Netflix’s (NASDAQ:NFLX) growth phase has undoubtedly come to an end. Not too long ago, Netflix stood out as one of Nasdaq’s (NDX) fastest-growing companies. Yet, the substantial surge in competition in recent years has flooded the SVOD/streaming sector, halting Netflix’s once-unbridled growth trajectory. Despite the now-oversaturated SVOD industry looking increasingly worse, NFLX stock has rallied more than 67% over the past year. This could be a strong selling opportunity. Thus, I am bearish on NFLX stock.

Netflix’s Growth Era is Likely Over

Netflix’s era of growth was truly spectacular, with the company’s competitive offering disrupting the much less convenient and value-for-money cable TV. Impressively, its compound annual revenue growth rate (CAGR) between 2010 and 2020 was 20.7% — a massive rate to sustain over such a prolonged period. Even in subsequent years, particularly during the COVID-19 pandemic, Netflix grew swiftly, capitalizing on the constraints imposed on out-of-home entertainment and solidifying its status as an essential service.

Sadly, these days are now behind us. Not only has Netflix already captured a massive chunk of its addressable market, but the surge in competition over the past few years has completely blocked its growth prospects.

Giants like Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), AT&T (NYSE:T), and Comcast (NASDAQ:CMCSA), alongside numerous smaller players, have penetrated the market, prompting consumers to subscribe to multiple services. In the meantime, all services have been hiking their prices rapidly. How is this different from cable TV, excluding the on-demand element?

Therefore, it’s no wonder that Netflix has an extremely hard time growing in the current market landscape. The consistent deceleration in revenue growth is proof of this. In its most recent Q2-2023 results, revenue growth came in at just 2.7%. This compares with 8.6%, 19.4%, 24.9%, and 26.0% achieved in equivalent periods of 2022, 2021, 2020, and 2019 respectively. The consistent year-to-year deceleration in revenue growth is unmistakable.

Based on the current trajectory, it looks like Netflix is likely to experience declining revenues sooner than later. Don’t forget that Disney+’s (NYSE:DIS) subscribers have been declining as well, as they fell by 12 million to 146.1 million quarter-over-quarter, according to Disney’s Fiscal Q3 report, coming in way below the forecast of 154.8 million. This clearly illustrates the ongoing market havoc in the streaming industry. Netflix may prove more resilient due to its long-standing brand and staple-like nature, but for how long?

Extended Rally Offers Opportunity for an Exit

Given the less-than-rosy outlook for the streaming industry, it might seem logical for investors to be hastily divesting from Netflix stock. While shares are certainly trading well below their peak pandemic levels, they have still managed to record an impressive rally of more than 70% over the past year. This resurgence likely owes itself to the Nasdaq’s broader recovery during this period, alongside the fact that investors might be gravitating toward the one profitable streaming company among the junk.

This paradoxical event may offer investors a great opportunity to exit the stock, especially those who made some series gains during this rally. With growth having essentially ceased while the stock’s valuation has once again ascended to astronomical heights, convincing reasons are not hard to come by. In particular, Netflix stock is currently trading at nearly 36 times this year’s projected earnings. This multiple is utterly unjustifiable, with revenue growth down the drain and interest rates rising.

One could argue that investors are betting on earnings growth, but ultimately, this is highly speculative. If anything, a halt in revenue growth could compress margins against rising costs, leaving shareholders with a stagnated company that trades at a very premium valuation. This sounds like the perfect formula for a significant share price plunge. It certainly doesn’t like the place I would want to have my money invested.

Is NFLX Stock a Buy, According to Analysts?

Wall Street seems to have a different view on Netflix, as the stock has attracted a Moderate Buy consensus rating based on 19 Buys, 13 Holds, and two Sells assigned in the past three months. At $466.39, the average Netflix stock forecast implies 15.1% upside potential.

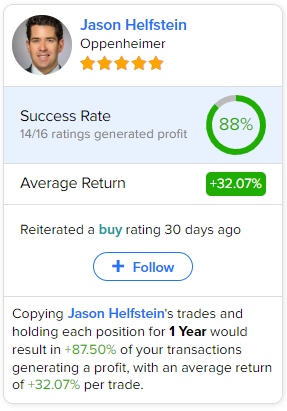

If you’re wondering which analyst you should follow if you want to buy and sell NFLX stock, the most accurate analyst covering the stock (on a one-year timeframe) is Jason Helfstein from Oppenheimer, with an average return of 32.07% per rating and an 88% success rate. Click on the image below to learn more.

The Takeaway

Netflix’s meteoric growth phase has undoubtedly concluded, marked by surging competition and a decelerating revenue trajectory. The streaming landscape, once ripe for disruption, has transformed into a crowded arena where established giants and nimble newcomers vie for subscribers’ attention and dollars. While NFLX stock has displayed an unexpected rally, the underlying reality remains clear: the industry shift and valuation metrics are compelling signals for a prudent exit.