Palantir Technologies (PLTR), which is a top provider of analytics and AI (artificial intelligence) services and technology, saw its stock drop ten days in a row prior its earnings report this past week.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Of course, this is nothing new for high-growth stocks lately. Wall Street has been dumping most of these securities.

Palantir stock did get some relief when it reported its Q1 results on May 11. On the news, shares jumped nearly 10% to $20.21.

Yet it was not able to hold on, and the stock price has since sunk to around $20, bringing the market capitalization to $37 billion.

Q1 Results

So, let’s get a rundown on the Q1 numbers. The company reported a net loss of $123 million or 7 cents a share. On an adjusted basis, the earnings per share was 4 cents, which was in-line with the consensus forecast.

As for revenues, they soared 49% to $341.2 million, which handily beat the Street estimate of $332 million. The biggest driver was the U.S. government business, which saw an 83% spike. (See Palantir Technologies stock analysis on TipRanks)

Note that when Palantir was founded – back in 2003 – the focus was generally on contracts for the CIA and the Defense Department. However, over the past decade, the company has been moving more aggressively into the commercial sector. In Q1, commercial segment revenues were $133 million.

Something else to consider about the quarterly results: Palantir said that it will accept Bitcoin from its customers and might even add this digital asset to its balance. As seen recently with Tesla (TSLA), this may prove to be a challenge. Tesla recently indicated it will no longer accept Bitcoin for orders because of concerns about the environmental impact of the digital mining.

Palantir’s Technological Advantage

Palantir generally caters to larger enterprise customers, as the average revenue per customer is about $8.1 million. In fact, the top 20 customers are at a hefty $36.1 million.

Additionally, the company has been able to scale its operations with proprietary technologies. The latest offering is Apollo for Edge AI. Launched in April, it is already getting traction. At the heart of this system is micro models, which are similar to microservices that allow for modern cloud computing. The technology essentially makes it much easier and more effective to deploy AI models across complex environments.

This technology holds enormous potential. For example, it can allow for the automation of factories, the use of sensors on oil rigs or even applications in space. All in all, Apollo for Edge AI should expand the company’s addressable market opportunity.

Wall Street’s Take

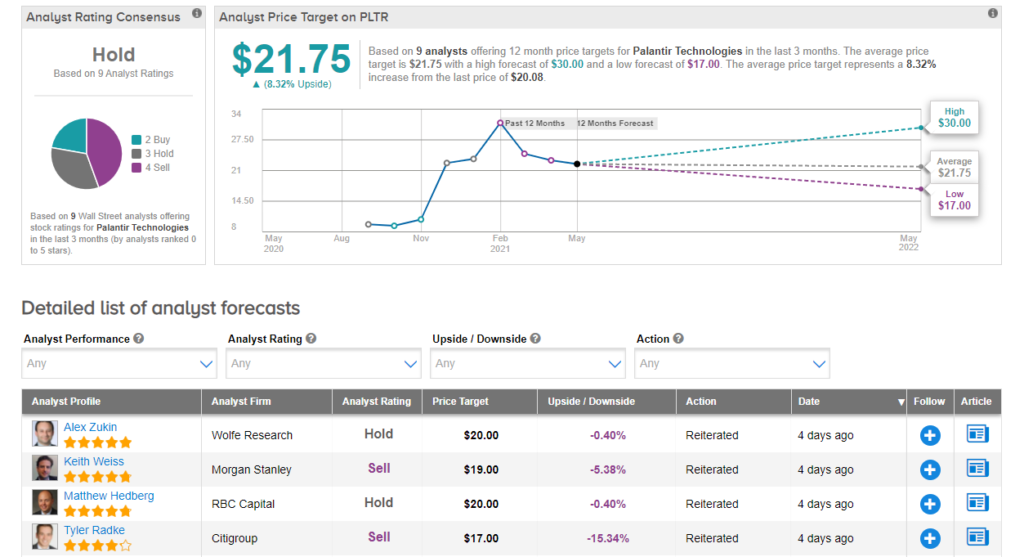

Turning to the analyst community, the consensus rating is a Hold, with 2 Buys, 3 Holds and 4 Sells logged over the past three months. The average analyst price target is $21.75, which implies 8.3% upside potential.

Bottom Line on Palantir

Palantir has built a powerful platform and is positioned to benefit from the secular trend of AI. Few companies have a similar level of experience, set of strong technologies and team of data scientists.

On the other hand, in today’s environment, Wall Street is not particularly interested in growth plays – especially those with high valuations. Consider that Palantir is trading at about 17 times sales, even with the recent drop-off in the stock price.

Therefore, it may be best to hold off and wait for things to settle before making a purchase.

Disclosure: Tom Taulli does not have a long or short position in Palantir stock.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.