OptimizeRx Corporation (OPRX) provides the largest digital health network “of its kind,” according to the company’s literature, and was well-positioned to prosper during the 2020 pandemic-driven economy. And the company certainly did prosper with record revenue and revenue growth.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

OptimizeRX Platform

The company has thrived during the pandemic due to the nature of the OptimizeRx platform, which has proven extremely beneficial as it limits face-to-face contact. The platform provides a digital communications bridge between doctors, patients, pharmaceuticals, and payers, with the intent of improving drug affordability, access, and adherence.

Setting aside the pandemic and remote medicine, a basic problem for pharmaceutical companies is that most doctors’ offices do not allow representative visits and drug samples. The OptimizeRx platform circumvents this need by providing sample vouchers and co-pay coupons for branded medications that can be printed by the doctor for use by the patient.

Business Transformation

The company began shifting its business model away from individual product deals to large enterprise recurring revenue, targeting large multi-brand pharmaceutical clients in 2019. The shift provides pharmaceuticals with the ability to connect with the other stakeholders, while promoting their brands and offering discounts.

The transformation has involved moving the platform to Amazon (AMZN) Web Services and company acquisitions in 2018 and 2019. OptimizeRX now has four basic applications: (1) ‘Financial Messaging’ for access to sample vouchers and co-pay coupons; (2) ‘Brand and Therapeutic Support Messaging’, which include brand awareness ads and therapeutic support message; (3) ‘Brand Support’, which assists pharmaceuticals with the promotion of their solutions; and (4) ‘Patient Engagement’, which provides interactive care via digital messaging.

Financial Performance

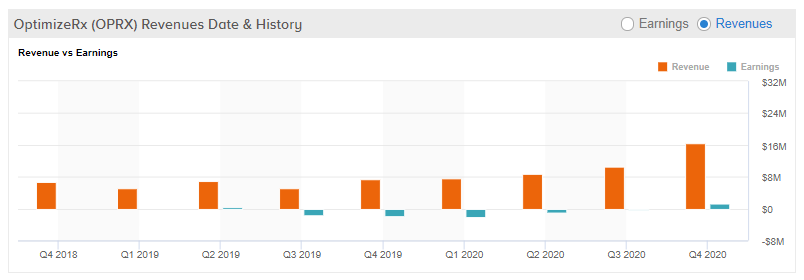

The pandemic has been the perfect backdrop for this transformation with the addition of 60 new brands in 2020, and resulting in record year-over-year revenue growth of 123% in Q4’20 and 76% for the year. Additionally, non-GAAP net income turned positive in Q4.

Looking Forward

While OptimizeRX management does not provide forward-looking guidance, they did offer some insights during the Q4’20 earnings call that are worthy of note.

For starters, at the end of the year, OptimizeRX had approximately 50 pharmaceutical customers, but in 2021, it has secured 19 new enterprise-level deals and has a pipeline of more than $180 million of potential new business.

In addition, the company also expects to exceed the 86% customer renewal rate it experienced in 2020. Finally, OPRX has indicated that the pandemic has not affected operations and does not expect that to be the case in the future.

Wall Street’s Take

From Wall Street analysts, OptimizeRx earns a Strong Buy consensus rating, based on 3 unanimous Buys. Additionally, the average analyst price target of $71.33 puts the upside potential at 41%. (See OptimizeRx stock analysis on TipRanks)

Summary And Conclusions

OptimizeRx is an industry leader in health communications solutions, providing the largest digital health network tailored for efficient communications between pharmaceuticals, doctor offices, patients, and payers. 2020 was a banner year for the company given the progression of its business model transformation and introduction of new applications, with it also providing essential services during the pandemic. Revenue was up 123% year-over-year for Q4’20 and 76% for the full year.

2021 should see OPRX continue this success story as the company expands its digital health network and lands new enterprise deals. In all likelihood, modern digital health communications are here to stay, even in a post-pandemic environment.

Disclosure: On the date of publication, Steve Auger did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.