After the bell rings to bring today’s market action to an end, Nvidia (NASDAQ:NVDA) will take its turn to deliver its latest quarterly statement.

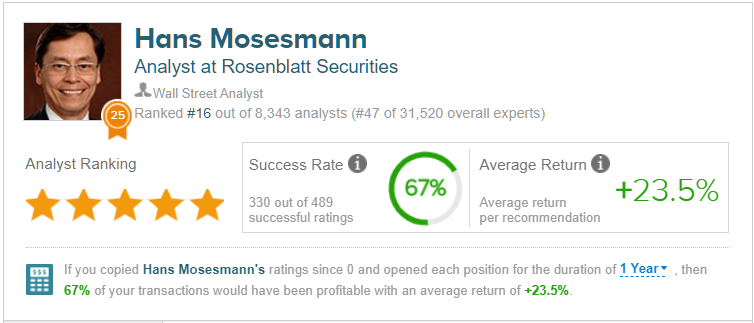

The chip giant’s fiscal fourth-quarter results (January quarter) come at a time when the Street is awash with AI (artificial intelligence) buzz. As a leader in the space, Nvidia stands to benefit greatly from the increasing usage of AI, as noted by Rosenblatt 5-star analyst Hans Mosesmann.

“Thematically,” says the 5-star analyst, “Nvidia has started to capture investor imagination on the first potentially big AI inference application in the Chatbot world: ChatGPT. We believe ChatGPT is just one of a multitude of AI-centric growth vectors going forward, which is fundamental to our 2- year thesis of a dynamic that is leading to a Mother-of-All-Cycles (MOAC), that the semi industry has never witnessed and a breakdown in original Moore’s Law economics (higher ASPs going forward).”

More in the here and now, Mosesmann expects Nvidia to deliver in line results for the January quarter, calling for revenue of $6.00 billion (consensus has $6.02 billion) and adj. EPS of $0.81 – the same as the Street.

For the outlook (April quarter), Mosesmann is below consensus on both the top-and bottom-line, expecting revenue of ~$6.0 billion and EPS of $0.80 vs. the Street at $6.34 billion and $0.88, respectively.

Nevertheless, despite the conservative stance, Mosesmann’s price target, at $320, remains the Street’s highest and is set to generate returns of 54% over the coming year. Unsurprisingly, Mosesmann’s rating stays a Buy. (To watch Mosesmann’s track record, click here)

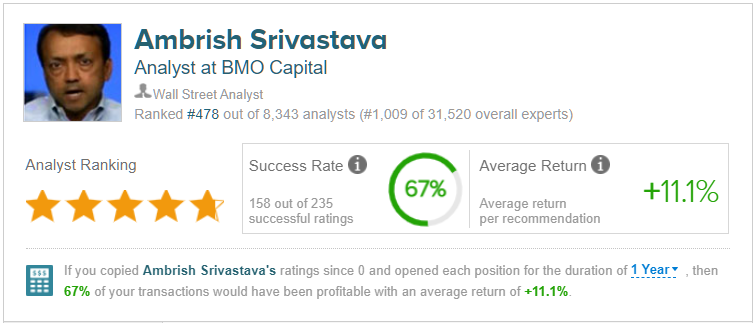

BMO analyst Ambrish Srivastava’s take is rather similar. Ahead of the print, the analyst is also down with consensus expectations for the quarter. However, looking ahead, Srivastava has lowered the adj. EPS outlook for FY24 from $4.45 to $3.95. “Our research suggests an increasing weaker environment for NVIDIA’s Data Center business, particularly as it relates to F1Q and F2Q,” explained the 5-star analyst.

However, that is where Srivastava’s bearish take ends, because beyond the near term, he sees generative AI presenting a potentially meaningful multi-billion dollar opportunity.

“We note that in our LT earnings power, we are now starting to include the potential impact from what generative AI could do to drive NVIDIA’s earnings over the longer term,” Srivastava went on to say.

And that potential merits a price target hike. The figure moves from $210 to $240, implying one-year gains of 16% could be in the cards. Srivastava’s rating stays an Outperform (i.e., Buy). (To watch Srivastava’s track record, click here)

Elsewhere on the Street, most are also backing Nvidia’s case; with a total of 16 Buys, 4 Holds and 2 Sells, the stock claims a Moderate Buy consensus rating. Going by the $233.73 average target, a year from now, the shares are expected to surge ~13%. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.