It’s down to the wire. The U.S. Presidential elections are only a week away, and with the polls showing Biden has an edge over President Trump, investors are preparing.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Oppenheimer’s Chief Investment Strategist John Stoltzfus points out that last week, stocks churned as investors rebalanced their portfolios, rotating and adding additional exposure to value stocks “while others took profits in growth names that had previously run-up substantially ahead of what could be higher capital gains and other taxes next year,” in the event that the Democrats come out on top.

Highlighting that the expectation of an effective COVID-19 vaccine is behind the broadening of investor appetite for equities, Stoltzfus argues this renewed appetite ” improves the attractiveness of value stocks.”

Going forward, the strategist notes the Federal Reserve’s efforts “underscore the case for the economy’s recovery and the equity markets’ resilience and potential from here.” Although a “blue wave” is seen as a potential risk, Stoltzfus thinks this outcome is very unlikely, and that continued split control should alleviate market worries.

Taking Stoltzfus’ outlook into consideration, our attention turned to three stocks Oppenheimer analysts believe can surge by at least 70% in the year ahead. Running the tickers through TipRanks’ database, we found out that each boasts a “Strong Buy” consensus rating from the broader analyst community.

Chromadex (CDXC)

Focused on improving the way people age, Chromadex operates as a science-based integrated nutraceutical company. Following a recent data readout, Oppenheimer thinks that now is the time to get on board.

On October 6, CDXC published the results from the Phase 2 study evaluating a nutritional protocol that includes its Nicotinamide Riboside (NR) product along with the current standard-of-care in mild to moderate COVID-19 patients. It should be noted that the study included roughly 100 patients and was conducted in partnership with ScandiBio Therapeutics, at a research hospital in Istanbul, Turkey.

Based on the data, patients dosed with the NR plus standard-of-care combination saw a 29% reduction in recovery time (6.6 days compared to 9.3 days). These results are on top of existing NR-related research, including 11 published clinical studies and others that are ongoing. According to management, a Phase 3 study is set to kick off soon.

Weighing in for Oppenheimer, 5-star analyst Brian Nagel commented, “For a while, we have recommended CDXC as a decidedly compelling, albeit speculative investment play within specialty consumer. We interpret [the] news as further indication that ChromaDex continues its extensive and admirable push to understand well the science behind NR and its namesake product TruNiagen.”

Going forward, Nagel believes that the consumer audience is poised to expand. “We are increasingly optimistic that a swell of NR-focused research from ChromaDex and its partners continues to build and management works to strengthen an effective marketing message that mass-market demand for NR and TruNiagen will expand, unlocking significant financial and operational levels of CDXC,” he explained.

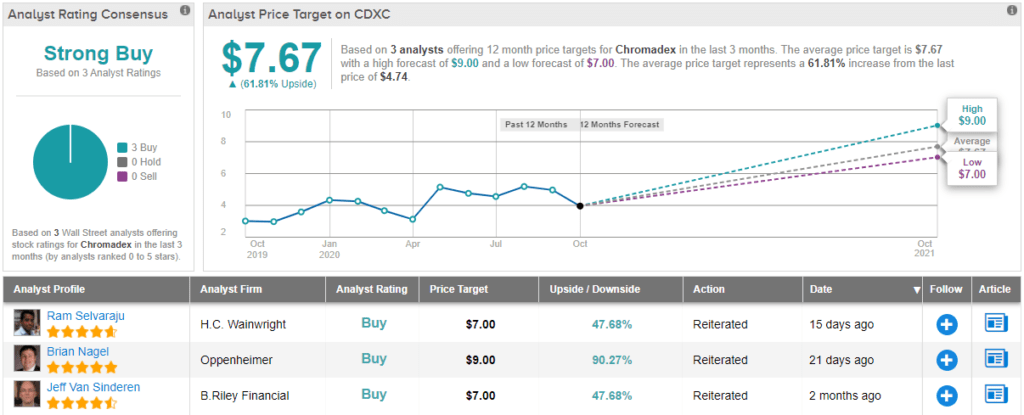

To this end, Nagel rates CDXC an Outperform (i.e. Buy) along with a $9 price target. Should the target be met, a twelve-month gain in the shape of a 90% could be in store. (To watch Nagel’s track record, click here)

