Apparel stocks haven’t done too well this year. With a recession likely closing in, apparel stocks could find themselves under pressure as demand for discretionary or nice-to-have goods takes a faster slide than most other goods. In this piece, we used TipRanks’ Comparison Tool to examine three top brands in the apparel space — Nike (NYSE: NKE), Lululemon (NASDAQ: LULU), and Aritzia (OTC: ATZAF) — to see which, if any, are capable of powering through the recession or consumer-spending slowdown to come.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Though it may be a good idea to part ways with some of the top apparel stocks before the economic climate has a chance to worsen, I’d argue that much of the damage in anticipation of a recession has already been baked in. Further, some of the top brands in the apparel space may be more resilient than expected if the coming downturn is mild.

At this juncture, it’s tough to tell what happens to the sales of the top apparel plays as supply-chain challenges pass. Just because supply is back in order doesn’t mean demand will stay hot.

In 2021, we saw demand overwhelm supply. In early 2023, we may witness the situation reverse itself, with too much supply and little demand. Apparel inventory gluts can have a near-term dampener on margins, as firms look to discounting and steep markdowns to make space.

In any case, supply-demand imbalances should normalize post-recession. However, until then, apparel stocks face yet another storm of headwinds. Nonetheless, let’s take a look at three top apparel stocks.

Nike

Nike is one of the most powerful forces in retail. Many firms strive to replicate its success, but it’s unlikely to be dethroned, even as new entrants look to take a bit of share away from its footwear and other arenas. Indeed, brands are built over many decades. In that regard, Nike’s strong brand affinity will likely help keep its sales buoyed better than some of its rivals.

Lululemon’s move into footwear should not have Nike shareholders shaking in their boots. If anything, Lululemon could find that footwear isn’t all as profitable an endeavor as it thought. Compared to other apparel, footwear can be a weight on margins unless there’s a signature swoosh on it.

It’s not just a strong brand that could help Nike fare better than peers during a downturn. Management has done a terrific job with its digital strategy. Its direct-to-consumer (DTC) effort has not only helped Nike keep the difference that would have gone into the pockets of other retailers like Foot Locker (NYSE: FL), but it has also allowed the firm to stay closer to its customers.

With strong customer loyalty and plenty of room to run in DTC (via e-commerce and Nike’s own flagship brick-and-mortar stores), Nike is a blue-chip kingpin that you can’t count out of the game. Down nearly 37% from its high, the stock trades at just shy of 30x trailing earnings. That’s still expensive, especially if sales slip quickly in 2023.

That said, DTC tailwinds will eventually overpower macro headwinds, making Nike an apparel play still worth a rich multiple.

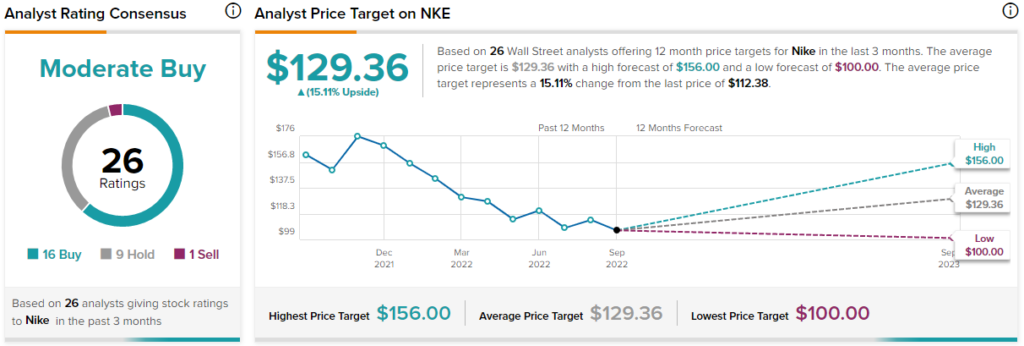

What is the Price Target for Nike Stock?

Wall Street remains upbeat on shares even in the face of a downturn, with 16 Buys, nine Holds, and just one Sell recommendation. The average NKE stock price forecast of $129.36 implies 15.1% in year-ahead gains.

