As 2023 comes to a close, I think it’s safe to say that artificial intelligence (AI) is the one phenomenon that captured the hearts of investors, even amid turbulent macroeconomic conditions. Today, the stage still seems set for some type of slowdown in 2024, but don’t expect investors to ignore the top AI-powered semiconductor/chip stocks — NVDA, AMD, and MU — as they continue to meet a demand that can only be described as hot.

Only time will tell if AI and its productivity-driving effect can keep acting as the tide that lifts stocks. My guess is that some of the less-apparent companies will also stand to rise as they look to keep up (with AI) or run the risk of being left behind.

The way I see it, AI (and AI hardware capacity) can grant competitive advantages to firms (including those outside of tech) that take the trend seriously. Further, underinvesting in AI chip tech seems somewhat riskier than overinvesting, at least as firms across the board fight to get up to speed with the latest hardware.

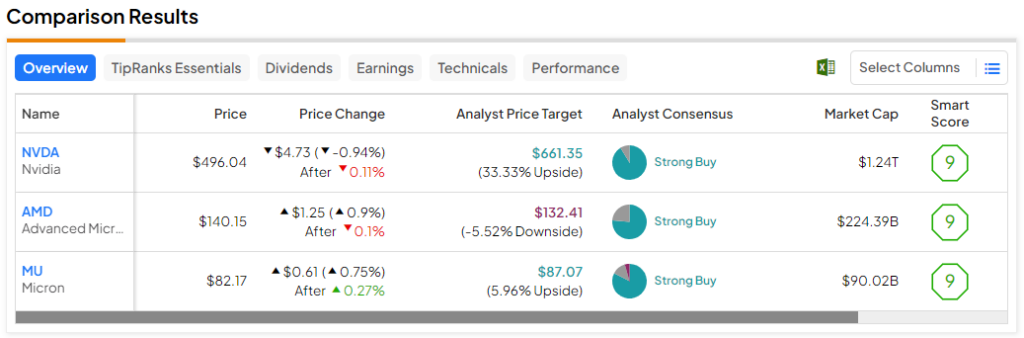

All considered, AI-powered semiconductor stocks may still have room to add to their gains in 2024. In this piece, we’ll use TipRanks’ comparison tool to check out three such names that have the blessing of most Wall Street analysts.

Nvidia (NASDAQ:NVDA)

Nvidia stock has arguably been the stock of the year, with shares now up 250% year-to-date. Undoubtedly, many value-conscious investors (like myself) have been deterred by the sheer momentum behind the name. The valuation still seems quite steep, but given the impressive growth and the promising AI chip demand trajectory — it seems like more of a secular tailwind than some sort of short-lived cyclical upswing — I’m inclined to be more bullish than bearish.

Sure, it’s never fun to “chase” a hot stock as a disciplined, valued investor, but the AI revolution is real, and Nvidia seems like one of the companies to emerge as one of the largest firms on the planet through the next decade. The company isn’t just innovating on the front of AI chips; it’s got major skin in the AI software game and even its own Omniverse offering. Indeed, it’s hard not to be awed by Jensen Huang when he showcases his firm’s new technologies.

For now, Nvidia stock is an obvious AI chip stock. The stock (and its hardware) look pricy relative to rivals, but given its dominance and front-row seat in AI, is it all that expensive? Perhaps it’s not, at least according to Bernstein’s Stacy Rasgon. In fact, Rasgon thinks it’s the “cheapest” AI pick for the year ahead.

Could the seemingly expensive stock actually still be undervalued? I think it’s very much possible. Rasgon notes that “multiples have compressed” amid the stock’s impressive ascent. Indeed, Nvidia isn’t just a story play. Earnings are growing, and they’re continuing to grow fast.

Rasgon also astutely observed that NVDA stock is close to the cheapest since 2018’s conclusion at around 25 times forward price-to-earnings (P/E). He’s right. Nvidia stock may not be as expensive as it seems, even on a P/E basis. Pending an AI chip demand implosion, I think it’s hard to bet against CEO Jensen Huang going into 2024.

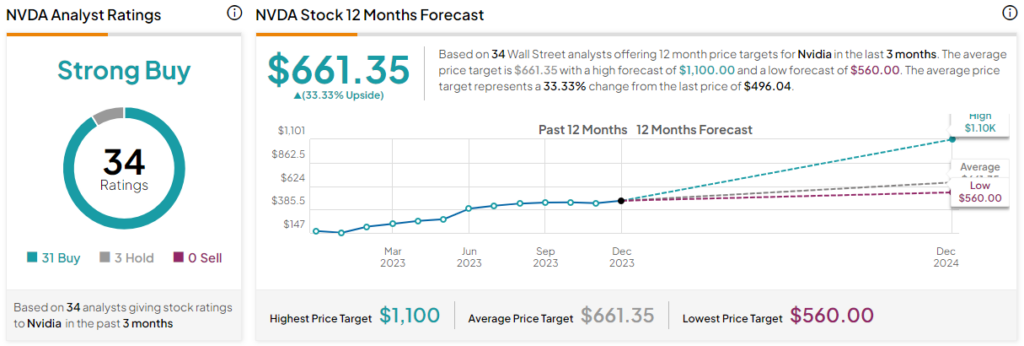

What is the Price Target of NVDA Stock?

