Bitcoin briefly touched its lowest price in a month on Monday — less than $39,000 — before rebounding slightly before the close. Moving in tandem, shares of cryptocurrency exchange Coinbase (COIN) dropped sharply early in the day before paring their losses by day-end.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Coinbase’s fall was surely tied in part to the decline in Bitcoin. But it also owed to Oppenheimer analyst Owen Lau cutting his price target on the crypto exchange’s stock by 17% yesterday, to $314 per share. And yet, even if Lau’s note was somewhat to blame for Coinbase’s decline, believe it or not: He actually likes Coinbase stock.

“We have done a dive deep into the bear thesis,” explains Lau in yesterday’s note, and far from being spooked by what he found, Lau says “the bear thesis is way overblown and… this creates an opportunity for long-term investors to get into one of the most disruptive companies in the market at … a very attractive valuation” of just 4.4 times current year sales.

Given that “comparable high-growth fintech companies” are selling for as much as 12.8 times sales, Coinbase stock may actually be as much as 65% undervalued, says Lau. And if he’s right about that, then his price target of $314 — barely twice Coinbase’s current share price — could actually prove conservative. But why are investors being offered such a big discount on Coinbase stock in the first place?

The sliding value of Bitcoin is one reason. As Bitcoin loses value, investors are naturally less enthusiastic about buying lead, leading to “soft” trading volume, says Lau. And yet, given the steep decline in the value of Coinbase stock — down 38% already this year — the analyst suggests that expectations of near-term trading revenue weakness may already be baked into the stock price. At the same time, however, Lau points out that “subscription and services revenue,” at least, remain healthy, and are likely to provide as much as 16% of Coinbase’s total revenues in Q1 2022.

Another of the bear theses against Coinbase that Lau isn’t impressed with, is the threat from increased competition. Coinbase “bears” worry that rival crypto exchanges will force trading fees lower through price competition — and this could be the case. However, Lau argues it ignores the longer-term trend of increasing “crypto adoption” that will grow overall trading revenues despite lower fees per trade.

Speaking of competition, Lau also notes that despite the weak crypto trading environment, Coinbase has been spending heavily on transmission and distribution infrastructure, as well as on general and administrative expenses (“T&D and G&A”), which may weigh on earnings. However, Lau notes that Coinbase has the option of ratcheting back spending if the trading environment gets any weaker — and it’s expressed a willingness to do so if necessary. Coinbase would prefer not to reduce spending, however, but rather to keep on spending on its infrastructure, to widen the gap with its competitors and make it harder for them to “catch up” to Coinbase’s leading position.

So long as Coinbase remains the leader in crypto trading — and especially so long as its valuation compares so favorably to other fintechs — Lau remains confident that Coinbase stock can still “outperform” the market. (To watch Lau’s track record, click here)

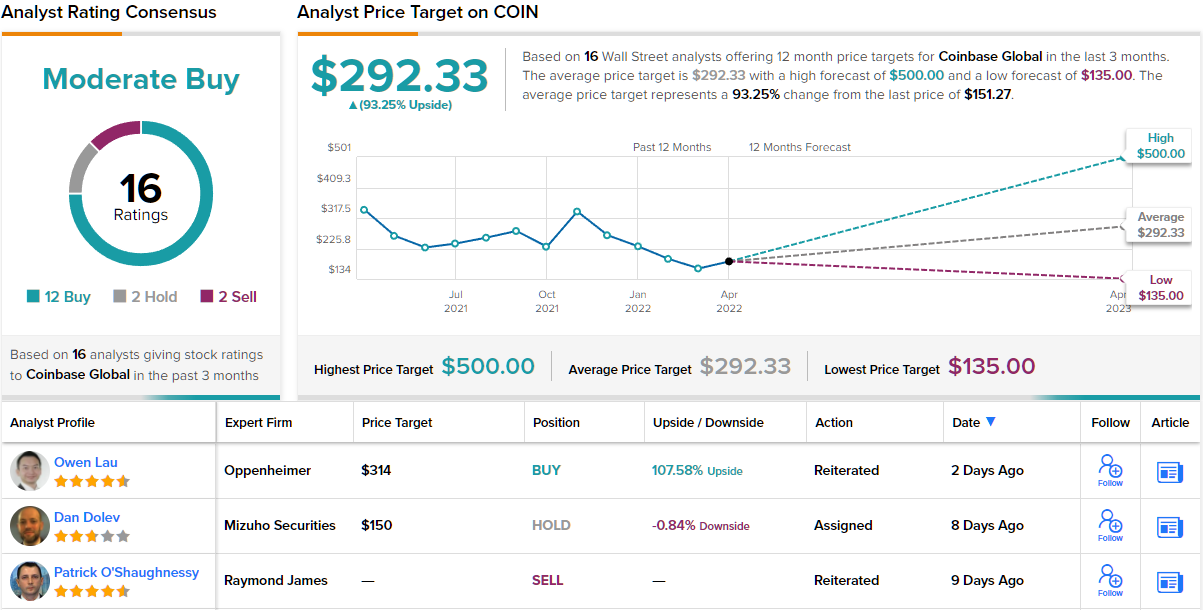

Turning now to the rest of the Street, where COIN has robust support among Lau’s colleagues. Based on 12 Buys, 2 Holds and 2 Sells, the stock has a Moderate Buy consensus rating. Impressively, the $292.33 average price target implies the stock will be changing hands at a 93% premium over the following months. (See COIN stock forecast on TipRanks)

To find good ideas for crypto stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.