PagerDuty (NYSE:PD), like most stocks in the tech space, has witnessed a selloff in 2022. While shares of this digital operations management software provider have lost significant value, its key performance metrics, including revenue growth, customer base, retention rate, and others, remain strong. This implies that the demand for its offerings has been sustained despite macroeconomic weakness.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

For instance, PagerDuty’s top line has continued to grow at an over 30% rate for the past several quarters. Further, PagerDuty has managed to control costs and reduce operating losses.

It recently delivered strong Q2FY23 financials, wherein its revenue increased by 34% year-over-year. Furthermore, it reported an adjusted operating loss of $3.4 million compared to $9.9 million in the prior-year period.

PagerDuty’s customer base continues to expand both on a year-over-year and sequential basis. Its total paid customer base increased to 15,174 in Q2, compared to 14,169 in the previous year’s quarter. What stands out is that PD’s customers with annual recurring revenue of more than $100,000 stood at 689 compared to 501 in Q2FY22 and 655 at the end of Q1FY23.

Furthermore, its dollar-based net retention rate continues to remain high, and in Q2, it came in at 124%.

Thanks to its robust financials and solid performance metrics, PD stock jumped 8.7% in the after-hours on Thursday.

Is PagerDuty a Good Stock to Buy?

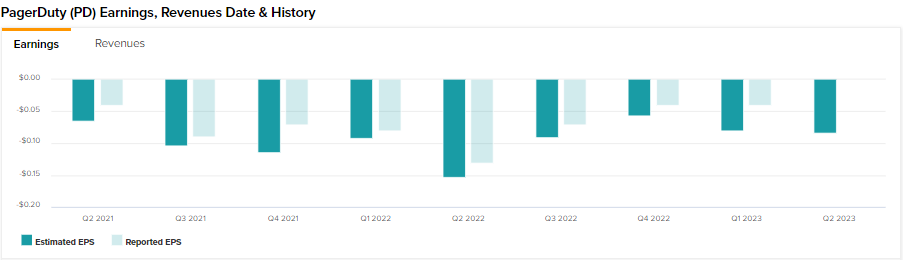

The ongoing momentum in PagerDuty’s business has consistently led the company to exceed analysts’ estimates in terms of the bottom line. In Q2, PD reported an adjusted loss of $0.04 a share compared to the analysts’ estimate of $0.08.

PD’s CEO Jennifer Tejada stated, “We continued to see strong demand across regions and verticals.” Further, she added that PagerDuty is “well positioned in an uncertain macro environment” with continued cloud adoption.

Due to the strength of its business, Wall Street is optimistic about PD stock. It has received three Buy and one Hold recommendations for a Strong Buy rating consensus. Hedge funds are also positive about PD’s prospects. Hedge funds bought 746.8K PD shares in the last three months.

PD Stock: Strong Upside Potential

Given the solid business fundamentals, strong performance metrics, and a positive outlook from analysts and hedge funds, PD stock is poised to deliver solid financials.

Furthermore, analysts’ average price target of $38.67 implies 60.5% upside potential.