Nvidia (NVDA) operates worldwide as a visual computing company.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

It operates in two segments: Graphics, and Compute & Networking. The Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms.

The Compute & Networking segment offers data center platforms and systems for artificial intelligence (AI), HPC, and accelerated computing, autonomous vehicle solutions, and much more.

Nvidia is an indispensable business with more orders than it can fill, partly due to the massive chip shortage. Despite the temporary supply chain bottlenecks, the company is generating outstanding free cash flow for shareholders, and is entering or growing in new sectors such as AI and autonomous vehicles.

I am bullish on NVDA stock. (See Nvidia stock charts on TipRanks)

Indispensable Technology

Nvidia technology has risen from a graphic chip and integrated circuit maker for gaming in 1993, to an industry juggernaut that is indispensable to our connected world.

Time magazine has recently named CEO Jensen Huang to its list of the 100 most influential people. Out of the top 500 supercomputers in the world, 342 use Nvidia technologies.

There are some risks associated with NVDA stock. First, some of the company’s revenue comes from GPUs used in cryptocurrency mining. A slowdown in mining due to regulations, value pullback, or other reasons could crimp this revenue stream.

Next, gaming activity increased significantly during the pandemic. Lockdowns and closures of other activities spurred the increase. While many believe the increase will persist, there is a chance that demand dips as the country fully reopens.

Profits, Free Cash Flow

Nvidia posted terrific numbers in Q2 FY22. The top-line revenue of $6.51 billion was up 68% over the same period of the prior year.

This was on the back of an 85% increase in gaming revenue. The company’s profitability was also impressive.

GAAP operating income of $2.4 billion represents a 38% operating margin. Total operating margin for the first six months of fiscal 2022 increased to 46% from the prior year’s 39%.

This level of profitability demonstrates the wide moat and pricing power that the company holds. Because of this strong showing, the company generated $2.7 billion in cash flows from operations in Q2 alone. NVDA stock trades at a forward price-to-earnings ratio of 44.8. This is not unusual for a high-growth, high-margin tech company in today’s market.

These results have allowed Nvidia to increase its cash and short-term investment balance to over $19 billion. In total, the company has a very healthy debt-to-asset ratio of 0.45.

This is important, as the acquisition of Arm, which is still pending, is expected to include $12 billion in cash, and $21.5 billion in NVDA stock in addition to other compensation.

The acquisition would help NVDA to become a world class computing company for AI. The deadline to complete this acquisition is the end of 2022.

Wall Street’s Take

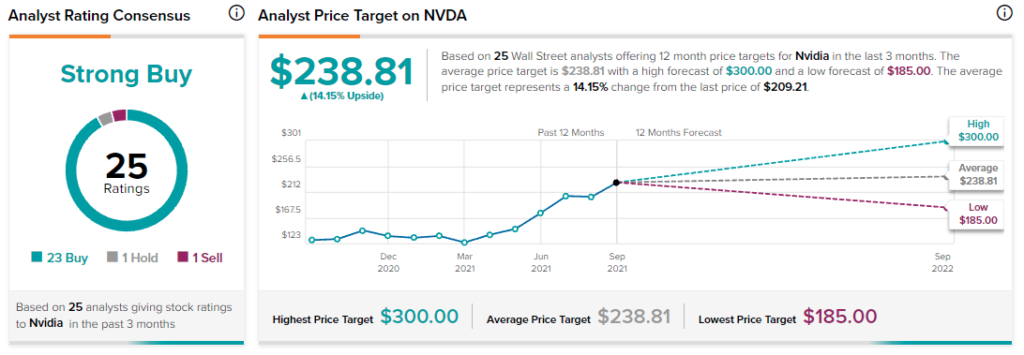

Wall Street analysts are extremely bullish on NVDA stock, with a Strong Buy consensus rating, based on 23 Buys, one Hold, and one Sell.

The average Nvidia price target of $238.81 implies 14.2% upside potential.

Summary on Nvidia

Nvidia has steadily grown and innovated into becoming a technology company that the world could hardly do without.

It has experienced epic demand trends and is capitalizing with profitability and cash flows.

The Arm acquisition is an exciting endeavor for NVDA’s emergence in the AI sector. The stock has recently pulled back from its highs, and this may signal an opportunity for investors.

Disclosure: At the time of publication, Bradley Guichard had a position in NVDA.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.