It’s not often that the analysts all agree on a stock, so when it does happen, take note. CDXC’s Strong Buy consensus rating is based on a unanimous 3 Buys. The stock’s $7.67 average price target suggests a 61% upside from the current share price of $4.70. (See CDXC stock analysis on TipRanks)

Apellis Pharmaceuticals (APLS)

Next up we have Apellis Pharmaceuticals, which develops innovative therapies that target complement mediated diseases. With a solid set up emerging for 2021, Oppenheimer is pounding the table on this healthcare name.

Recently, APLS provided an update on its pipeline, including its systemic C3 inhibitor, pegcetacoplan, which will target C3G/IC-MPGN and ALS. 5-star analyst Justin Kim, who covers APLS for Oppenheimer, points out that C3G and IC-MPGN reflect a significant opportunity for systemic C3 inhibition, based on data that supports the role of complement activation and deposition.

Even with the “sub-optimal response” from a leading Factor D inhibitor, the analyst is optimistic about the C3 approach, “which could demonstrate a more potent and broader inhibition of the cascade.” It should be noted that a Phase 2 open-label study enrolling up to 12 patients was recently initiated.

On top of this, given that Alexion’s C5-approach is being explored in an ongoing Phase 3 ALS program, Kim has high hopes for this indication. “With APLS’ Phase 2 study enrolling ~200 patients, the company believes the study could be registration-enabling. At a potential case rate of ~5/100,000 in the U.S., ALS (and neurology) could reflect the largest longer-term opportunity for the systemic C3 pipeline, consistent with Alexion’s neurology focus,” he mentioned.

If that wasn’t enough, pegcetacoplan is currently in Phase 3 development for paroxysmal nocturnal hemoglobinuria (PNH) and geographic atrophy (GA). Although APLS faces hefty competition, Kim sees “a best-in-class product profile in pegcetacoplan, based on the available data.” The analyst added, “With a potential PDUFA expected in the middle of 2021 for PNH, we believe investors remain focused on potential commercial considerations for pegcetacoplan’s lead indication.”

As for the GA opportunity, Kim stated, “We highlighted in our launch our appreciation for GA, which continues to be a potentially transformative catalyst for shares at study readout (Q3 2021). With the DERBY and OAKS studies completing enrollment, we remain bullish on pegcetacoplan’s positioning in GA, the clinical meaningfulness of currently available data, and market opportunity.”

“As the long-term fundamentals remain robust and favorable, we continue to view APLS as an underappreciated biotech tracking well for a potential first approval in a well-understood commercial rare disease market, significant optionality in blockbuster indication geographic atrophy, and intriguing earlier-stage opportunities and assets (C3G, COVID-19, gene therapy). We expect management to continue to execute on these objectives, effecting re-rating of the shares,” Kim summarized.

