Major EV stocks are in the red this year as investors moved to safer value bets from growth stocks amid soaring inflation, high interest rates and geopolitical concerns. Moreover, prolonged chip shortage and supply chain disruptions due to lockdowns in China have impacted EV production.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Chinese EV stocks have been facing an additional challenge of potential delisting from U.S. exchanges due to failure to comply with audit requirements.

Given this challenging backdrop, we used the TipRanks Stock Comparison tool to stack up Nio, XPeng, and Tesla against each other and pick the electric vehicles stock which the Street favors.

Nio (NYSE: NIO)

Premium EV maker Nio has now listed its shares on Hong Kong and Singapore exchanges, thus addressing concerns about the potential delisting of its shares on the U.S. stock exchange, to some extent.

Nio’s April deliveries declined due to supply chain issues and COVID-19 restrictions in China. That said, Wall Street continues to be bullish on the company’s long-term prospects.

Recently, Bank of America Securities analyst Ming Hsun Lee upgraded Nio stock to a Buy from a Hold, and increased the price target to $26 from $25. Lee feels that negative factors have already been priced in and the stock is trading at attractive valuations currently. The analyst expects higher sales and better margins in the second half of this year.

According to Lee, key growth catalysts for Nio include a robust model cycle and order backlog, the ability to pass on increased costs to customers through price hikes, supply chain normalization, and reduced ADR delisting concerns given Nio’s new exchange listings.

Lee raised his sales volume estimates for 2022 and 2023 by 3% and 8%, respectively, based on Nio’s new model launches and the recovery in production.

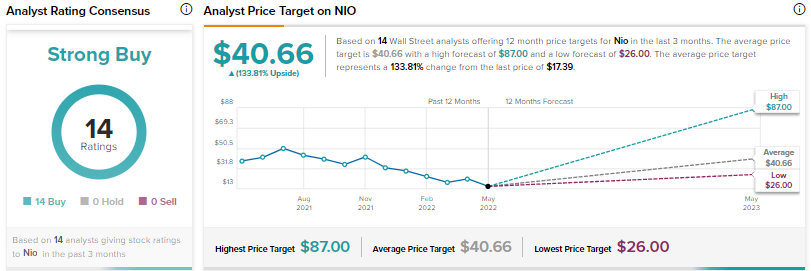

Other analysts are in agreement with Lee’s bullish stance, resulting in a Strong Buy consensus rating based on 14 unanimous Buys. At $40.66, the average Nio price target implies 133.81% upside potential from current levels. Shares have plunged 45% year-to-date.

XPeng, Inc. (NYSE: XPEV)

XPeng targets the mid- to high-end segment in China’s EV market. The company is also expanding into the European EV market.

Last week, XPeng announced its Q1 results, with revenue rising nearly 153% to RMB 7.45 billion ($1.18 billion). It delivered 34,561 vehicles in Q1, up 159% year-over-year.

However, the company’s adjusted loss per ADS (American depositary share) widened to RMB 1.80 ($0.28) in Q1’22 from RMB 0.88 in Q1’21 due to higher research and development expenses, increased marketing expenses, and a rise in expenses related to sales network expansion. Further, investors were disappointed with XPeng’s Q2’22 outlook, which reflected slower growth rates.

Barclays analyst Jiong Shao lowered his price target for XPeng stock to $30 from $39 and reiterated a Buy rating. Shao feels that investors should “ignore” Q2 outlook as XPeng’s long-term thesis remains intact.

Shao noted that XPeng’s production is gradually resuming and Q2 is “abnormal” due to lockdown-induced supply chain issues. Shao believes that XPeng is set to be among key beneficiaries of EV consumption stimulus.

Overall, consensus among analysts is a Strong Buy on XPeng stock based on 10 Buys and one Hold. The average XPeng price target of $39.41 implies 67.70% upside potential from current levels. XPeng shares have tumbled 53% so far this year.

Tesla, Inc. (NASDAQ: TSLA)

While shares of other EV makers are impacted by macro headwinds, Tesla shares have an additional factor that make the stock more volatile – it’s CEO Elon Musk’s actions and tweets. Most recently, his proposed acquisition of Twitter, which he has since put on hold, has led Tesla shareholders to again question the company’s leadership. Although, it can be surmised that Musk’s outspokenness is a quality many investors appreciate.

On the operational front, Tesla delivered stellar Q1 results despite supply chain woes and inflation. However, concerns continue to linger about whether Tesla will be able to meet its full-year production goal of 1.5 million vehicles as supply chain issues persist.

That said, Credit Suisse analyst Dan Levy believes that the pullback in Tesla stock offers an attractive entry level given that the company’s long-term opportunities remain intact.

Following a visit to the company’s Fremont facility, Levy noted that while Tesla’s manufacturing focus ahead is on its Shanghai, Berlin and Austin gigafactories, “Fremont has shown ongoing manufacturing kaizen.” Meaning improvement, Kaizen is a philosophical Japanese business term which refers to continuous small changes building up to positively affect a company from top to bottom.

However, the analyst expects Tesla’s near-term, mainly Q2, performance to reflect “some regression” in its margins and total deliveries essentially due to production challenges at the Shanghai facility.

Levy reiterated a Buy rating with a price target of $1,125.

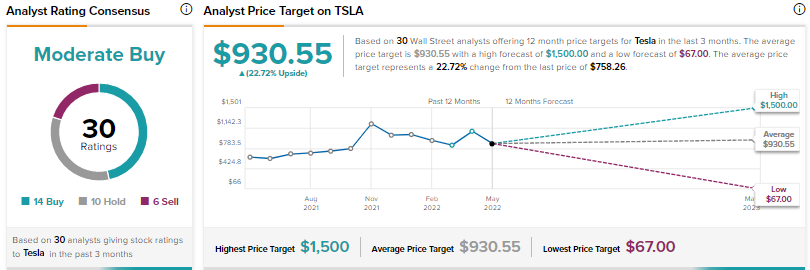

Overall, the Street is cautiously optimistic on Tesla with a Moderate Buy consensus rating that breaks down into 14 Buys, 10 Holds, and six Sells. The average Tesla price target of $930.55 suggests 22.72% upside potential from current levels. Shares are down 28% year-to-date.

Conclusion

Demand for electric vehicles remains strong despite recent price hikes by major EV makers. Wall Street analysts are currently treading carefully with regard to Tesla, while they are very bullish about Nio and XPeng. With a higher upside potential based on the Street’s average price target and a unanimous Buy rating from all analysts, Nio seems to be a better pick right now.

While supply-chain issues and macro headwinds might impact near-term performance, Nio’s strong position in the Chinese EV market, expansion into new geographies, like Europe, continued innovation, and its battery-as-a-service offering make it an attractive long-term pick.

Read full Disclosure