Anyone still expecting Nvidia (NVDA) to deliver a beat-and-raise quarterly report got a rude awakening on Monday. The chip giant released preliminary financial results for its fiscal second quarter (F2Q23 – July quarter) and got a thumbs down from the Street.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Nvidia now sees Q2 revenue hitting $6.7 billion, an increase from the $6.5 billion delivered in the same period a year ago, but some distance below its previous outlook for $8.1 billion – and what the Street was expecting. The company is set to report the quarter’s financials on August 24.

Nvidia put the lackluster performance down to a poor display of its gaming segment – a reflection of the macroeconomic climate and consumers cutting back on discretionary spending.

Gaming revenue is now expected to come in at $2.04 billion, a 44% sequential drop and 33% below the year ago period’s haul. Analysts were calling for $3.04 billion.

Data center sales are expected to reach $3.81 billion, a quarter-over-quarter increase of 1% and a 61% year-over-year uptick but falling short of the consensus estimate of $3.99 billion.

Investors were evidently disappointed and while Rosenblatt’s Hans Mosesmann saw a revision coming, he is still taken aback by the extent of it. However, the analyst has in no way turned into an NVDA bear.

“The Nvidia pre was somewhat expected, but the magnitude was not and informs of the significant change in market dynamics that we believe has little to do with crypto mining issues,” the 5-star analyst explained. “The Street demanded a reset and Nvidia has given this in plentiful fashion. We believe datacenter fundamentals are unchanged and the secular AI trajectory of the company’s hardware, software, and platforms remain healthy, and we see the risk-reward for investors as highly attractive at current price levels.”

To this end, Mosesmann sticks with a Buy rating on Nvidia shares, although the price target is given a reduction – lowered from $400 to $320. Nevertheless, that remains a Street-high target and set to generate one-year returns of 77%. (To watch Mosesmann’s track record, click here)

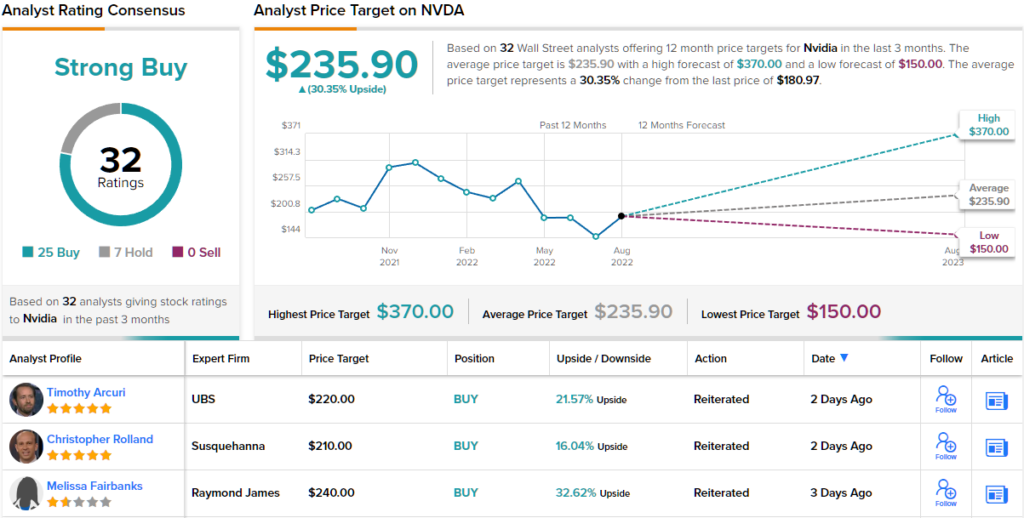

Big-name tech firms tend to get a lot of attention from Wall Street’s stock analysts, and Nvidia is no exception. The stock has no fewer than 32 analyst reviews on record, and they break down 25 to 7 in favor of the Buys over Holds, for a Strong Buy analyst consensus view. NVDA is currently priced at $180.97 and its $235.90 average price target indicates room for ~30% share appreciation from that level. (See Nvidia stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.