Investors often look for opportunities to invest in large-cap stocks as they are generally associated with companies having a proven track record and well-established business models. The large-cap stocks have a market capitalization between $10 billion to $200 billion. Using TipRanks’ Stock Comparison Tool, we placed Nike (NKE), Palantir (PLTR), and Uber Technologies (UBER) against each other to find the large-cap stock that is the best pick, according to Wall Street analysts.

Nike (NYSE:NKE)

Shares of athletic footwear and apparel giant Nike have plunged nearly 29% year-to-date. The company’s lackluster performance due to rising competition, lack of innovation, and macro pressures has weighed on investor sentiment.

Nike announced mixed Q1 FY25 results and disappointed investors by withdrawing its full-year guidance. Under the leadership of its new CEO Elliott Hill, the company aims to revive its business by enhancing its product assortment and refocusing on innovation. However, these initiatives could take time to drive improved financials.

Nike is scheduled to announce its results on December 19. Based on the guidance issued with the Q1 FY25 results, the company expects its Fiscal second-quarter revenue to decline in the range of 8% to 10%. Further, management expects the Q2 FY25 gross margin to contract by 150 basis points due to higher promotions, an unfavorable channel mix, and supply chain deleverage. Analysts expect Nike’s Q2 FY25 EPS to plunge about 38% to $0.64, with revenue expected to fall more than 9% to $12.12 billion.

Is Nike Stock a Buy or Sell?

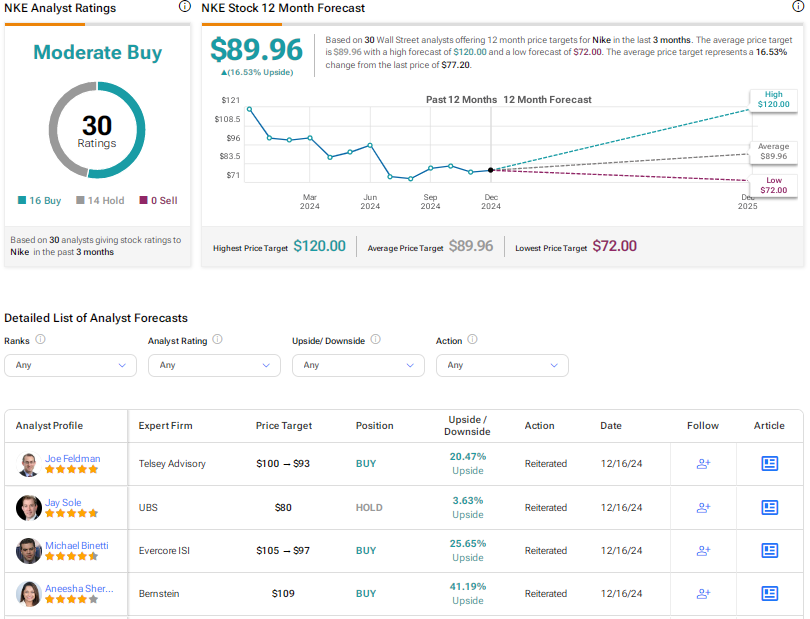

Ahead of the Q2 FY25 results, Citi analyst Paul Lejuez reiterated a Buy rating on NKE stock with a price target of $102. Lejeuz expects Nike to deliver an EPS of $0.58 in Q2, which is lower than the consensus estimate and reflects weakness in the company’s gross margin due to aggressive clearance of excessive inventory.

The analyst is looking forward to the new CEO’s commentary on the inventory position and the company’s strategy to return to revenue growth.

Amid the ongoing uncertainties, Wall Street is cautiously optimistic about Nike stock, with a Moderate Buy consensus rating based on 16 Buys and 14 Holds. The average Nike stock price target of $89.96 implies 16.5% upside potential from current levels.

Palantir Technologies (NASDAQ:PLTR)

Palantir Technologies stock has rallied over 328% year-to-date, as investors are impressed with the company’s financial performance and are upbeat about its future prospects, fueled by artificial intelligence (AI)-induced demand. Moreover, the data analytics company’s shift to the Nasdaq from the NYSE and its inclusion in the Nasdaq 100 Index (NDX) also boosted investor confidence.

The company impressed investors with its beat-and-raise Q3 results, with revenue rising 30% year-over-year to $725.5 million. Notably, the U.S. commercial revenue increased 54% year-over-year, while the U.S. government revenue was up 40% in the third quarter.

