Whatever you think of crypto, it is likely to more than just a fad. Although the crypto market is prone to extreme bouts of volatility, over the past decade it has proved resilient and has moved ever closer to mainstream adoption.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Businesses that ignore the rise of Bitcoin and its fellow digital currencies will do so at their peril, or so seems to be the line of thought at digital payments innovator PayPal (PYPL).

“PYPL has a long-term vision for crypto and digital currencies as part of its all-inclusive ‘Super App’ strategy,” said Mizuho analyst Dan Dolev following recent chats with PayPal’s crypto business leaders. “It views crypto as a strategic gateway into its vast ecosystem. The strategy includes a robust offering, focus on ease-of-use, and broad reach.”

The company thinks crypto is nothing less than the “next wave of innovation in financial services.” Therefore, it is essential to have a “robust crypto offering” to ensure maximum appeal.

PayPal is already a well-known global brand and intends to use its standing to provide consumers with better access to crypto and to drive user engagement “beyond simply buying and holding assets.” It also cooperates fully with the regulators, which considering crypto’s struggles with various regulatory bodies, Dolev thinks is an advantage PayPal has over peers as “its trusted brand and substantial scale grants it a seat at the table with regulators.”

So far, the company has been “pleasantly surprised” with the reaction to its crypto offerings on both the PayPal App and Venmo.

“Users who have engaged with these products are returning to the app more frequently and logging in at 2x the frequency prior to trading crypto,” Dolev noted.

Also, there hasn’t been any noticeable difference so far between the engagement of different age groups or income levels, indicating the product appeals beyond just millennials or Gen Z.

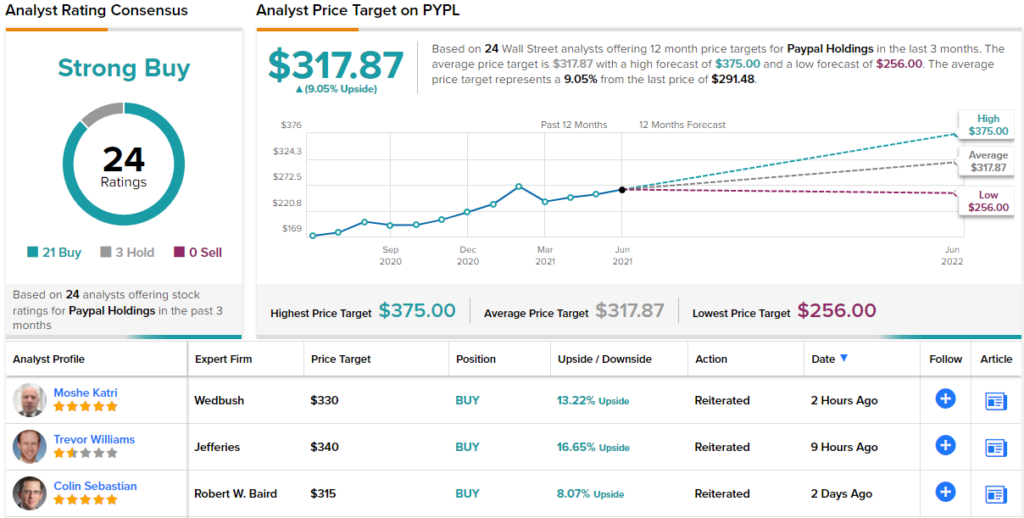

So, good news for PayPal and crypto enthusiasts but what does it mean for investors? All in all, Dolev reiterated a Buy rating for PYPL shares, backed by a $375 price target. Investors are looking at upside of ~29% from current levels. (To watch Dolev’s track record, click here)

Most of Dolev’s colleagues agree. Out of the 23 recent PYPL reviews, 21 say Buy and 3 recommend to Hold, all culminating in a Strong Buy consensus rating. The average price target clocks in at $317.82, suggesting one-year gains of 9%. (See PayPal stock analysis on TipRanks)

To find good ideas for crypto stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.