Semiconductor powerhouse Nvidia (NVDA) is on deck to report its second-quarter fiscal 2023 results after the closing bell on August 24. The results come at a time when the market is jittery about more interest rate hikes this year, leading to a recession. Ahead of its results, we will discuss a few key questions and factors that could have possibly shaped its Q2 performance.

What Does Nvidia Do?

NVIDIA leads the world in visual computing technologies and is best known for the invention of the highly popular graphic processing unit (GPU).

With metaverse and other hyper-realistic technologies on the tech world’s horizon, the demand for Nvidia’s graphical hardware is on the rise. This is because the strong processing power of Nvidia’s technology is exactly what is needed to support the next generation of AI and other immersive technologies.

Why Is NVDA Stock Down?

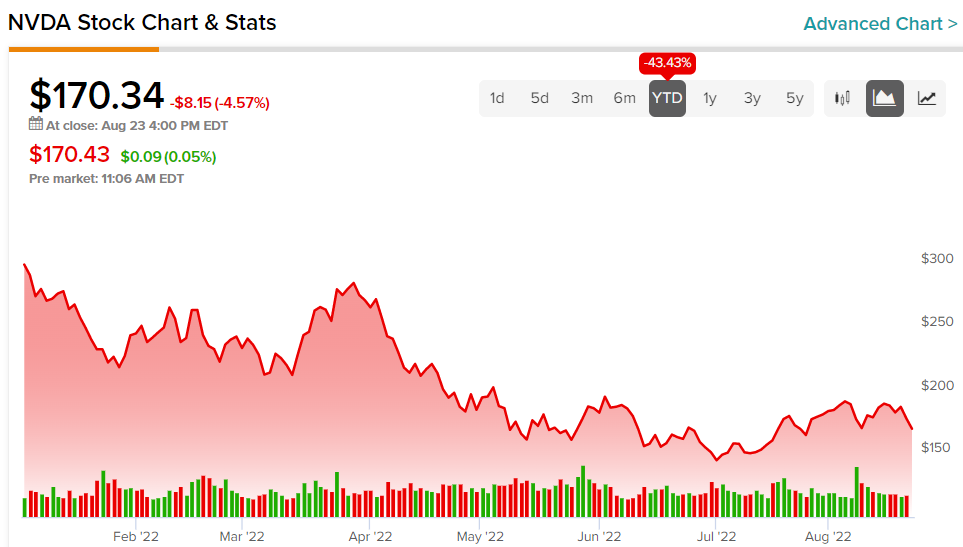

Nvidia has lost almost 44% of its valuation so far this year, due to challenges like component shortages, high input costs, foreign exchange headwinds, geopolitical friction, and high borrowing rates.

However, more specifically, Nvidia lost about 5% at the market close on Monday. A combination of a weak preliminary Q2 announcement and a broader tech market sell-off has hurt the stock, which is heading into the earnings release.

What Is in the Cards for Q2?

A preliminary look into the company’s Q2 financials reveals that it faces a revenue shortfall of $2 billion, resulting from price cuts to encourage sales. This is likely to have hurt the company’s bottom line in the to-be-reported quarter.

Moreover, the company witnessed a sharp decline in demand for gaming products and lower-than-expected growth in data center revenues due to continued supply shortages.

Nvidia is suffering from what is believed to be a ‘crypto hangover’ for gaming chips. Experts are of the opinion that Nvidia’s revenues from data center will take the lead over those from the gaming segment in Q2 and beyond. Thus, Nvidia is expected to predominantly address the data center domain till gaming trends normalize, after suffering from dwindling demand during the crypto crash.

This is also a reason why most analysts are hoping that Nvidia will focus more on data center sales because there is not much to do in the gaming area (this being a broader-market issue).

Morgan Stanley analyst Joseph Moore believes that there is not much downside risk left for Nvidia’s gaming sales expectation for Q2. But, there is still “some uncertainty around data center.”

Is NVDA a Good Stock to Buy?

Although Moore was one of the analysts who preferred to remain on the sidelines for more good news, KeyBanc analyst John Vinh reiterated a Buy rating on the stock with a price target of $230 ahead of the print. Vinh believes that the preliminary announcement has already highlighted the challenges that the company faced in Q2. He expects the company’s downsides to have bottomed out in the quarter.

Vinh also believes that Nvidia is uniquely positioned to cash in on secular growth opportunities in the AI/ML industry, citing limited competitive risks, thanks to its CUDA software stack.

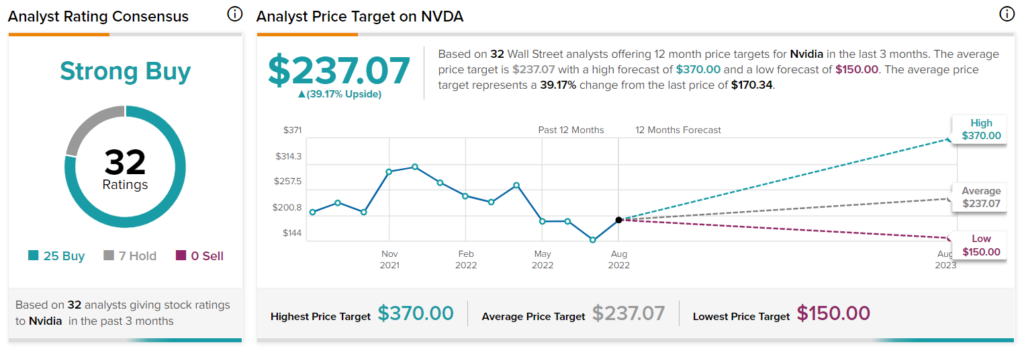

Wall Street, in general, thinks that Nvidia is a good stock to buy now. Analyst consensus has a Strong Buy rating on Nvidia, supported by 25 Buys and seven Holds. NVDA’s average stock price prediction is $237.07, reflecting upside potential of 39.17% from pre-Tuesday price levels.

Ending Thoughts: We Shouldn’t Be Too Bearish on NVDA Yet

Notwithstanding the near-term headwinds that Nvidia has been facing, NVDA is expected to continue to reign over one of the fastest-growing digital workloads. Emerging technology is also expected to bring forth a meaningful and sustainable revenue stream for the company in the longer term.

Is it very likely that the company’s risks bottomed in Q2, and Nvidia is now approaching an uphill track.

Read full Disclosure