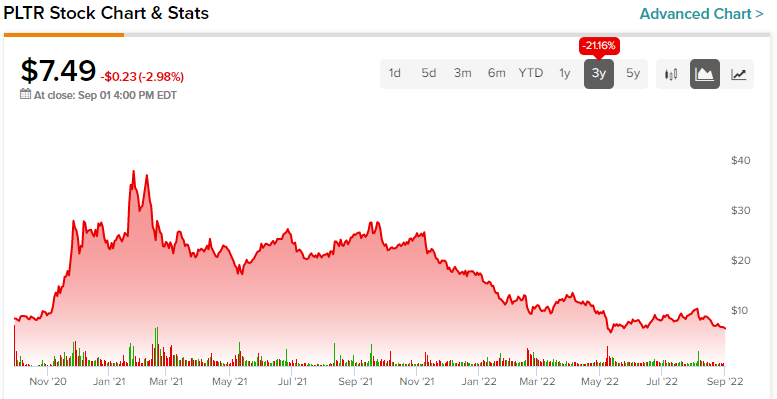

Shares of secretive big data analytics firm Palantir (NASDAQ: PLTR) have been on an absolutely dreadful ride since peaking out in early 2021. The former WallStreetBets favorite has many meme traders licking their wounds. However, those who rode the crash lower may have more reason to stick around than run to the exits as shares tumble further below their $10 IPO price.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company isn’t profitable yet, leaving it in the blast zone of this ongoing market sell-off. The recent Jackson Hole meeting shot down any hopes of rate cuts. While some may think Fed chairman Jerome Powell is bluffing, it’s probably not a good idea to catch falling knives unless you’re willing to run the risk of seeing your portfolio get cut down.

Palantir is still the exciting play on big data it was when it went live on the public markets back in 2020. The firm’s government contracts are a testament to the type of powerful and innovative technologies that CEO Alex Karp and his team are working on. Sure, it’s hard to understand the magnitude of Palantir’s software. That said, it’s a mistake to discount Karp’s capabilities as his firm looks to take the commercial arena by storm.

Government contracts are always nice, but commercial clients expand Palantir’s growth horizons and, possibly, its margins. When it comes to fallen growth darlings like Palantir, investors want to see progress on margins. Unprofitable firms can be rewarded by this market as long as the margin trend is intact.

Higher rates mean profits in the distant future aren’t worth paying up as much for. Palantir doesn’t generate a profit today. However, if it can show margin improvement, profitability may be perceived as closer rather than further in the future.

In any case, growth stocks like Palantir remain hard to value following its disappointing annual forecast that saw full-year revenue and adjusted income projects to come in at $1.9 billion and $342 million, respectively. Both figures were well below analyst estimates.

Palantir Faces Pressure Ahead of Recession

With a recession on the horizon, intense competition in the data analytics market, and “uncertain” timing of huge U.S. government contracts, the lower-than-expected outlook was more than warranted. The volatility-inducing nature of large-scale U.S. contracts is forgivable. However, increased competitive pressure from other players in the scene, most notably data-warehousing firm Snowflake (SNOW) — they just posted a blowout quarter — seems like a cause for concern, in my opinion.

In prior pieces covering Snowflake, I noted that the dominant platform was likely to see growth “snowball” over time. The robust platform is poised to get even better in a recession. As Snowflake continues to innovate, it could be difficult for Palantir to hit the spot as it looks to further diversify beyond government contracts.

As corporate budgets tighten in a recession, Snowflake could hog IT spending, leaving less wiggle room for firms like Palantir to show prospective clients what they stand to miss out on.

Further, Snowflake’s usage-based revenue recognition model will be hard to stack up against. I believe usage-based pricing is the way of the future. Palantir and other data-analytics Software-as-a-Service (SaaS) firms may have to jump aboard the bandwagon to give Snowflake a run.

At $7 and change per share, Palantir seems more like a “show-me” stock than a “must-buy.” The stock still doesn’t look like a screaming bargain at 10x sales, especially as Snowflake continues to expand its presence in the data cloud. Further, the implications of a recession should not go discounted. For these reasons, I am neutral on the stock.

Palantir: Commercial Growth is the Key to Success

Palantir can more than justify its hefty price-to-sales multiple if it finds success in the commercial market. Though Snowflake is a force to be reckoned with in big commercial data, I’d argue that the growing market could leave room for a few big winners. Palantir could be one of them, as it looks to offer its own value-adding offerings.

When it comes to value-adding software, it’s about cost savings or providing leads to increase revenue. If Palantir can add value, commercial clients will come. In its latest quarter, Commercial revenue was up 46%, far greater than U.S. Government revenue, which was up just 27%. Indeed, Commercial is Palantir’s growth driver to watch, moving forward.

What is Palantir Stock’s Price Target?

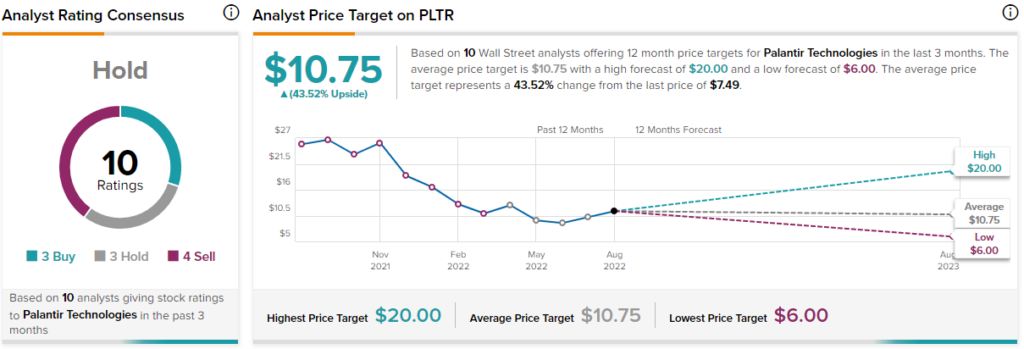

Turning to Wall Street, PLTR stock comes in as a Moderate Buy. Out of 30 analyst ratings, there are 22 Buys, seven Holds, and one Sell recommendation.

The average Palantir price target is $10.75, implying upside potential of 12.9%. Analyst price targets range from a low of $6 per share to a high of $20 per share.

Conclusion: High Growth Potential, but Tough Times are Ahead

It’s been a nasty tumble for shares of Palantir, but there’s still a lot of growth to be had as the firm sets its sights on Commercial.

Given Palantir’s track record of working with highly-sensitive government contracts, the firm may have the edge over rivals in industries where privacy is of utmost importance (think the financial sector).

In any case, tough times lie ahead, making it difficult to draw a line in the sand. A push in Commercial bodes well for longer-term margins, but profitability is still a few years in the future. Alex Karp sees his firm going profitable in 2025. If all goes to plan, I think that’s a realistic target.