The past couple of weeks have been a roller coaster ride for Nikola (NKLA). Shares of the electric truck maker have plummeted following a damning report accusing the company’s founder Trevor Milton of making fraudulent claims and duping investors. Shares took another dive as Milton subsequently resigned from the company, leaving questions whether Nikola has any future without its notorious ringleader at the helm.

But is a comeback in the cards? Last week the stock clawed back a hefty amount of the loss, gaining 36% in three consecutive sessions.

A business update by management in which the company reiterated its plan to become a leader in zero-emissions transportation appears to have soothed investors’ jittery nerves.

Nikola anticipates completing five prototype Nikola Tre BEV trucks at the IVECO JV facility over the following weeks, expects to road test them in Germany this year, and to begin production shipments, as planned, in late 2021.

Additionally, assuaging investors’ biggest fears, the company’s planned partnership with General Motors still appears on track.

While Nikola’s partnership model has been subject to criticism lately, J.P. Morgan analyst Paul Coster calls it “a compelling strategy.”

However, Coster also points out Nikola’s near-term success hinges on GM signing on the dotted line.

“We think the GM partnership deal is the most important near-term catalyst,” Coster said. “Failure to consummate the GM deal would be a fatal blow for the Badger initiative, but a serious blow to the more important Truck initiative too, in our view. The fuel station partnership announcement is less important, in our view, though a potential validation of the company that could resonate with investors. Pending completion of the five Nikola Tre trucks could be a boost to credibility, obviously… For now, the GM partnership is a stress-test for the company.”

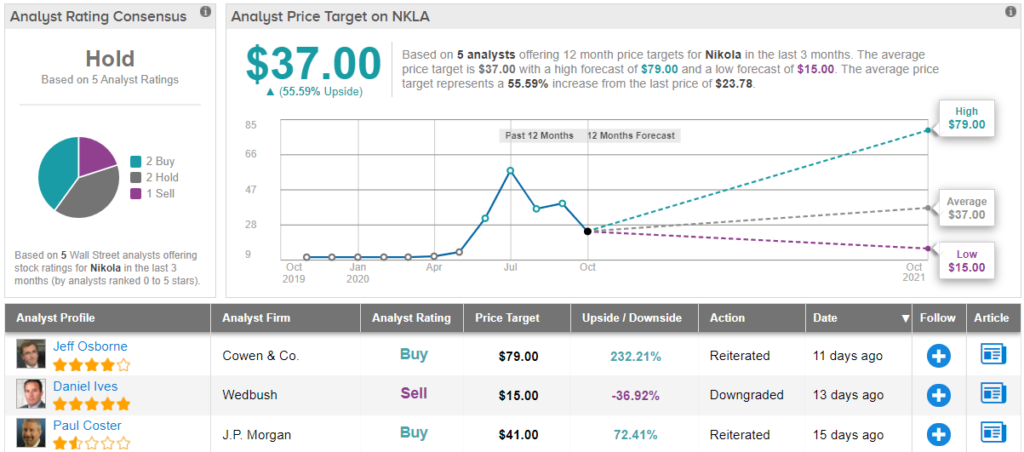

Coster remains positive on Nikola and keeps an Overweight (i.e. Buy) rating along with a bullish $41 price target. The analyst, therefore, expects shares to add nearly 70% from current levels. (To watch Coster’s track record, click here)

Nikola appears to be the subject of much head scratching on Wall Street. On the one hand, based on 2 Buys and Holds, each, and 1 Sell, the stock has a Hold consensus rating. Conversely, an average price target of $37, suggests potential upside of 55.5% in the year ahead. (See NKLA stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.