Friday is set to be an important day for Palantir (NYSE:PLTR). The big data specialist’s 4-year, $458 million contract with the U.S. Army for its Army Vantage program – its data-driven operations and decision-making platform – is up for renewal.

A previous note from William Blair analyst Louie DiPalma highlighted the strong possibility the new contract will likely be a lot less than the initial $458 million agreement. That is due to comments made by Brian Raftery, the U.S. Army’s PEO EIS’s Army Data and Analytics Platforms’ (ARDAP) project manager, at a recent industry event that suggested potential conflicts over data ownership with the current vendor and hinted at the possibility that a change could “ruffle some feathers.”

Since then, DiPalma has had conversations with the army and those signal its appetite for change.

“While the Army clarified that it was referring to the general industry (not Palantir) in its discussion of data ownership issues, it said it still remains committed to overhauling Vantage from being sourced solely to Palantir to a multivendor architecture,” DiPalma explained. “It also reaffirmed that it intends to maximize the use of open-source technology.”

Why is an overhaul needed in the first place? The information request to vendors indicated a desire to embrace an open architecture and move away from all-encompassing, monolithic technology stacks. The goal being to have an approach will “enable the Government to enable best value for tool/service selection, and economical cost sharing.”

The total contract value of the renewal will ultimately show the degree of the Army’s commitment to Palantir. Going by the presentations made at the event, DiPalma remains convinced Palantir won’t be the sole recipient of the $458 million contract as it was in December 2019. “Further,” he summed up, “we believe there is the potential that the revenue run-rate is cut from the $116 million per year level described in the press release.”

Overall, DiPalma’s assessment suggests it’s best for investors to maintain a cautious stance for the time being. The analyst has rates PLTR shares as Underperform (i.e., Sell) without specifying a fixed price target. (To watch DiPalma’s track record, click here)

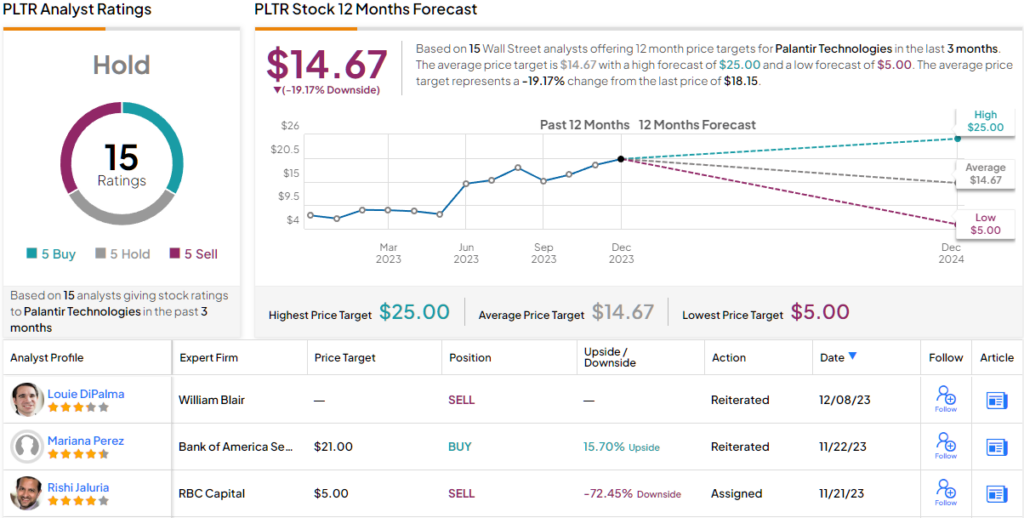

Looking at the ratings breakdown, the Street is evenly split here; the stock receives a Hold consensus view based on a mix of 5 Buys, Holds and Sells, each. At $14.67, the average target suggests the shares (which have delivered year-to-date gains of an impressive 180%) are due a cooling down period; the figure stands at $14.67, representing downside of ~19% from current levels. (See Palantir stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.