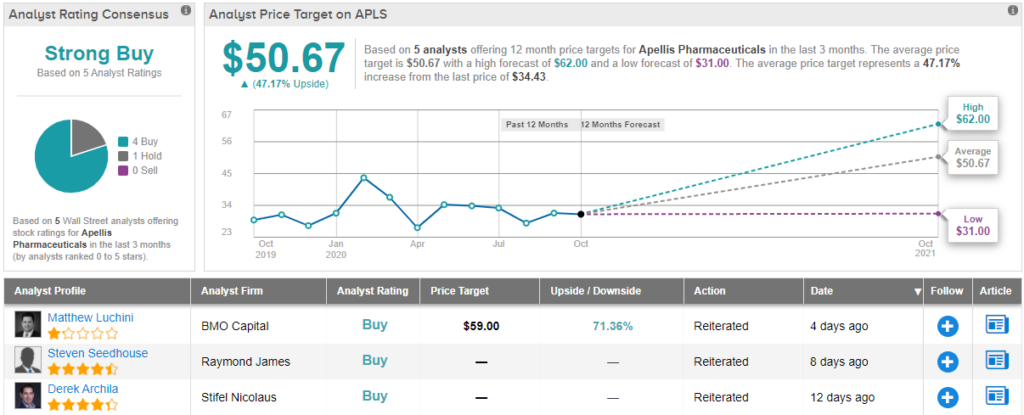

Everything that APLS has going for it convinced Kim to maintain his Outperform (i.e. Buy) rating. In addition to the call, he left the price target at $62, suggesting 71% upside potential. (To watch Kim’s track record, click here)

What does the rest of the Street have to say? 4 Buys and 1 Hold have been issued in the last three months. Therefore, APLS gets a Strong Buy consensus rating. Based on the $50.67 average price target, shares could rise 47% in the next year. (See APLS stock analysis on TipRanks)

Boingo Wireless (WIFI)

As for Boingo Wireless, it provides connectivity to mobile devices over small-cell systems that encompass LTE as well as Wi-Fi spectrum and networks. According to Oppenheimer, this company’s future looks bright.

Representing the firm, 5-star analyst Timothy Horan tells clients that uncertainties related to the pandemic and valuation prompted him to downgrade the rating back in April, but now, he sees an attractive entry point.

Given that WIFI has solid assets across growing end-markets (Military and DAS), and the stock is trading at 13x Horan’s 2021 cash EBITDA, which is a 35% discount to a 20x purchase price and reflects a 25% discount to tower companies trading at approximately 25x 2021E EBITDA, the analyst believes an acquisition is likely.

“We believe there’s a high probability Boingo sells part or all of its business to towers or an infrastructure-focused private equity firm in the next year. A strategic buyer could improve EBITDA by $15 million on unnecessary overhead expenses alone. Plus, there’s a strong appetite for wireless infrastructure, shown by multiple recent transactions,” Horan explained.

Most likely, the business will be broken up into three different companies, with it worth roughly $800 million on a SoTP basis compared to its current $500 million enterprise value, according to Horan. He also argues that the Military/Multifamily segment has a $600 million enterprise value business based on a 18x EBITDA multiple and his $34 million EBITDA estimate, with DAS and Wholesale making up another $200 million in firm value.

Expounding on the Military and DAS opportunity, Horan commented, “Positively, more 4G/5G spectrum will be deployed and Boingo expects to go live with a carrier for the LIRR’s first phase by the end of 2020. The Military business has shown resiliency through the pandemic. Boingo saw a large traffic uptick in Q2 2020 on Military bases and it’s expanding higher ARPU 100Mbps service to more bases.”

Additionally, Horan expects WIFI’s Q3 results to be weak due to lower airport and venue traffic, but believes that revenue and cash EBITDA have most likely bottomed, with management making significant efforts to trim expenses.

“We believe Boingo’s wireless assets are unique and the pandemic has highlighted the need for its critical neutral infrastructure to support connectivity. Recent acquisitions point to a strong interest for wireless infrastructure and Boingo’s valuation is attractive at current levels. Military and DAS have been resilient and are well-positioned long-term,” Horan concluded.

In line with his optimistic approach, Horan joined the bulls, upgrading the rating from Perform to Outperform and attaching a $15 price target. Investors could be pocketing a gain of 63%, should this target be met in the twelve months ahead. (To watch Horan’s track record, click here)

Are other analysts in agreement? They are. Only Buy ratings, 7 to be exact, have been issued in the last three months. So, the message is clear: WIFI is a Strong Buy. Given the $19.86 average price target, shares could surge 116% in the next year. (See WIFI stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.