Lululemon

Lululemon is another top brand that’s unlikely to lose its appeal for too long. Like Nike, Lululemon has done an incredible job of bolstering its digital presence while improving the in-store experience.

At its latest investor event, management laid out a five-year growth plan called the “Power of Three.” Innovation, e-commerce, and global expansion are the three pillars of growth. Arguably, Lululemon already gets an “A” grade in each category. Still, there’s room to run over the next five years, and I don’t suspect a 2023 economic recession to derail the firm’s remarkable strategic plan.

Perhaps the most intriguing of the three growth engines is innovation. After all, you don’t usually expect technology from a clothing maker. Though technological innovation in the context of clothing may sound gimmicky, there’s no denying that patented fabrics and the sort will allow the company to command higher prices. If anything, the tech and innovation pillar seems more like a means to give its marketing a boost.

As Lululemon embarks on its five-year journey, it expects to cut further into the turf of Nike. Thus far, Lululemon’s footwear push has been met with mixed success. Still, it’s too early to make any calls with its footwear push. Lululemon has merely dipped a toe into the waters, and it will be interesting to see if any unique technologies can help it give Nike a better run (forgive the pun) for its money.

Lululemon trades at 45.7x trailing earnings, with a 6.4x sales multiple. It’s clearly the aggressor in apparel, but questions linger as to whether it can stack up against the time-tested Nike brand.

What is the Price Target for Lululemon Stock?

Wall Street stands by Lululemon with 17 Buys, five Holds, and one Sell. The average Lululemon price target of $380.90 implies upside potential of 8%.

Aritzia

Aritzia is a mid-cap up-and-coming apparel star in Canada. Like Lululemon, the women’s clothing brand was born in Vancouver, British Columbia, and has seen brand affinity take off in recent years. Though Aritzia offers upscale fashion instead of just athletic apparel, I think the company has a world of growth ahead of its as it continues to increase its presence in the U.S. market.

Further, unlike athletic apparel, which can be timeless (just look at the Nike Air Jordan sneakers), demand for high-end fashion is more closely linked to the seasons.

Undoubtedly, Aritzia has the most room to run of the three apparel stocks on this list. As the recession strikes, I think markdowns and discounting will hit Aritzia the hardest, given the nature of its apparel.

In any case, Aritzia shares have already been punished quite harshly. As more consumers become aware of the brand, I’d look for Aritzia to take the role of a share taker.

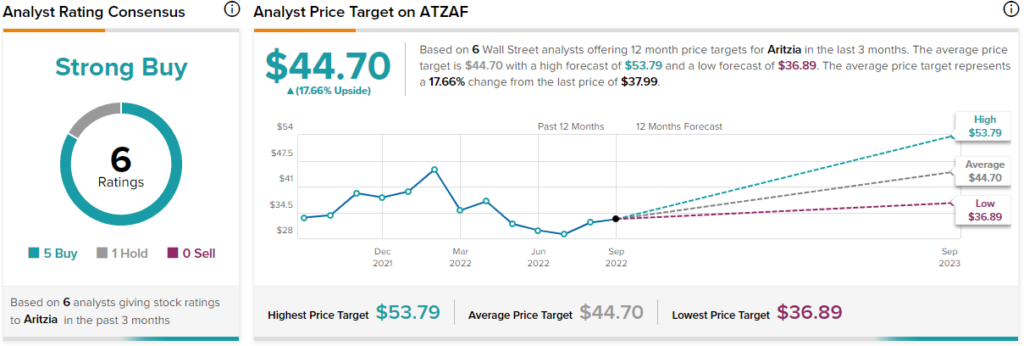

What is the Price Target for Aritzia Stock?

Wall Street loves the Canadian retailer, with five Buys and one Hold rating. The average ATZAF stock price forecast of $44.70 signals a respectable 17.7% upside potential.

Conclusion: Wall Street Expects the Most Upside from Aritzia

Nike, Lululemon, and Aritzia are magnificent apparel stocks to consider buying on any dips. Wall Street expects the highest returns from Aritzia over the next year, although NKE has similar upside potential.