The year is almost over, and it would hardly be an exaggeration to say most investors will be glad to wave goodbye to 2022. Those backing Nio (NIO) are certain to be amongst such a crowd. Like many other Chinese names, the shares have endured a torrid time and are down by 70% on a year-to-date basis.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

But with 2023 at the gate, are things really about to get any better? That depends mostly on two things, says Deutsche Bank’s Edison Yu.

“Looking at 2023, investors are hyper concerned about the 2Cs: competition and COVID,” the analyst noted. “While we certainly think some caution is warranted, we don’t see NIO as very vulnerable beyond the older 866 models given its strong branding, unique ecosystem (battery swapping), and fresh product portfolio particularly on sedans.”

Yu’s comments come ahead of the EV maker’s Q3 results, which the company will announce before the market opens tomorrow (Thursday, Nov 10).

With Q3 deliveries of 31,607 already reported, Yu anticipates a “mostly decent quarter with potential for headline margin upside from regulatory credits” which accounts for Yu’s gross margin forecast of 16.5% coming in higher than the Street’s call for 14.9%.

As for the headline numbers, Yu estimates revenue of 13.2 billion RMB and adjusted EPS of (1.04). Consensus has 13.1 billion RMB and (1.11), respectively.

That said, given the recent Hefei COVID disruptions impacting October’s production numbers, Yu expects the Street’s gaze will turn to the Q4 delivery outlook.

The company delivered 10,059 units in October, with Yu believing production was affected to the tune of 2,000-3,000 given the start-stop conditions.

Yu now thinks Nio will deliver 45,000 units in Q4, a figure which still assumes a “big month-over-month recovery” in November and December. However, the analyst also thinks Nio could offer a conservative guide so to “leave some cushion.”

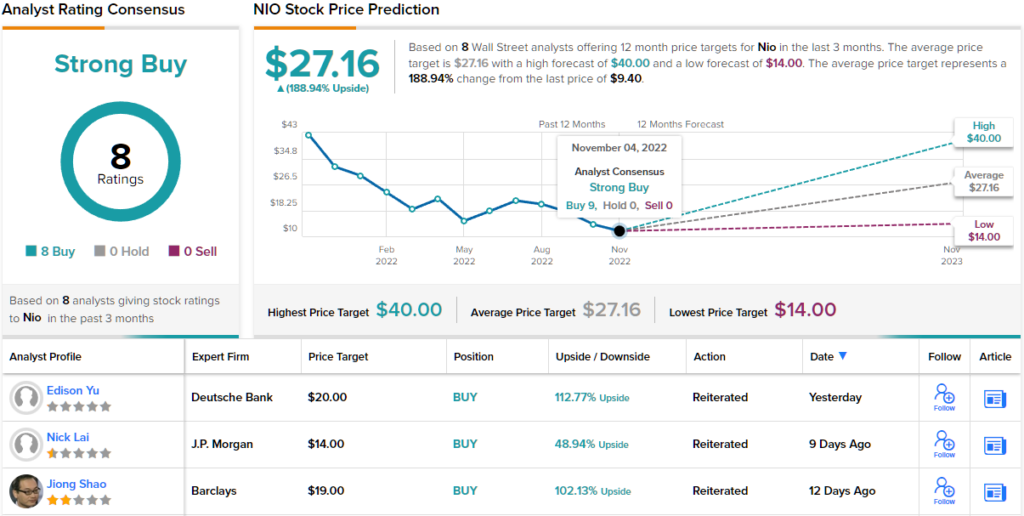

All told, while Yu thinks sentiment seems “much too negative,” he nevertheless lowers the price target for NIO from $39 to $20. Still, there’s upside of 112% from current levels. Yu’s rating stays a Buy. (To watch Yu’s track record, click here)

Sentiment might be low, but Nio still gets the Street’s full backing. All 8 analyst reviews on file are positive, making the consensus view a Strong Buy. The analysts evidently think the shares are significantly undervalued by now; the average target stands at $27.16, suggesting they will climb ~189% higher over the one-year timeframe. (See Nio stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.