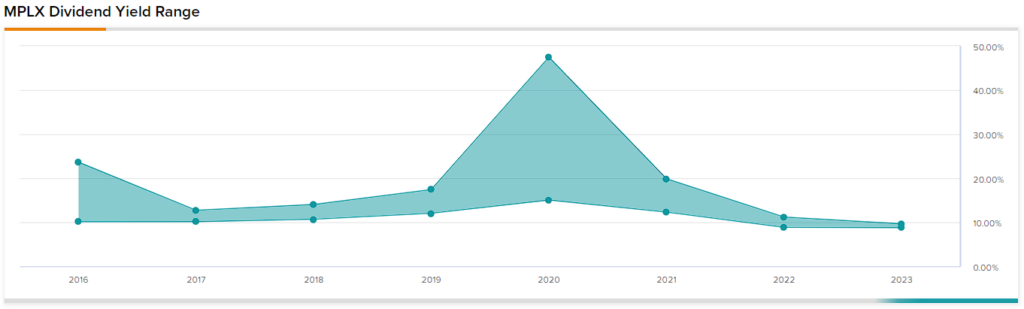

Oil & gas midstream giant MPLX LP (NYSE:MPLX) is an energy stock that currently offers a 9%+ dividend yield, which I find to be one the most compelling in the market.

This is for several reasons, including the partnership’s strong distributable cash flow generation and smart capital allocation practices. Coupled with my belief that MPLX’s valuation is currently situated at favorable levels, I am bullish on the stock.

Sturdy Cash Flows to Support Distributions, Further Hikes

MPLX’s cash flow generation has been very strong in recent quarters, sufficiently supporting the partnership’s underlying dividends (referred to as “distributions” in MPLX’s case) and allowing for further payout hikes.

The firm had a highly successful 2022. It was characterized by notable growth in adjusted EBITDA and distributable cash flow (DCF) at rates of 3.9% and 4.1%, respectively, amounting to $5.8 billion and $5.0 billion. Further, MPLX has seamlessly carried forward its momentum into the beginning of 2023.

MPLX’s Q1-2023 results showcased a pleasant performance fueled by growth in throughputs and increased rates within its Logistics & Storage segment. Additionally, the Gathering & Processing segment thrived with a noteworthy 21% surge in gathered volumes and a 4% rise in processed volumes. Given the current energy security landscape, the demand for MPLX’s mission-critical infrastructure remains exceptionally high.

Consequently, MPLX was able to post adjusted EBITDA (which excludes such extraordinary items and provides a much more accurate view of improvements in operations) of $1.52 billion, up 9.0% year-over-year. Deducting MPLX’s interest expenses, net income after settling the preferred dividends came in at $915 million, a 15.4% gain year-over-year.

With such a notable growth in net income, and consequently, in DCF, MPLX should continue to grow its distributions per share at a satisfactory rate, as it has done every year over the past decade. In fact, considering MPLX’s performance in Q1 and industry developments, industry analysts on Wall Street estimate that the company will generate approximately $6.00 billion in EBITDA this year.

After making the necessary adjustments, my estimate suggests that MPLX is likely to achieve DCF per share of around $5.10. This indicates year-over-year growth of approximately 3.4%. Based on the current annualized distribution rate of $3.10, payouts are well covered, as the payout ratio stands close to 60%, suggesting sufficient room for further hikes.

MPLX’s confidence in growing distributions at stimulating rates over time is also suggested by management’s latest hike, which was by an adequate 9.9% to a quarterly rate of $0.775.

Balance Sheet Optimization, Buybacks to Boost Financials

Besides MPLX’s core operating merit, the partnership’s balance sheet and overall financials should improve over time, backed by management’s proper capital allocation practices.

Regarding optimizing the balance sheet, gradual deleveraging has been one of MPLX’s top priorities. While total debt did increase from $20.3 billion in Q4-2022 to $20.9 billion in Q1-2023, the partnership was paying down aggressively in previous quarters. Thus, total debt currently stands at the same levels as in early 2020. In the meantime, however, earnings have grown. Consequently, MPLX’s debt-to-EBITDA ratio currently hovers at a reasonable 3.5x, providing management with notable flexibility.

Further, MPLX has been repurchasing units (shares) in bulk, which should help grow DCF/unit faster over time and aid with distribution coverage even as the company continues to increase its payouts. In a sense, through buybacks, MPLX retires “expensive” units on the cheap, saving massively on future distributions it would pay on these units.

Since late 2019, MPLX has repurchased and retired about 6.7% of its common units outstanding. It may not sound like a great chunk of the total equity, but given the partnership’s hefty distributions, it does translate to notable future savings.

Is MPLX Stock a Buy, According to Analysts?

Turning to Wall Street, MPLX LP has a Moderate Buy consensus rating based on five Buys, one Hold, and one Sell rating assigned in the past three months. At $40.71, the average MPLX LP stock price target suggests 19% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell MPLX stock, the most profitable analyst covering the stock (on a one-year timeframe) is T J Schultz from RBC Capital, with an average return of 21.48% per rating and an 84% success rate. See below.

The Takeaway

Yields have risen in recent times due to rising interest rates, resulting in valuations correcting across the board. However, not many equities feature a 9%+ yield that is as well covered as in MPLX’s case. The partnership continues to generate robust cash flows while there is ample room for management to keep increasing payouts.

The combination of a high yield, unit buybacks, and a relatively humble valuation multiple (price/DCF of 6.7 implies the possibility of a blended investor yield of nearly 15%) indicates attractive capital returns with a notable margin of safety. Hence, income-oriented investors, in particular, are likely to find MPLX to be a great fit for their portfolios.