Nvidia stock is a Strong Buy, according to analysts, with 31 Buys and three Holds assigned in the past three months. The average NVDA stock price target of $661.35 implies 33.3% upside potential.

Advanced Micro Devices (NASDAQ:AMD)

If Nvidia isn’t your cup of tea, perhaps AMD, Nvidia’s top rival, is. Like Nvidia, AMD has a legendary CEO, Lisa Su, who’s more than capable of capitalizing on the rise of AI. And it’s proven to be a bad idea to bet against her firm, even as it traded at elevated valuation multiples. As the company looks to close the gap with Nvidia in AI chips (a difficult feat), I think it’s hard not to be bullish, given the potential rewards if it can pull it off.

On a forward P/E basis, AMD is pricier than Nvidia stock at north of 37 times next year’s expected P/E. Pricier? Perhaps, but it’s not absurdly expensive in my books, given how much AMD stands to win if it plays its cards right in 2024.

Earlier this month, AMD pulled the curtain on its much-awaited Instinct MI300X AI chip. Some AI software heavyweights like Microsoft (NASDAQ:MSFT) and Meta (NASDAQ:META) have also committed to using it to run their AI applications. That’s a big deal that seems to suggest the playing field stands to even out.

Even if AMD can’t meet Nvidia’s stride for stride with its latest innovations, I previously noted that it can still win big market share with competitive pricing. Either way, there exists a scenario where both AMD and Nvidia can win as the AI supercycle continues into the new year. For now, it seems unrealistic for AMD to crush Nvidia on the front of AI chips. That said, it doesn’t need to in order to keep its rally running strong.

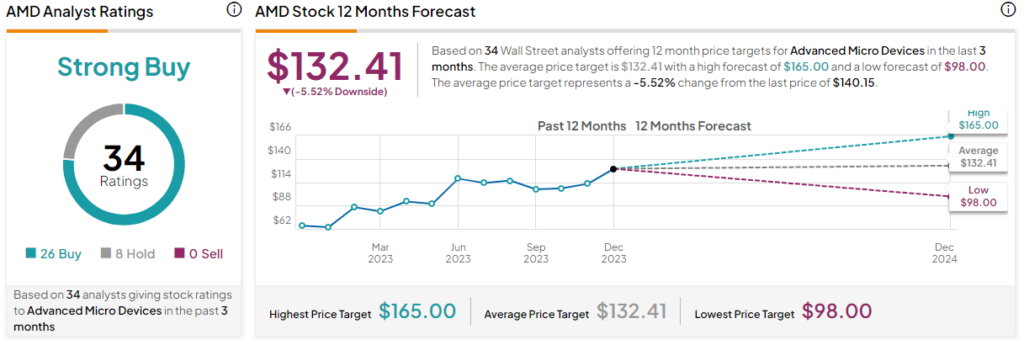

What is the Price Target of AMD Stock?

AMD stock is a Strong Buy, according to analysts, with 26 Buys and eight Holds assigned in the past three months. The average AMD stock price target of $132.41 implies 5.5% downside potential.

Micron (NASDAQ:MU)

Micron is a memory play that also stands to benefit from the rise of AI hardware firepower. More AI applications and connected devices call for greater memory needs. Year-to-date, the stock’s up over 64%, thanks to solid results and AI enthusiasm. Moving ahead, Micron’s margins could receive more of a lift as its management team looks to top what some analysts (like Wedbush Securities’ Matt Bryson) believe is a low bar. Given strong industry dynamics and a modest valuation, I remain bullish on MU stock.

Micron has already boosted its guidance for Q1, calling for revenue in the ballpark of $4.7 billion, up from the $4.2-4.6 billion range, thanks to robust memory demand trends. That said, there’s a good chance of an overshoot, not just in Q1 but for the next few quarters. Citi’s Chris Danely is bullish on the DRAM (Dynamic random access memory, a type of chip memory) market for the new year, going as far as to name Micron his firm’s top semiconductor pick.

As Nvidia and AMD hog the headlines, Micron seems like an intriguing (and less heated) way to play the semiconductor scene.

What is the Price Target of MU Stock?

Micron stock is a Strong Buy, according to analysts, with 20 Buys, three Holds, and one Sell assigned in the past three months. The average MU stock price target of $86.98 implies 5.9% upside potential.

Conclusion

Nvidia stock still has an unbelievable amount of upside for the year ahead, say analysts, with a whopping 33.3% in expected upside. I think analysts are right to be pounding the table on Nvidia. It’s a high-flyer, but perhaps shares aren’t nearly as pricy as they seem.