Nvidia (NASDAQ:NVDA) smashed analysts’ expectations for the third quarter of Fiscal 2024, thanks to its dominance in the artificial intelligence (AI) space. The blockbuster results have pushed Wall Street to reconsider the enormous growth potential that the chip maker holds. Following the Q3 print, two five-star analysts with a Buy rating on NVDA, Matt Ramsay of TD Cowen and Vijay Rakesh of Mizuho Securities, have hailed NVDA as their “Top Pick.”

Analysts Predict Significant Upside for NVDA Stock

After the earnings results, analyst Rakesh increased the model estimates for NVDA and also raised the price target to $625 (25.1% upside) from $590. The primary factors for his optimism include Nvidia’s better-than-expected guidance for the January quarter, backed by AI momentum and the expected rebound in gaming.

Meanwhile, analyst Ramsay is a little more optimistic about NVDA’s growth. He maintained a price target of $700 (40.2% upside), citing incredibly strong results and guidance. Ramsay has full trust in Nvidia’s wide moat, which will help the company continue to dominate the AI space.

Investors Fret Over China Curbs

Notably, NVDA stock did not respond as enthusiastically to its blowout quarterly results, which may have something to do with investor concern about its growth prospects. Even so, analysts believe that its data center revenue is poised to leverage the burgeoning demand for AI hardware and software products.

Despite the U.S. restrictions on chip exports to China, management has maintained that Nvidia’s revenue and earnings will grow substantially in Fiscal 2025. Also, Nvidia is already working on manufacturing chips that would comply with U.S. standards for export to China and the Middle East. Plus, the semiconductor giant is trying to get government licenses to sell its high-end products to both nations.

Is Nvidia Stock Expected to Grow?

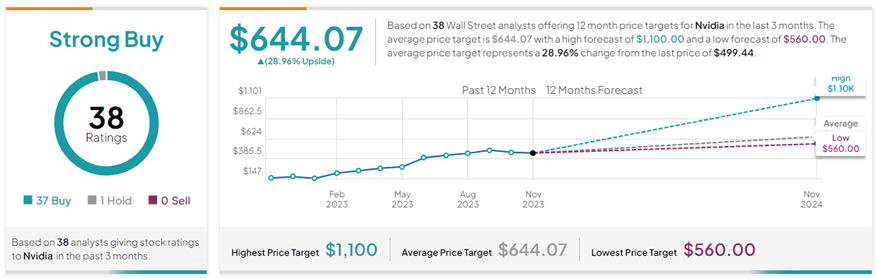

With 37 Buys versus one Hold rating, Nvidia has a Strong Buy consensus rating on TipRanks. The average Nvidia price forecast of $644.07 implies nearly 29% upside potential from current levels. Based on these, Nvidia has a Strong Buy consensus rating on TipRanks. The average Nvidia price forecast of $644.07 implies nearly 29% upside potential from current levels. Year-to-date, NVDA stock has exploded by 249%.

Ending Thoughts

Nvidia has yet again proven its supremacy in the AI space. The two five-star analysts reiterated that there is no stopping Nvidia from continuing to conquer the largest market share (roughly 95%) in the generative AI space. Going by their optimism and the management’s unequivocal confidence in growth prospects, we can safely say that Nvidia is on track to perform brilliantly in the coming quarters.