Many electric vehicle (EV) makers fared well in 2023 even as high interest rates and macro pressures weighed on demand and EV affordability. Moreover, market leader Tesla (NASDAQ:TSLA) triggered a price war to fight intense competition and boost volumes. EV demand could rise in 2024, given that interest rates are expected to come down. Bearing that in mind, we used TipRanks’ Stock Comparison Tool to place Nio (NYSE:NIO), Tesla, and Li Auto (NASDAQ:LI) against each other to find the EV stock that could generate the best returns in 2024, as per Wall Street analysts.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Nio (NYSE:NIO)

Chinese EV maker Nio’s performance in the first three quarters of 2023 failed to impress investors. The uncertainty associated with the company’s deliveries, weak margins, continued cash burn, and persistent losses have impacted investor sentiment for Nio. Intense competition in the Chinese EV market and macro challenges weighed on the company’s performance in 2023.

On January 1, Nio reported a 13.9% year-over-year growth in its December deliveries to 18,012 EVs. With this, the company’s Q4 2023 deliveries reached 50,045 vehicles, up 25% compared to the prior-year quarter.

Looking ahead, Nio is expected to benefit from the $2.2 billion strategic equity investment from CYVN Holdings, an Abu Dhabi-based investment vehicle. Nio bulls are also optimistic about the company’s upcoming models, including the ET9, for which deliveries are expected to start in Q1 2025.

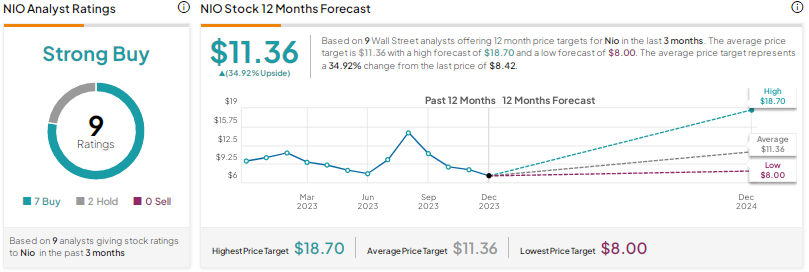

What is the Future Price of Nio Stock?

On Tuesday, Morgan Stanley analyst Tim Hsiao said that Nio’s better-than-expected monthly and quarterly deliveries signal solid demand and operational execution. He thinks that the year-over-year increase in deliveries reflects the company’s growing market presence and customer acceptance.

While the analyst acknowledged near-term challenges, he expects Nio’s financial investment and product development, especially in battery swapping and advanced driver-assistance systems (ADAS), to bolster its competitive position. Additionally, he expects the upcoming launch of Nio’s sub-brand ALPS to strengthen its growth trajectory.

With seven Buys and two Holds, Nio earns a Strong Buy consensus rating. The average Nio price target of $11.36 implies nearly 35% upside potential. NIO ADRs (American depositary receipts) have declined about 14% over the past year.

Tesla (NASDAQ:TSLA)

Tesla stock has rallied 102% over the past year despite growing concerns about the impact of CEO Elon Musk’s aggressive price cuts on the company’s margins. Moreover, investors have also been concerned about the high costs related to Cybertruck and the uncertainty related to the acceptance of this much-delayed product.

Moreover, Tesla is facing intense rivalry from several emerging EV players. The company’s Q4 deliveries of 484,507 helped it bring the overall 2023 deliveries to about 1.81 million units, surpassing the company’s guidance of 1.8 million EVs. However, Q4 deliveries were not strong enough as Tesla lost the top EV maker position in the quarter to Chinese automaker BYD (BYDDY) (HK:1211), which delivered 526,409 fully electric vehicles in the same period.

Nonetheless, Tesla remained ahead of BYD in terms of full-year deliveries, maintaining its leadership in the battery-powered EV space.

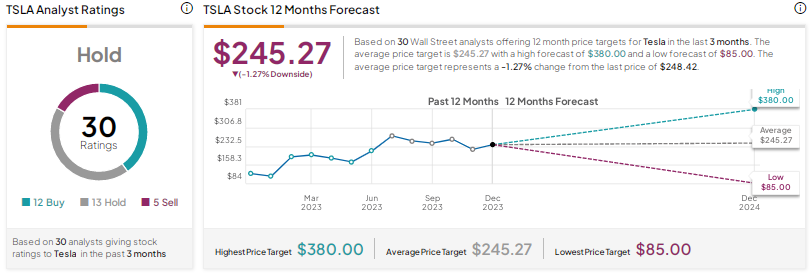

What is the Future Price of Tesla Stock?

Following Tesla’s Q4 deliveries report, Goldman Sachs analyst Mark Delaney noted that though deliveries touched a record high, they were only slightly above consensus. He believes that key debates will now be around Tesla’s automotive adjusted gross margin as Tesla offered discounts and incentives in some regions in Q4 to boost volumes while increasing prices for Model Y in China.

The analyst thinks that investors will also focus on the extent to which a reduction in subsidies for certain models in the U.S. and Europe will impact volumes.

Delaney reiterated a Hold rating on TSLA stock with a price target of $235. The analyst remains on the sidelines, as he thinks that shares are fully valued at current levels. Moreover, he expects the company to announce additional price cuts.

Overall, Wall Street is sidelined on Tesla stock, with a Hold consensus rating based on 12 Buys, 13 Holds, and five sells. The average TSLA stock price target of $245.27 indicates that the shares are fully valued at current levels.

Li Auto (NASDAQ:LI)

Chinese EV maker Li Auto delivered a solid performance in 2023 despite macro pressures and a slower-than-expected recovery in China. The company delivered 50,353 vehicles in December, marking the first instance of monthly deliveries crossing the 50,000 mark. Furthermore, the company’s Q4 deliveries increased by an impressive 185% year-over-year to 131,805 EVs, surpassing its own guidance of 125,000 to 128,000 units.

Despite upbeat Q4 deliveries, investors were disappointed as the company slightly delayed the launch of its first fully battery-powered EV, MEGA, to March 1, 2024, with deliveries scheduled to commence in early March. The company had earlier indicated that deliveries would start in late February after planning a December 2023 launch.

Nonetheless, the company is confident that Li MEGA will emerge as the preferred model in the above RMB 50,000 yuan range of vehicles.

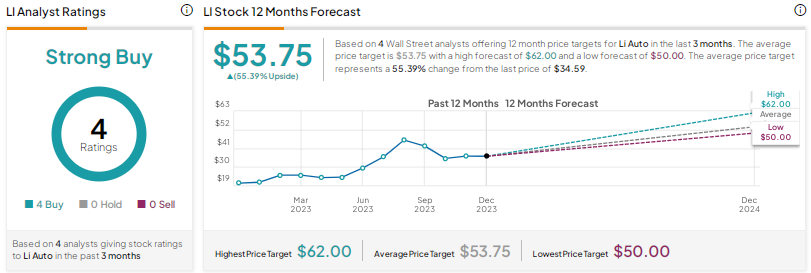

Is Li Auto Stock a Buy, Sell, or Hold?

Wall Street is highly bullish on Li Auto stock, with a Strong Buy consensus rating based on four unanimous Buys. The average price target of $53.75 implies 55.4% upside potential. Li Auto shares have advanced about 70% over the past year.

Conclusion

Wall Street is very optimistic about Chinese EV makers Li Auto and Nio but cautious about Tesla. Li Auto’s strong execution and continued innovation have impressed investors and analysts alike. Even after a solid rally in 2023, analysts expect a higher upside in LI stock than the other two EV stocks.