Palantir raised its full-year guidance, citing robust AI demand. It now expects its U.S. commercial revenue to grow by at least 50% in 2024. Further, it expects to generate adjusted free cash flow in excess of $1 billion.

Is PLTR a Good Stock to Buy?

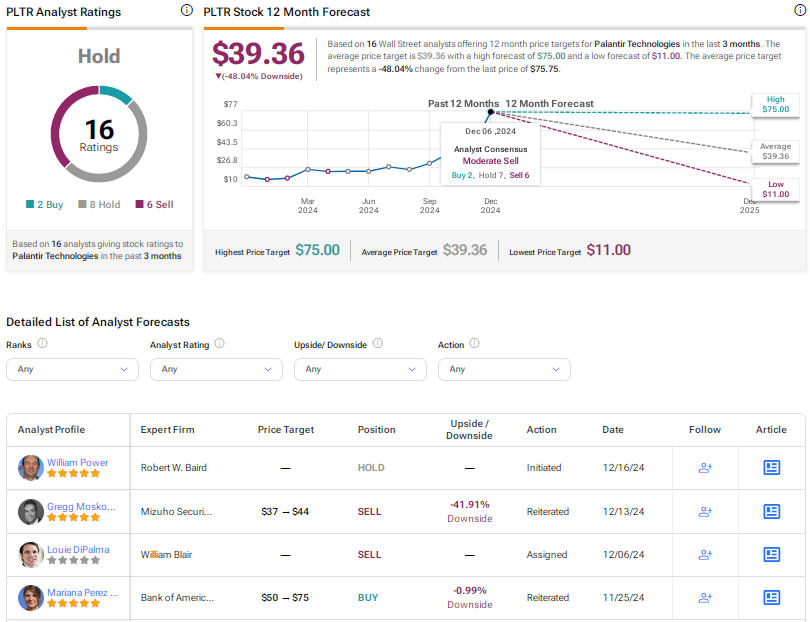

Recently, Baird analyst William Power initiated coverage of PLTR stock with a Hold rating and a price target of $70. The analyst is positive about the company’s growth opportunities, with its AI capabilities supercharging data platforms for commercial and government customers.

Power highlighted the company’s expertise in driving generative AI applications into production. Despite his optimism about PLTR’s prospects, the analyst prefers to remain on the sidelines due to the stock’s year-to-date jump and high valuation.

Given the stock’s significant rise, several other analysts are also concerned about PLTR’s elevated valuation. Wall Street has a Hold consensus rating on the stock based on two Buys, eight Holds, and six Sells. The average PLTR stock price target of $39.36 implies a notable downside risk of 48%.

Uber Technologies (NYSE:UBER)

Shares of ride-hailing and delivery platform Uber Technologies are down 2.5% year-to-date, reflecting concerns over the potential impact of fully autonomous driving technology on the company’s business model.

These concerns have overshadowed the company’s market-beating third-quarter results. Uber reported a 20% year-over-year growth in its Q3 revenue to $11.2 billion. Meanwhile, EPS (earnings per share) jumped significantly to $1.20 from $0.10 in the prior-year quarter due to a $1.7 billion benefit related to the reevaluation of the company’s equity investments.

Management highlighted that it was the first time that the company’s GAAP operating income surpassed $1 billion. Moreover, the company is on track to generate a 20% growth in gross bookings on a constant current basis for the full year.

Is Uber a Buy or Hold?

Recently, TD Cowen analyst John Blackledge reiterated a Buy rating on Uber Technologies stock with a price target of $90. The analyst believes that the opportunity for Uber’s delivery business remains large. He expects core delivery bookings to increase in the low to mid-teens range in 2024-2027, driven by new growth areas like grocery and other verticals.

Blackledge expects delivery growth to continue to be driven by strong user trends, higher frequency, and basket size growth. The analyst mentioned some levers for future growth, including continued geographical expansion, user growth, and a rise in Uber One members.

Uber scores Wall Street’s Strong Buy consensus rating based on 33 Buys versus two Hold recommendations. The average UBER stock price target of $93.35 implies 55% upside potential from current levels.

Conclusion

Wall Street is highly bullish on Uber Technologies stock compared to the other two large-cap stocks discussed above. Analysts see solid upside potential in Uber stock than in the stocks of Nike and Palantir. Uber’s dominance in the ride-hailing space, further expansion opportunities in the delivery business, and solid fundamentals are expected to drive its stock higher.