Electric car maker Nikola (NKLA) has been grabbing headlines for all the wrong reasons recently. Shares took a 19% tumble on Monday after the company announced that its founder and chairman, Trevor Milton, had resigned.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following a September 10 report, in which short-seller Hindenburg Research alleged Milton had made fabricated claims about NKLA technology, Milton found himself in hot water.

Weighing in on this development for RBC, analyst Joseph Spak wrote, “We believe this was a hard, but necessary step for Nikola in wake of allegations against Milton raised by a short-seller report and SEC investigation. In our view, Nikola’s promise was always further out and mostly tied to opportunity they have with fuel cell truck leases and hydrogen infrastructure build-out. This opportunity while large, is not without challenges/risks.”

Spak points out that many of the issues raised in the report could be from earlier days and might not be a reflection of where NKLA is now, but notes “they have undoubtedly raised a cloud over NKLA.” However, the analyst makes a point to clear up misconceptions.

“NKLA relying on partners for the commercial trucks, hydrogen, Badger, etc., which had always been part of their plan. The comparison to a more vertically-integrated TSLA was never apt (aside from both doing alt. propulsion, biz models quite different) and many were too focused on Badger (much smaller opp). And to be fair, many OEMs (especially in CVs) also rely on other partners for key components,” Spak explained.

If Milton had stayed on, it might have added extra uncertainty with respect to customers and partners, so says Spak.

Further, its strategy of selling “routes” via fuel cell truck leases, and helping solve problems associated with hydrogen infrastructure build-out made NKLA a stand-out, in Spak’s opinion. “If they’re able to succeed, this could potentially create a first mover advantage and a feedback loop allowing them to sell more trucks. As they built out series stations along A to B dedicated routes, they would also slowly be building a larger hydrogen infrastructure to leverage,” he added.

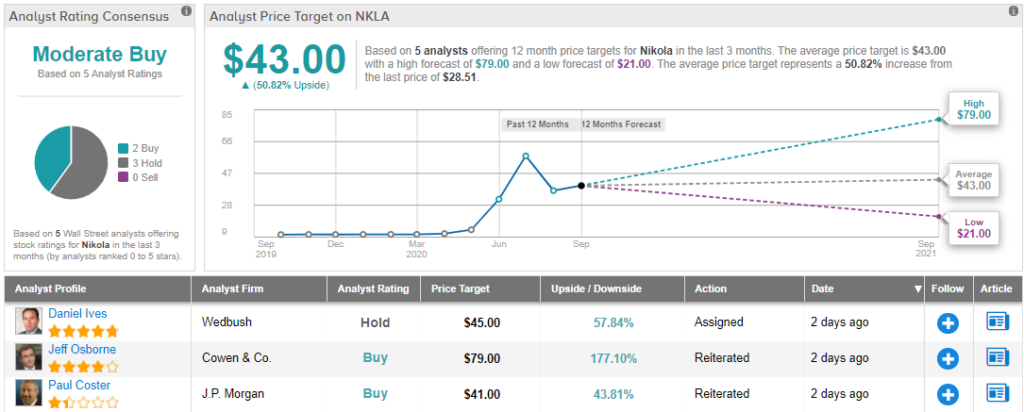

Spak does, however, think “Nikola’s stock will be in ‘penalty box’ for a while as they look to rebuild credibility with Street.” As a result, he slashed the price target from $49 to $21, to go along with his Sector Perform rating. Should this target be met in the twelve months ahead, it would reflect a 26% decline. (To watch Spak’s track record, click here)

Looking at the consensus breakdown, 2 Buys and 3 Holds have been published in the last three months. As a result, NKLA gets a Moderate Buy consensus rating. The $43 average price target is more aggressive than Spak’s and implies 51% upside potential from current levels. (See NKLA stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.