Once the bell rings on Wednesday (Feb 16), Nvidia (NVDA) will take its turn to deliver the January quarter (F4Q22) results.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The chip giant’s latest earnings come at an almost unprecedented period for the company – and stock – in recent times. The shares have suffered at the hands of 2022’s extremely volatile environment and sit 18% into the red year-to-date.

This is a rather unusual sight. Yet, looking ahead to the print, Rosenblatt analyst Hans Mosesmann expects something more familiar, anticipating the results will beat the consensus estimates once again. That said, the upside might be capped this time around.

“We see the January quarter being driven by strength in all end-markets, with Data Center and Gaming as the standouts,” the 5-star analyst said, before adding, “We believe constraints in supply, broadly speaking, will be a factor that limits near-term upside.”

Looking ahead to the April guide, Mosesmann expects the company’s outlook will also exceed expectations. The analyst sees the company guiding above the Street’s revenue forecast of a low-single-digit quarter-over-quarter decline. Robust data center sales, vigorous AI and cloud computing verticals, growing ray tracing adoption, and continued momentum in the Automotive segment should all play their part.

As for what to keep an eye out for on the earnings call, Mosesmann will be looking for more color on the Omniverse, details on how the 3-product strategy is progressing, comments regarding the anticipated length of the supply chain shortages and the consequences of the Arm deal’s collapse.

All in all, Nvidia remains one of Mosesmann’s “favorite secular semiconductor plays,” and the analyst sees a number of “growth vectors” coming into play – including the Omniverse, next generation networking/ DPU adoption and autonomous driving.

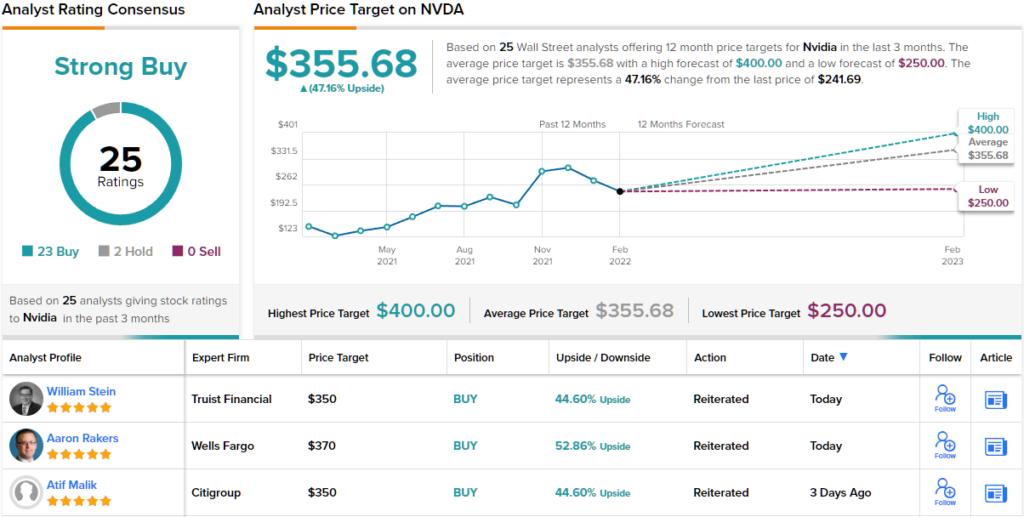

As such, the analyst sticks with a Buy rating and a Street-high price target of $400. Should his thesis play out, a potential upside of ~65% could be in the cards. (To watch Mosesmann’s track record, click here)

Barring two skeptics, the rest of Wall Street’s analyst corps agree here; with an additional 22 Buys, the stock qualifies with a Strong Buy consensus rating. There’s decent upside projected too; going by the $355.68 average target, shares will climb by 47% over the one-year period. (See Nvidia stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.