Moderna (MRNA) has been one of the S&P 500’s worst performers of late.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The return to normal is near, and the role vaccines will play in this new normal remains to be seen.

Of course, there are many who suggest that over the long term, booster shots may become a fact of life. That’s probably true. However, forecasting forward similar impressive results in the years to come is becoming harder for this highly valued stock.

Given surging inflation and the prospects of rising interest rates, as well as geopolitical concerns that have popped up of late, high-growth stocks like Moderna are taking a back seat in this market. the outlook for this company is one that many aren’t totally sold on.

I find myself in this camp, and am bearish on MRNA stock right now.

Earnings Strong, but Can Trend Continue?

Moderna’s recent Q4 2021 earnings beat has certainly inspired bulls to once again consider this company as a high-growth option in the biotech space.

The company’s mRNA vaccine has been successful against previous variants. With more and more of the world’s population getting vaccinated, there remains a large potential market for Moderna to go after.

The company beat both its revenue and earnings expectations. On the top line, the company reported $7.2 billion in sales, prompting a guidance raise of $2 billion for this fiscal year. Moderna brought in $11.29 per share in earnings, substantially higher than analyst estimates.

So, what’s not to like about these numbers?

Well, there’s some debate as to just how long this company’s growth trajectory can be maintained. Unvaccinated folks getting vaccinated for the first time are few and far between.

While booster shots are expected to be needed for recent waves, recent research has pointed to the idea that vaccines may protect us far longer than previously thought.

Thus, MRNA stock is one that’s difficult to assess right now.

Another question that comes up is just how virulent (deadly) future variants will be. If we see an increasing trend toward less-virulent strains of the coronavirus come about, there is some potential for vaccine hesitancy to pick up among individuals.

Given that Moderna’s cash flows are solely dependent on the performance of its vaccine relative to other options in the market right now, investors are likely to pay attention not only to the actual earnings of this company, but the projected earnings quality of Moderna moving forward.

Vaccine Demand Ebbs

As per the Centers for Disease Control and Prevention, around 64% of the entire U.S. population is fully vaccinated. Moreover, the national vaccination rate is rising much more slowly as compared to the early days of this pandemic.

In just a span of two months, the share of fully vaccinated Americans reached 50% from 40%. It took another four months to take these numbers to 60%. Vaccination for COVID spiked in December when the country reported its first Omicron variant. However, the vaccination rate has declined since then.

Moderna’s vaccine for COVID-19 is its only commercial product. So, as the demand for vaccines subsides, MRNA stock could decline further.

Meanwhile, BioNTech and Pfizer are developing a vaccine to aim directly at the Omicron variant. This vaccine might get approval by March 2022.

Moderna has also started clinical trials for its vaccine of the same category, though the race is once again on among these top biotech players.

Wall Street’s Take

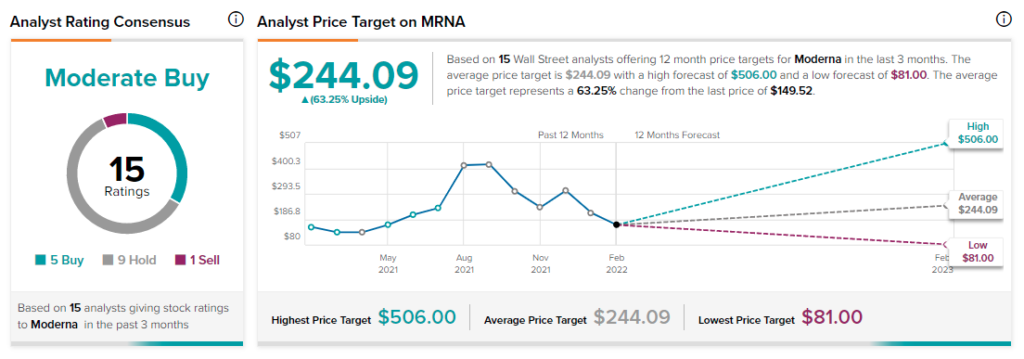

As per TipRanks’ analyst rating consensus, Moderna is a Moderate Buy. Out of 15 analyst ratings, there are five Buy recommendations, nine Hold recommendations, and one Sell recommendation.

The average Modera price target is $244.09. Analyst price targets range from a high of $506 per share to a low of $81 per share.

Bottom Line

Moderna appears difficult to value right now. This company has posted incredible results, and appears to be firing on all cylinders.

However, from a fundamentals perspective, there’s a lot of risk with MRNA stock right now. Should vaccine demand decline over time, this is a company without a pipeline of alternative drugs to make up the difference.

Accordingly, investors may want to be careful in attempting to catch this falling knife.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure