Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL) are old-time rivals that have continued their dominance many decades later, from the rise of the personal computer to the modern and rapidly advancing age of artificial intelligence (AI). Indeed, Microsoft and Apple are two tech titans that prove there are some firms out there that can keep on growing into old age. To do so, continuous reinvention by means of disruptive innovation and smart business practices have been key areas.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

As we move into 2024, the main question is which tech behemoth has more AI upside. Indeed, Microsoft was/is the AI stock to own for 2023, with its exposure to ChatGPT-owner OpenAI and its new AI offerings that are released frequently, enough to keep rivals on their toes.

Though Apple has been busy with AI, incorporating it into new features (the smarter AutoCorrect in the latest iOS update), it’s unknown when the company will have its own generative AI or large language model (LLM) to stack up with the growing list of competing offerings, including ChatGPT, Claude, and more.

In any case, I remain bullish on both Magnificent Seven companies heading into 2024, a year that’s sure to be full of AI surprises.

The Pace of Innovation at Microsoft Has Got to Be Intimidating for AI Rivals

In recent months, Microsoft has been busy rolling out its Copilot AI across its software. Thus far, Wall Street has been absolutely loving it, rewarding shares of MSFT with enough gains to hit a new all-time high recently, just shy of $385 per share.

More recently, Microsoft stated its new AI model named Phi-2 is more capable than that of its rivals, specifically in logic-related tasks like programming and mathematics. Indeed, it seems like there’s some new AI model launching every couple of weeks that’s able to put the existing ones to shame. That may very well be the pace of innovation we’ll come to expect in the new year as firms look to advance in what can only be described as an AI war.

Microsoft is a $2.8 trillion enterprise behemoth that is moving remarkably fast with AI — but in a way (hopefully) as to not break things.

Meanwhile, Apple has been content sitting mostly on the sidelines when it comes to its latest and greatest AI technologies. Just because it’s tighter-lipped doesn’t mean it’s “behind” in the AI race. For now, it’s hard to tell what Apple has in store for 2024 on the AI front as it looks to launch its very first spatial computer in the Apple Vision Pro. It’s hard to ignore the buzz surrounding potential AI endeavors going on behind the scenes, though.

Is MSFT Stock a Buy, According to Analysts?

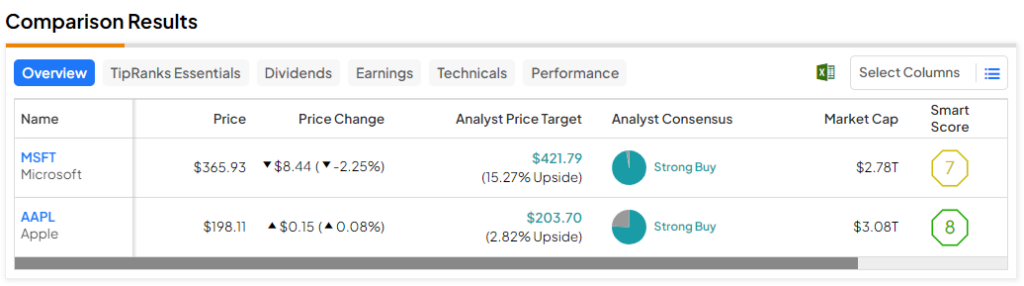

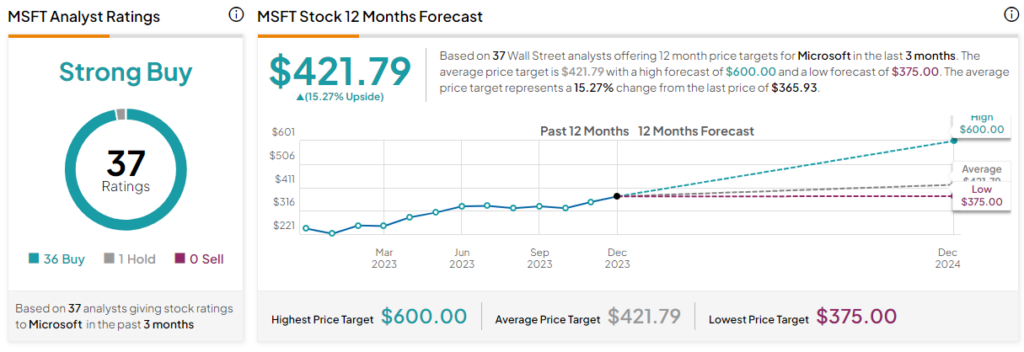

On TipRanks, MSFT stock comes in as a Strong Buy. Out of 37 analyst ratings, there are 36 Buys and one Hold recommendation. The average MSFT stock price target is $421.79, implying upside potential of 15.3%. Analyst price targets range from a low of $375.00 per share to a high of $475.00 per share.

Is Apple Ready to Make an AI Splash in 2024? Analysts’ Opinions Vary

Apple analyst Min-Chi Kuo, a man who’s been spot on with past Apple predictions, sees the iPhone maker spending $4.75 billion on AI servers in 2024. That’s a big bet on the future of AI. That said, Kuo doesn’t believe Apple will launch a generative AI model in the new year.

Morgan Stanley (NYSE:MS) views Apple as one of the firms that are poised to benefit greatly from AI once it goes mainstream, going as far as to call it “an AI enabler.” The investment firm sees Apple becoming one of the winners in the realm of “edge AI” as soon as early 2024.

What exactly is edge AI? Imagine having powerful AI models on your own device (think your iPhone) that don’t require you to rely so heavily on the cloud. Profoundly powerful machine learning (ML) algorithms may very well be in the palm of your hand rather than on some remote server. Indeed, the concept is quite profound and could mark the next step in the world of AI.

Only time will tell how the next chapter of the AI story unfolds. Regardless, it’s an exciting subsegment of AI that could put Apple at or around the front of the AI race at some point in the future. Whether the move is in 2024 or 2030, I believe Morgan Stanley is right on the money when it says Apple is one of the bigger beneficiaries of AI.

Indeed, it’s hard to tell exactly where Apple stands with its AI strategy. As always, we’ll probably have to wait until CEO Tim Cook is ready to announce before we can know with 100% certainty what the Cupertino-based giant is really up to and where it stands on the front of various technologies.

Is AAPL Stock a Buy, According to Analysts?

On TipRanks, AAPL stock comes in as a Strong Buy. Out of 33 analyst ratings, there are 25 Buys and eight Hold recommendations. The average AAPL stock price target is $203.70, implying upside potential of 2.8%. Analyst price targets range from a low of $150.00 per share to a high of $240.00 per share.

Bottom Line: Apple Stock Could Have More AI Upside From Here

I think Microsoft stock’s upside may be limited as it’s pretty common knowledge that it’s an AI leader at this juncture. The stock goes for 36.3 times trailing price-to-earnings (P/E), notably above Apple’s 31.8 times trailing P/E multiple. If edge AI is the next stepping stone, I’d not be shocked if Apple ends up closing the valuation gap with its long-time rival.

For now, Wall Street loves both companies but expects a bit more upside from Microsoft (15.3% vs. 2.8%). Nonetheless, expect average price targets to shift drastically as new developments arise from both firms on the front of AI.