not be quick to subside.

PayPal Faces Serious Competition

As tech heavyweights like Apple (AAPL) and Amazon (AMZN) seek to take a deep dive into the payments space, incumbent players like PayPal are bound to see pressure on sales and margins.

With firms like Amazon getting in on the action, with its “Buy with Prime” and promise of rapid order fulfillment, PayPal needs to adapt or run the risk of losing considerable share from big tech’s push into digital payments.

Buy Now Pay Later (BNPL) companies have also begun to crowd the checkout page of your average digital retailer, providing consumers with many options to pay. BNPL firms have been a mere thorn in the side of PayPal, but Amazon could prove a disruptive threat.

As Amazon’s “Buy with Prime” button becomes more widespread, fewer shoppers may be inclined to hit the PayPal button by default.

PayPal Going Down the “Super App” Route

Looking ahead, PayPal seems focused on innovating to get its moat back, with new features conveniently located in its “super app” to help lure users back to its ecosystem.

Arguably, PayPal already has a super app with a wide range of financial services beyond just payments. Though such services could help rebuild the PayPal moat, I don’t see any standout features or functionality that competitors cannot replicate.

It’s convenient to have payments, cryptocurrency trading, and all the sort in one app. That said, Apple could easily replicate such features and one-up PayPal on the convenience factor with the inclusion of features native to the iOS operating system.

PayPal CEO Dan Schulman is bullish on the future of super apps. Though China has embraced the “super app” trend, I do not think the concept in itself is enough to help PayPal come out ahead of its rivals.

Wall Street’s Take on PYPL Stock

Turning to Wall Street, PYPL stock comes in as a Strong Buy. Out of 32 analyst ratings, there are 25 Buys, six Holds, and one Sell.

The average PayPal price target is $115.29, implying upside potential of 43.7%. Analyst price targets range from a low of $75.00 per share to a high of $180.00 per share.

Conclusion: PayPal May Need to Acquire to Remain Competitive

It’s hard to remember the last time PayPal stock traded near 25 times trailing earnings. Though economic headwinds could weigh on payments in the coming quarters, PayPal remains a top dog in payments with the ability to pivot and adapt before Amazon and Apple can really give it a squeeze.

The M&A route seems like the right way to go if PayPal is to stand up to behemoth-sized rivals. The firm’s $4 billion acquisition of Honey in 2020 did not come cheap. That said, it’s money-saving innovations like Honey that could lure consumers to PayPal’s ever-improving super app.

While many disliked the Honey deal in 2020, I think it’s a unique deal that could sweeten the pot (forgive the pun) for PayPal users. With a solid balance sheet, I expect PayPal could acquire its way to add new features to its super app.