It’s been clear for a while now that the stock market is on an upward trajectory, buoyed by a resilient economy and retreating high inflation. The good news, according to John Stoltzfus, Chief Investment Strategist at Oppenheimer, is that the chances of the bull market continuing are more likely than the bears grabbing hold of the narrative once again.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

“Our appraisal of the market landscape at this time suggests that opportunity outweighs risk as current monetary policy generates a transition from a ‘free money’ environment to an environment with a traditional cost of borrowing,” Stoltzfus said.

Moreover, given the resilience exhibited by the US economy, along with improvements in the CPI headline and CPI core metrics, Stoltzfus thinks the S&P 500 is primed for further gains. Therefore, he has increased his year-end 2023 target for the S&P 500 index to 4900 from the 4400-target set last December. This represents an additional return of 7% from current levels.

If the market is set to keep pushing forward, investors will be presented with more opportunities and Oppenheimer analysts have an idea where those will manifest themselves best. Amongst their choices, they see two names delivering returns of at least 50% over the coming months. After running the tickers through TipRanks’ database, it’s clear the rest of the Street is in agreement, with each earning a ‘Strong Buy’ consensus rating.

Enovix Corporation (ENVX)

The first Oppenheimer pick is Enovix, a company at the forefront of next-generation battery advancements. The company is a developer and manufacturer of high-capacity lithium-ion batteries with innovative 3D cell architecture. Enovix’s 3D Silicon Lithium-ion batteries promise to deliver higher energy density and longer-lasting performance compared to traditional lithium-ion batteries, making them a potential game-changer in various applications such as smartphones, wearable devices, electric vehicles, and other portable electronics.

It’s early days for this company although its cutting-edge tech has garnered significant attention and investments. In the meantime, Enovix is making meaningful strides on the production end. Given continued operational improvements at its Fab1 site, in Q2, production exceeded company targets, as the firm produced 22,502 units, a 25% improvement on the 18,000 units expected initially.

The total revenue funnel rose to $1.59 billion, a 9% sequential increase due to customer opportunities rising by 14% quarter-over-quarter to 121. And during the quarter, Enovix disclosed that the U.S. army had put in a purchase order for BrakeFlow-enabled cells to be used for the U.S. army’s soldier central power source.

Lastly, the company also secured $70 million of non-dilutive local funding from YBS International Berhad that will go toward its first high-volume production line in Malaysia.

All this activity has piqued the interest of Oppenheimer analyst Colin Rusch, who sees a bright future for this battery tech disruptor.

“As ENVX continues to make progress commercializing its proprietary battery technology, both volume and yield metrics are tracking to plan at its Fremont facility while process optimization in Malaysia is also on plan. We are encouraged to see the company growing its sales pipeline and making incremental progress on moving customers through design and qualification processes. With ENVX completing the announced debt financing on Fab 2, we note capex for the year was reduced $50M which we believe should aid investor comfort on its balance sheet and the strength of Malaysian manufacturing partner,” the 5-star analyst opined.

“We continue to be constructive on shares as we believe the company is executing well on elements that will drive target manufacturing costs while building customer confidence in its ramp,” Rusch summed up.

These comments form the basis for Rusch’s Outperform (i.e., Buy) rating, while his $36 price target makes room for 12-month returns of ~74%. (To watch Rusch’s track record, click here)

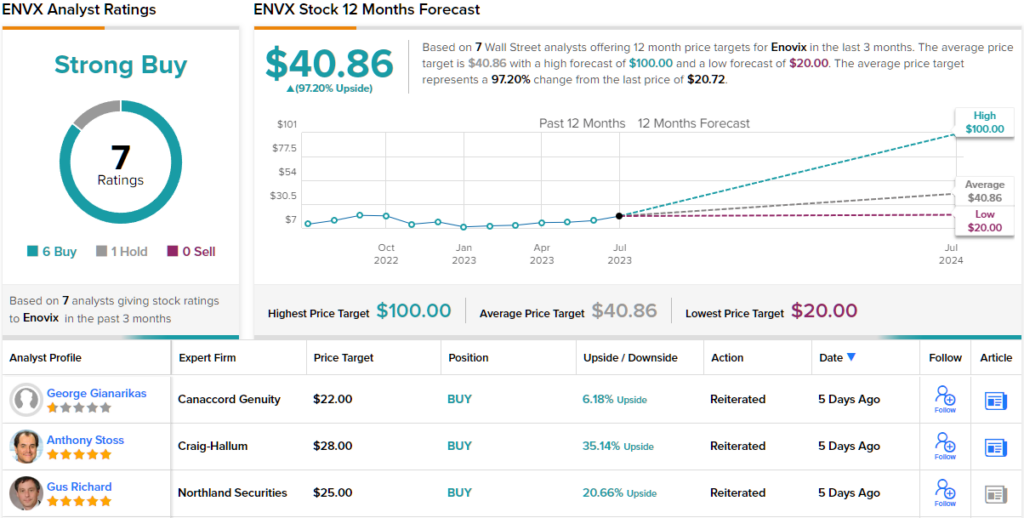

Overall, the bulls have it on this one. 6 Buys and 1 Hold have been issued in the last three months. Therefore, ENVX gets a Strong Buy consensus rating. The average target is even more bullish than Rusch will allow; at $40.86, the figure suggests shares will rise by 97% in the months ahead. (See Enovix stock forecast)

UroGen Pharma (URGN)

Let’s switch lanes now and turn to the biotech industry for our next Oppenheimer-backed name. UroGen Pharma’s primary focus is on creating innovative therapies for urothelial and specialty cancers. The company has pioneered its RTGel platform, a unique reverse-thermal hydrogel technology designed to enhance the efficacy of current medications by prolonging their interaction with urinary tract tissues.

Every biotech’s mission is to get its product approved and Urogen can boast success on that front. In 2020, the FDA approved Jelmyto as a treatment for adult patients with low-grade upper tract urothelial cancer (LG-UTUC). In 1Q23, Jelmyto generated revenues of $17.2 million, compared to $13.6 million in the same period last year.

More recently, a prospective treatment from the pipeline has been grabbing the headlines. Last week, the company unveiled encouraging top-line data from two late-stage studies of UGN-102, an intravesical (within the bladder) solution designed for treating low-grade intermediate risk non-muscle invasive bladder cancer (NMIBC). Impressively, the candidate achieved the primary endpoints in both Phase 3 studies. Looking ahead, UroGen has plans to submit a marketing application for UGN-102 next year, marking a significant step towards potential approval.

It is UGN-102’s potential that drives Oppenheimer analyst Leland Gershell’s positive thesis. In fact, despite the huge share price strides, Gershell still views the stock as undervalued.

“Given the strong performance on both trials’ primary endpoints and no safety surprises, we see little risk to FDA approval and launch in 2025 as we await ENVISION durability of response data early next year,” Gershell explained. “We believe UGN-102 has $1B+ peak sales potential following its strong pivotal results… We believe shares trade at a discount to the value of Jelmyto and UGN-102, and that development progress and earlier pipeline advancement will support stock upside over the next 12 months.”

To this end, Gershell rates URGN an Outperform (i.e. Buy), and his new $33 price target (bumped up from $22) makes room for additional returns of 66% over the one-year timeframe. (To watch Gershell’s track record, click here)

Overall, 2 other analysts join Gershell in the bull camp, and while one stays on the sidelines, the stock still claims a Strong Buy consensus rating. Going by the $39.25 average target, a year from now, investors will be locking in gains of ~98%. (See URGN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.