In this piece, I evaluated two cybersecurity stocks, Cloudflare (NYSE:NET) and Zscaler (NASDAQ:ZS), using TipRanks’ comparison tool to determine which is better. A closer look reveals different reasons to be bearish on both—as shocking as that may be to some investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cloudflare provides a wide array of cloud services, including cloud cybersecurity, denial-of-service mitigation, content delivery network services, and domain service registrations. Zscaler is a cloud security company that provides protection from cyberattacks and data loss by securely connecting devices, users, and applications.

Cloudflare shares have skyrocketed this year, climbing 45.6% year-to-date, and are up 25.5% over the last 12 months. Zscaler stock has also soared, rising 55% year-to-date, although it is up a less impressive 17.6% over the last 12 months.

With similar year-to-date rallies, some investors may be surprised that there is a quite noticeable and meaningful gap between their valuations. Neither company is profitable, so we’ll use their price-to-sales (P/S) ratios to compare their valuations. For comparison, the U.S. software industry is trading at a P/S of 9.5 versus its three-year average of 10.3.

Cloudflare (NYSE:NET)

At a P/S of 19.4, Cloudflare is trading at a considerable premium to its industry, although its valuation has come down dramatically from its peak of over 118 in late 2021. However, despite that decline in valuation, the large number of recent insider and hedge fund sales indicates there is significant profit-taking occurring in the stock, suggesting a bearish view may be appropriate.

Insiders have unloaded $4.4 million worth of Cloudflare shares over the last three months (if you only count “informative” transactions). If you count “uninformative” transactions, there hasn’t been a week without insider sales in quite some time.

Notably, all the recent insider sales have been auto-sell transactions, suggesting that Cloudflare’s price has been repeatedly hitting the prices insiders have established in their preset trading programs. Planning ahead to sell their shares at the company’s recent share prices suggests insiders don’t think its stock will rise further anytime soon.

Hedge funds are also exceptionally bearish on Cloudflare. Funds dumped 3.2 million shares during the last quarter, suggesting there may be no more upside for the stock in the near term. With Cloudflare stock soaring so high so fast this year, it’s no surprise that so much profit-taking has occurred among insiders and hedge funds.

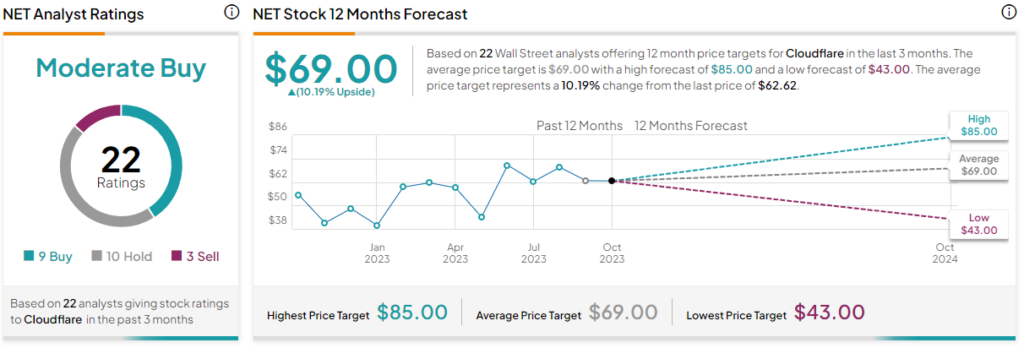

What is the Price Target for NET Stock?

Cloudflare has a Hold consensus rating based on nine Buys, 10 Holds, and three Sell ratings assigned over the last three months. At $69.00, the average Cloudflare stock price target implies upside potential of 10.2%.

Zscaler (NASDAQ:ZS)

At a P/S of 15.8, Zscaler is also trading at a premium to its industry, although it’s at a discount to Cloudflare. Nonetheless, Zscaler is beginning to look like a bubble stock, given that it’s now dangerously close to overbought territory. This suggests a bearish view may be appropriate.

Unlike Cloudflare, Zscaler is not seeing a mass exodus of insiders and hedge funds despite its surging stock price. In fact, Zscaler is continuing to climb, up 17.6% over the last three months. Meanwhile, Cloudflare shares are down 7% in the last three months.

Unfortunately, the continued rise in Zscaler’s stock price has pushed its relative strength index (RSI) reading up to 66, and overbought territory kicks in when the RSI hits and surpasses 70. On the other hand, Cloudflare’s RSI stands at 58, closer to a normal range due to its stalling.

In short, Zscaler looks due for a correction, as in a decline of at least 10% from a recent peak.

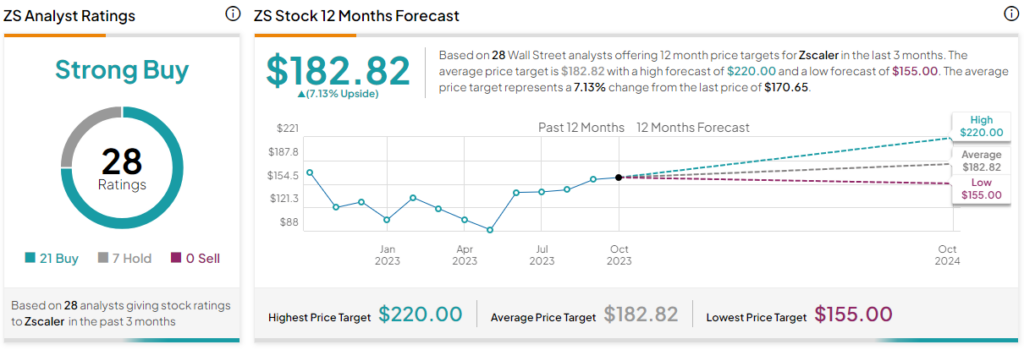

What is the Price Target for ZS Stock?

Zscaler has a Strong Buy consensus rating based on 21 Buys, seven Holds, and zero Sell ratings assigned over the last three months. At $182.82, the average Zscaler stock price target implies upside potential of 7.1%.

Conclusion: Bearish on NET and ZS

Both Cloudflare and Zscaler have received valuations that are much higher than they deserve due to extreme investor euphoria. As mentioned above, neither company is profitable. Yet, Cloudflare has a market capitalization of $20.9 billion, while Zscaler’s market cap stands at $25.1 billion.

At some point, these companies could deserve more constructive views, but for now, their valuations are just too high and look set for a correction. In fact, it’s a challenge to pick a winner from these two. On the one hand, Cloudflare’s RSI isn’t close to entering overbought territory like Zscaler’s is. However, on the other hand, Cloudflare is seeing insider and hedge fund selling, while Zscaler is not.

Thus, it seems safe to say that the result of this pairing is a very unusual tie — with an equally bearish view of both.