The electric vehicle (EV) industry faces a significant challenge: declining demand in the midst of a challenging economic environment.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

It has been an industry-wide issue with even segment leader Tesla enacting a series of price cuts throughout the year as it attempts to convince consumers to get the checkbook out. Additionally, legacy OEMS have indicated they will slow down the transition to EVs and at the same time some of the new players have exhibited some serious struggles.

However, says Needham analyst Chris Pierce, one company is on a rather different, and far more positive, trajectory. In the face of increasingly negative sentiment towards broad EV adoption, Rivian (NASDAQ:RIVN) appears to be a hidden gem in the transition from internal combustion engines (ICE) to EVs.

Pierce elaborates, stating, “RIVN is the only supply-constrained OEM within our coverage, with pricing power and longer-term brand halo effects driving higher confidence in TAM expansion, with RIVN unveiling and launching their lower-priced R2 vehicle from a position of strength. RIVN continues to score well vs peers in our used-vehicle pricing checks, increasing our confidence in RIVN’s unique position in the industry at this time.”

There’s data to back up such a claim. According to Pierce’s industry checks, Rivian’s R1T pickup is performing better in the market than Ford’s F-150 Lightning. And despite Rivian’s higher retail volumes, there are fewer of its vehicles available for resale.

The comparison to Ford might be apt, as Pierce anticipates Rivian will adopt a similar approach to OEMs whereby rather than resorting to MSRP (manufacturer’s suggested retail price) cuts to “protect residual values,” the company will offer “higher levels of incentives.”

However, even as the company has shown consistent execution through the year, Pierce thinks investors have been slow to give Rivian credit. The upshot is that for those focused on the long-term, there’s a “compelling investment opportunity” at play.

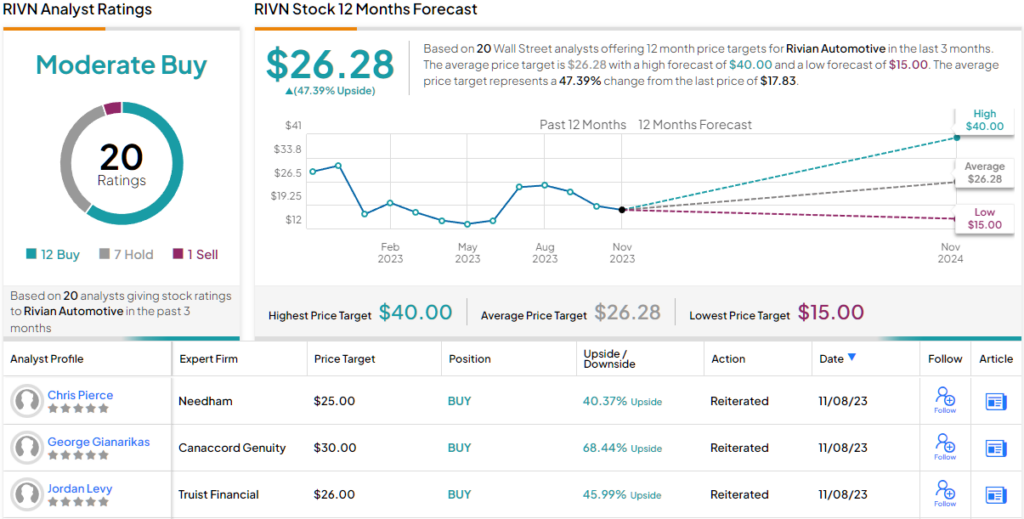

Accordingly, Pierce pounds the table on RIVN shares, reiterating a Buy rating along with a $25 price target. Should this target be met, a twelve-month gain of ~40% could be in store. (To watch Pierce’s track record, click here)

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 12 Buys, 7 Holds and 1 Sell add up to a Moderate Buy consensus. The average target is slightly higher than Pierce will allow; at $26.28, the figure makes room for one-year returns of ~47%. (See Rivian stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.