Thanks to the stellar bull run in Nvidia (NASDAQ:NVDA) stock, it became the first chip company to attain $1 trillion in market cap. NVDA stock has gained about 181% year-to-date, reflecting a surge in demand for its chips that drive AI (Artificial Intelligence) applications. Further, NVDA’s leadership in the AI space and Generative AI driving significant upside in demand for its products indicate that the uptrend in its stock could sustain.

NVDA Winning the AI Race

With growing AI adoption, NVDA has positioned itself as the leading operating system for AI. During the Q1 conference call, NVDA’s CFO, Colette Kress, said that cloud service providers, consumer Internet companies, and enterprises around the world are racing to deploy its flagship Hopper and Ampere architecture GPUs (Graphics Processing Unit) to meet the growing demand for AI applications in training and inference. This reflects the widespread recognition of NVDA’s technology and its crucial role in powering AI-driven solutions.

Furthermore, NVDA is witnessing strong momentum in verticals like automotive, healthcare, telecom, and financial services, where AI and accelerated computing have seen rapid adoption.

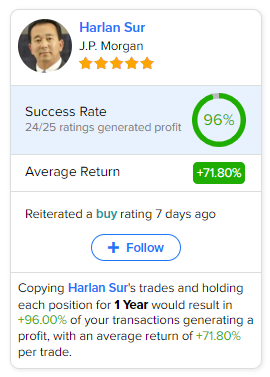

J.P. Morgan analyst Harlan Sur reiterated a Buy rating on NVDA stock following the investor group meeting earlier this month. In a note to investors dated June 7, Sur highlighted that the demand for generative AI remains strong, with Datacenter products witnessing solid growth. Also, the shipment volumes of H100, its GPU optimized to develop, train, and deploy generative AI, have ramped up.

What is the Prediction for Nvidia Stock?

NVDA stock has appreciated quite a lot. However, analysts’ average price targets show further upside potential. It’s worth highlighting that competition is rising for NVDA, with Advanced Micro Devices (NASDAQ:AMD) revealing its AI chip, the Instinct MI300X GPU. However, Goldman Sachs analyst Toshiya Hari remains upbeat about NVDA’s prospects. He expects the company to maintain a lead in the AI space, at least in the near term, due to the deployment of complex AI models.

Overall, NVDA stock has received 32 Buy and four Hold recommendations for a Strong Buy consensus rating. Analysts’ average price target of $449.92 implies 9.68% upside potential.

Investors should note that Harlan Sur is the most accurate analyst for NVDA stock, according to TipRanks. Copying Sur’s trades on NVDA stock and holding each position for one year could result in 96% of your transactions generating a profit, with an average return of 71.80% per trade.