Chip giant Nvidia (NASDAQ:NVDA) once again delivered stellar financial numbers. However, its solid Q3 earnings and robust Q4 outlook failed to lift its share price. This prompts us to ask whether to invest or not in Nvidia stock. Based on analysts’ consensus ratings, NVDA stock is a Buy. Further, Nvidia sports a “Perfect 10” Smart Score (learn more about Smart Score here) on TipRanks, suggesting a higher likelihood of outperforming the broader markets. All these show that investors should invest in NVDA stock.

As analysts and TipRanks’ Smart Score favor NVDA, let’s delve deeper to understand why it is a Buy near the current levels.

Factors Impacting Nvidia Stock

While there could be multiple reasons why investors didn’t show enthusiasm for Nvidia’s solid Q3 performance, the most notable ones are apprehensions related to China and concerns about the company’s valuation. Nvidia emphasized that sales to China and other impacted regions, which are now subject to licensing requirements, have consistently represented around 20% to 25% of Data Center revenue in recent quarters. The company anticipates a substantial decline in sales to these destinations in the fourth quarter.

Nonetheless, Nvidia’s management quickly pointed out that the decline in sales in those regions will be more than offset by solid growth in the other areas. This means investors shouldn’t fret over challenges related to China.

While Nvidia is poised to benefit from massive demand for AI (Artificial Intelligence) and its dominant position in the AI sector, its stock continues to trade at a premium multiple than its peers. Nvidia stock is trading at forward price-to-sales multiple of 22.39, much higher than Advanced Micro Devices (NASDAQ:AMD) and Intel’s (NASDAQ:INTC) valuation multiple of 8.49 and 3.42. However, NVDA’s premium valuation is justified due to its leadership in AI and stellar growth. Further, Nvidia’s revenue from the Data Center segment alone is higher than the overall revenue of Intel and AMD. With this backdrop, let’s look at the Street’s projection for NVDA stock.

Is Nvidia Expected to Go Up?

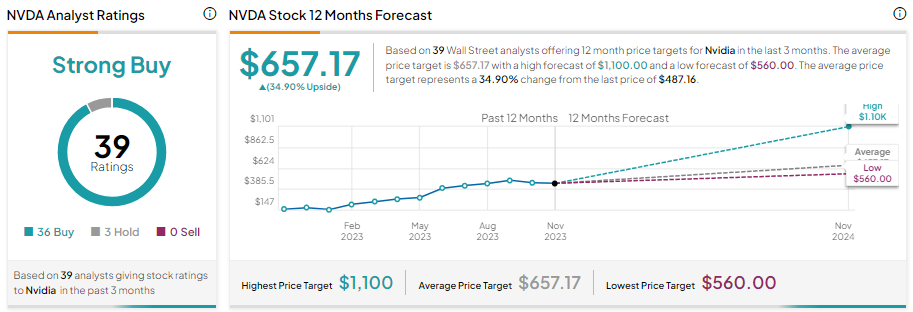

Wall Street analysts’ average price target suggests that Nvidia stock is expected to go up. The stock has already gained over 233% year-to-date. Moreover, analysts’ average price target of $657.17 implies 34.90% upside potential from current levels.

Further, with 36 Buy and three Hold recommendations, Nvidia stock has a Strong Buy consensus rating on TipRanks.

Bottom Line

With its industry-leading AI platform and focus on accelerating its product development cycle, Nvidia is well-positioned to deliver strong financial numbers in the coming quarters. The company expects its Q4 revenue to reach nearly $20 billion, compared to $6.05 billion in the prior-year quarter. Moreover, its business momentum will likely be sustained driven by solid demand for AI. These positives are reflected in analysts’ Strong Buy consensus rating.