Top video-streamer Netflix (NASDAQ:NFLX) has been on a hot run, thanks in part to promising recent quarters and some pricing adjustments. As virtual reality (VR) takes off again, I’d look for Netflix to prove itself as an obvious beneficiary as it looks to pioneer new, innovative ways to entertain people from their homes.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Undoubtedly, Netflix stock got ahead of itself in 2021 before things came crashing down. Though shares have been in rally mode for over a year now, I do think the run can be extended if VR is, in fact, poised to become a mainstream technology.

VR’s Big Moment May be Close. Netflix Won’t be Left Behind.

Indeed, many VR ambitions have been crushed over the years. The hardware has always been a limiting factor stopping the masses from buying VR headsets. Though Meta Platforms (NASDAQ:META) has made its metaverse ambitions clear, an overwhelming majority of consumers have yet to make the dive, partially due to the high cost of a headset but mostly due to the lack of a genuinely mind-blowing experience.

Think about the type of awe that we had when we tried ChatGPT for the very first time or even the sense of magic we experienced from the first Apple (NASDAQ:AAPL) iPhone.

For any consumer product, the cost-versus-capability debate will go on. When it comes to VR, though, I do believe that capability trumps cost. Further, with Apple unveiling its Vision Pro headset (or spatial computer, as it calls it) earlier this month, the firm seems to be betting that people will pay a substantial sum ($3,500 is nothing to sneeze at!) for a truly next-generation experience.

Back to Netflix. The company seems to have lost its way amid the continued maturation of the video-streaming market. It seems like there are too many streaming apps to keep track of these days — too many options, a limited amount of time, and a budget that is getting more constrained amid macro headwinds.

Regardless, Netflix seems to be holding its own as a leader, and as VR looks to become a prime-time technology, I view Netflix as one of the potential beneficiaries as it looks to explore new ways of creating immersive entertainment content.

Netflix Stock’s Expectations are High as the Valuation Expands Again

With a 46.1 times trailing price-to-earnings multiple, investors expect Netflix to keep on growing. Undoubtedly, there are only so many cost tiers Netflix can serve up, as well as only one time it can shake freeloaders from paying up. Fortunately, VR represents one arena where Netflix can innovate and regain more of the rich growth multiple it used to command when it was one of the priciest members of the FAANG basket.

Many critics questioned Apple’s Vision Pro for lacking a “killer app.” Should Netflix begin to explore more immersive content that makes viewers the “star of the show,” Netflix may very well be one of the “killer apps” that helps make an expensive VR headset worth the price of admission.

Though Netflix doesn’t have concrete plans to break into the nascent VR content space, I would not be shocked if it did at some point over the next few years, provided enough consumers buy headsets. Indeed, Netflix could gain as Meta and Apple duke it out in the headset space.

Stranger Things VR Could be a Sign of Things to Come

Recently, Netflix released a Stranger Things VR trailer. It appears like any VR game but could be a glimpse of what to expect from the company in the distant future. Immersive games and experiences could be key to convincing your average consumer to purchase a VR headset.

Netflix is a newcomer when it comes to video gaming, but with strong brands and a willingness to explore new entertainment media, I do not doubt its ability to succeed in gaming.

However, it has been a rather slow and underwhelming start with the company’s mobile gaming push. Perhaps VR, rather than mobile, is the place where Netflix can really see its gaming business take it to the next level.

Is NFLX Stock a Buy, According to Analysts?

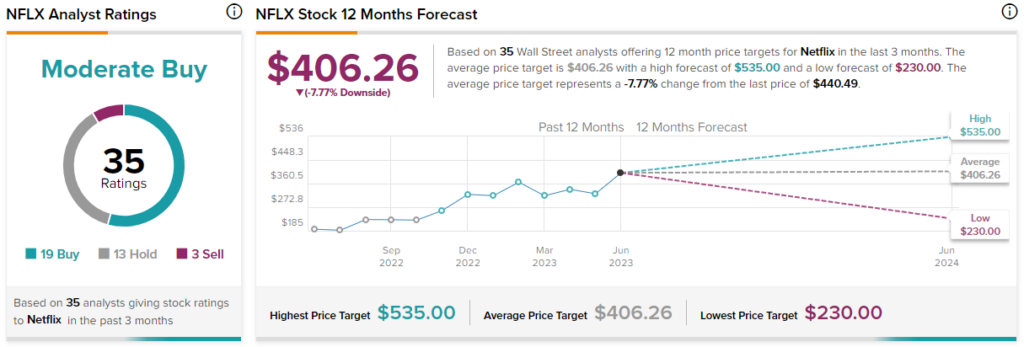

Turning to Wall Street, NFLX stock comes in as a Moderate Buy. Out of 35 analyst ratings, there are 19 Buys, 13 Holds, and three Sells.

The average Netflix stock price target is $406.26, implying downside potential of 7.8%. Analyst price targets range from a low of $230.00 per share to a high of $535.00 per share.

The Bottom Line on Netflix Stock

Netflix stock’s run could be far from over if it’s able to keep innovating and trying new things in this pivotal moment for new-generation technologies like AI and VR.

As AI and AR technologies ascend, I do view Netflix as just one of the potential winners as its content moves from the flatscreen to three-dimensional realms.