Questions about Palantir’s (PLTR) ability to meaningfully penetrate the commercial market have underpinned the bear thesis for the big data specialist.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company’s latest set of quarterly results have only provided the naysayers with more ammunition.

But first, let’s look at the quarter’s positives.

In Q3, non-GAAP EPS of $0.04 met the Street’s target, while revenue increased by 35.5% year-over-year to $392 million, $5.54 million above consensus. And looking ahead to Q4, Palantir is targeting revenue of $418 million, above Wall Street’s forecast for $402 million. The company’s guidance for full-year revenue of $1.527 billion is also higher than the consensus estimate of $1.505 billion.

But now to the bad parts, of which RBC’s Rishi Jaluria thinks there are plenty.

While the Commercial segment exhibited acceleration for the fourth quarter in a row, Jaluria estimates that without the SPAC investments, Commercial revenue increased by 22%, a “deceleration” of the 25% growth seen in 2Q.

“We do not believe revenue from SPAC investments is sustainable,” explained the 5-star analyst, “Especially given the relatively small size of the companies Palantir is investing in. Overall total deal value is actually down sequentially excluding SPAC investments.”

Even more alarming, growth for Palantir’s bread and butter, Government revenue – or what Jaluria calls the “strongest part” of the business – also slowed down, as the analyst had anticipated. However, the declaration was more acute than expected, with the growth rate “nearly cut in half from 2Q to 3Q.” Government deal value also increased by just 7% from the same period last year. “We believe Palantir got direct benefits from COVID-related spending and those benefits have already faded,” Jaluria opined on the slow down.

Due to the deceleration for both Government and the Commercial (ex-SPAC) segments, Jaluria does not believe that the company’s target of 30%+ growth every year until 2025 is realistic.

“We still believe Palantir has good technology and strong customer government relationships,” the analyst summed up, “But given the valuation, would like to see additional proof points of clean, sustainable 30%+ growth before getting more constructive.”

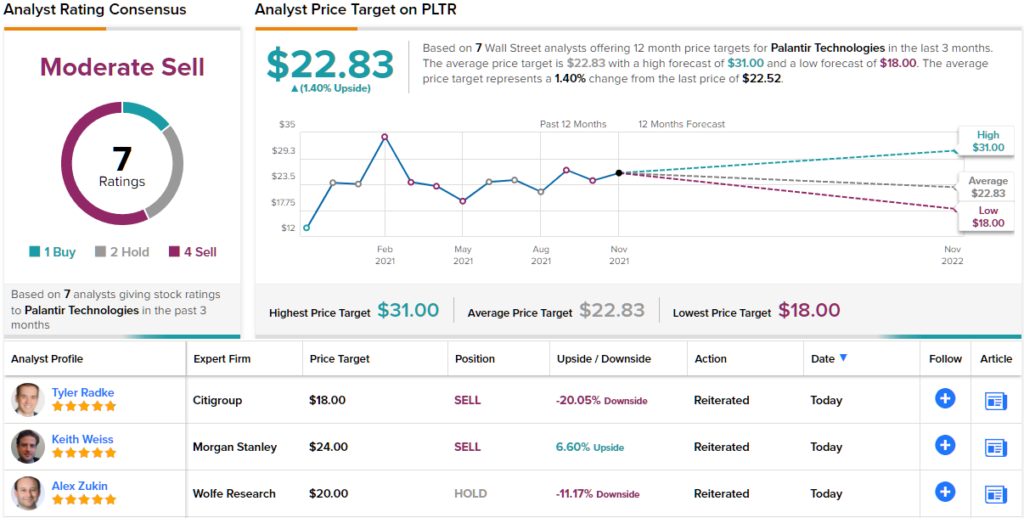

To this end, Jaluria downgraded PLTR’s rating form Sector Perform (i.e. Hold) to Underperform (i.e. Sell) and slashed the price target from $25 to $19. The analyst therefore expects shares to trend south by nearly 16% over the coming months. (To watch Jaluria’s track record, click here)

The rest of the Street’s assessment is hardly less downbeat; based on 4 Sells, vs. 1 Buy and 2 Holds, the analyst consensus rates the stock a Moderate Sell. (See Palantir stock analysis on TipRanks)

To find better ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.