Shares of graphics hardware behemoth Nvidia (NVDA) really excited investors during its 2022 Investor Day presentation, shedding light on a plan to become the first $1 trillion semi company. If there’s a company that can pull it off, it’s Nvidia, with its brilliant leader Jensen Huang.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Undoubtedly, the total addressable market (TAM) for Nvidia is enormous. The innovative graphics-processing unit (GPU) maker has a front-row seat to video gaming, automotive tech, AI, and data center. Undoubtedly, a nice slice of each of the following markets could propel the company’s market cap above the $1 trillion mark.

Still, it’s Nvidia’s Omniverse initiative that could be the key to unlocking next-level growth over the next decade once we move closer to the concept of the metaverse.

However, although Nvidia is on the cutting edge of next-generation technology, I am neutral on the stock. It’s not that I wasn’t excited about Nvidia’s investor day or the $1 trillion opportunities at hand. It’s the valuation of the stock going into a higher-rate environment.

The growth sell-off has been unforgiving thus far, and it may not be over. With a 22.7 times sales multiple, NVDA stock faces tremendous downside risk if the broader growth sell-off continues.

For that reason, I’m in no rush to chase Nvidia stock to trillion-dollar market cap territory. It will come in due time, but it will surely be a rocky road to the level, with the growth trade starting to show its wobbly legs.

Nvidia’s Omniverse is the Answer to Meta’s Metaverse

Add the exciting Nvidia Omniverse effort into the equation, and the trillion-dollar aspirations are not at all far-fetched. Thanks to a timely name change, Meta Platforms (FB) has propelled the concept of the metaverse to the forefront. In recent months, though, the growth trade has faded, and the metaverse ambitions of Mark Zuckerberg have started to seem more far-fetched.

With interest rates on the rise, profitability matters more than exciting stories. Still, there’s no denying the long-term potential in the metaverse. Arguably, Nvidia is one of the better-equipped companies to construct the metaverse, not Meta. Unlike Meta, Nvidia has been in the gaming business for a very long time, with its top-of-the-line hardware that helps gamers run their favorite titles.

Not only does Nvidia’s background give its Omniverse offering a greater chance at success, but it also lacks the questionable reputation that Facebook has. Further, early teases of Nvidia’s Omniverse appear so much more exciting than the Meta presentation that revealed the firm’s new name and focus.

Simply put, Nvidia is a graphics power king, and it’s this hardware edge that could allow it to transition consumers into virtual worlds, which will likely be gaming-centric.

Nvidia Stock’s Valuation Remains Excessive

Nvidia’s Investor Day did not fail to impress this year. In many ways, its presentation is becoming more exciting than the likes of an Apple keynote (at least until the company has a chance to unveil the Apple Car or mixed-reality headset). The initial reaction was profoundly positive. Still, the stock has been shedding some of its recent gains.

At the end of the day, valuation matters. As one of the priciest semi stocks out there, Nvidia stock could be one of the growth stocks to face amplified damage as the rate-driven valuation reset continues.

Further, many industries Nvidia is pushing towards may not be tremendously profitable until many years down the road. Think nascent markets like AI and Omniverse. They’re undoubtedly exciting, but it’s unclear when next-generation AI and the metaverse will be ready for prime time.

If sizeable profits from such awe-inspiring initiatives are closer to 2030 than 2022, the stock will undoubtedly take a hit, especially now that the Fed has shown signs of increased hawkishness.

Wall Street’s Take

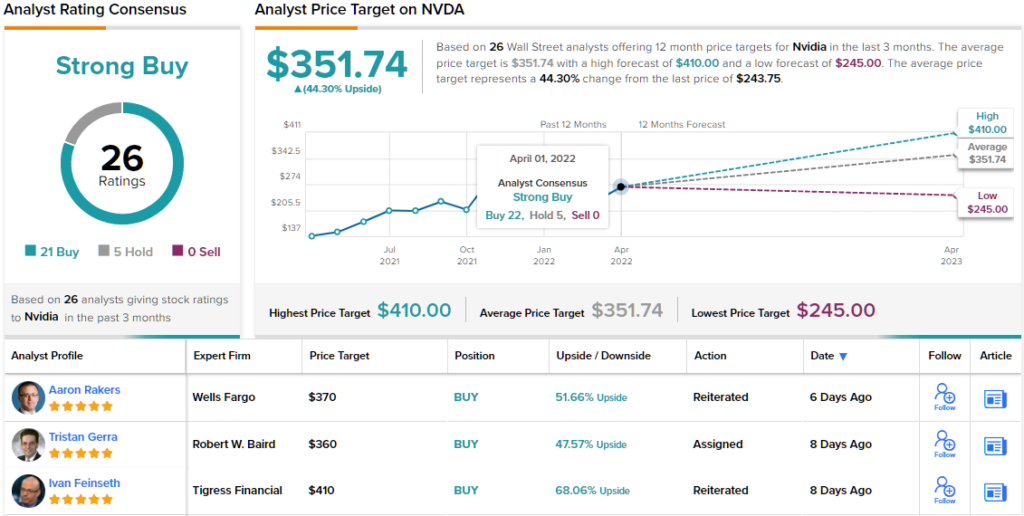

Turning to Wall Street, NVDA stock comes in as a Strong Buy. Out of 26 analyst ratings, there are 21 Buy recommendations and five Hold recommendations.

The average Nvidia price target is $351.74, implying an upside of ~44%. Analyst price targets range from a low of $245 per share to a high of $410 per share. (See NVDA stock forecast on TipRanks)

The Bottom Line

Nvidia is such a great company with a visionary founder-led leader. Nvidia’s TAM is huge and seems virtually unbounded, but the real risk to the stock at these valuations is what happens with the growth trade.

The company itself will be firing on all cylinders, and I do not doubt that it will deliver. That alone may make the stock worth a hefty premium, but is ~23 times sales too hefty a premium? I’m not so sure.

In any case, I’d take a raincheck on the name because the “growth at any price” trade seems all but done now that the Fed is so focused on inflation.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure