Preliminary figures for Q2 earnings are starting to come in, and we’ll get final numbers over the next few weeks. One thing is clear: revisions are running downward, as the combination of high inflation and rising interest rates is starting to bite into corporate profits. The big question for investors remains, how will this impact stocks going forward?

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Mike Wilson, chief US equity strategist from investment banking giant Morgan Stanley, takes the bearish view. Noting the headwinds put in place by increasing inflation and interest rates, he goes on to point out that the jobs situation is also starting to show some ominous numbers. On that front, jobless claims are beginning to rise while posted job openings are starting fall. Taken all together, these are indications of possible recession.

While Wilson only puts a 36% chance of a recession hitting the US over the course of the next year; he does not think that the market will show any sustained rally over the next 6 months, and that the S&P 500 is likely to end the year at or near 3,900, a mere 30 points above current levels.

“We don’t believe this bear market is over, even if we avoid a recession — the odds of which are increasing… The combination of continued labor, raw material, inventory, and transport cost pressures coupled with decelerating demand poses a risk to margins that is not reflected in consensus estimates, in our view,” Wilson added.

In the meantime, where does this leave us? A market that’s relatively flat by year-end doesn’t preclude volatility in the shorter term, and that means there will be opportunities for investors who don’t mind the risk.

Wilson’s stock analyst colleagues at Morgan Stanley have picked out two stocks that they believe are primed for gains. According to TipRanks platform, these are Strong Buy stocks, with plenty of upside potential; Morgan Stanley sees them gaining over 60% in the coming months. Here are the details.

Toast, Inc. (TOST)

We’ll start in the tech world, where Toast is a software firm catering to the restaurant industry. The company’s products are designed to streamline restaurant operations, allowing point of sale transactions, take-out ordering, gift card and loyalty program management, email marketing, online ordering, mobile ordering and payment for guests on-premises, delivery via on-demand drivers – the list is long. All of these functions are available to enterprise customers through an Android app, accessible via smartphone or tablet device. The software package was created specifically for restaurant business customers.

Toast has only been a publicly traded entity for a short time; the company held its IPO in September of last year. The event was successful; Toast raised gross funds of $1 billion and hit a market value of $19.9 billion. Since the IPO, however, the stock has fallen by 78% and the company’s market cap now stands at $7.1 billion.

The company’s stock was pummeled earlier this year by wider-than expected net losses. In February’s 4Q21 report, Toast reported an EPS loss of 23 cents, nearly double the 12-cent forecast. The more recent 1Q22 report was more upbeat, but the shares have failed to regain traction since its release.

In Q1, Toast reported important increases in several key metrics. The app was in use in 62,000 locations, 45% more than the year-ago quarter, an increase that powered a 90% gain in revenues, which reached $535 million. Annual recurring revenue, an important indicator of future sales, showed a 66% year-over-year gain, hitting $637 million.

The best news came in earnings. EPS moderated quarter-over-quarter from a 23-cent loss to a 5-cent loss – but more importantly, it beat the forecast, which had expected a 12-cent EPS loss.

Morgan Stanley analyst Josh Baer likes Toast as a software company for investors to watch, writing, “We favor TOST’s setup given its continued share gain momentum, conservatism in the model and share underperformance yielding an attractive valuation at only 0.19x EV/Gross Profit /Growth vs. the overall software average at 0.42x.”

Baer also looks back at the company’s recent financial report, and sees plenty of evidence for underlying strength: “In Q1 results Toast called out that they have not seen any material impact to restaurant spend as it relates to macro trends. In Q1, Toast beat consensus for revenue and gross profit by 9% and 41%, respectively ,and guided to revenue 12% ahead of consensus and EBITDA margins of (8.5%) ahead of consensus of (10.4%).”

Considering the disconnect between the company’s share performance and its financial results, Baer rates TOST as Overweight (i.e. Buy) going forward, and sets a $27 price target that implies a one-year upside potential of ~92%. (To watch Baer’s track record, click here)

Clearly, Wall Street’s analysts are choosing to see the big picture when it comes to TOST; they’ve given the stock a 7 to 1 split favoring Buy reviews over Holds for a Strong Buy consensus rating. The stock is priced at $14.08 and its $22.38 average price target indicates room for 59% growth ahead. (See TOST stock forecast on TipRanks)

Targa Resources Corporation (TRGP)

From tech, we’ll turn to the energy industry. Targa Resources is a midstream firm, one of the many companies that works moving hydrocarbons from well-heads to terminals to refineries. Targa operates a network of assets in Gathering & Processing and Logistics & Transportation, placed in several of North America’s most active and productive energy production regions. The company’s assets are focused on the movement, storage, processing of natural gas and natural gas liquids.

Targa operates mainly in the Texas-Oklahoma-Louisiana region, with assets in the Permian Delaware and Midland basins, the Barnett and Eagle Ford shales of Texas, the Andarko Basin of Oklahoma, and on the Guld Coast from Houston into Louisiana. These assets are connected by a network of pipelines. The company also has a separate asset footprint in the Bakken shale fields of North Dakota.

This year, while the S&P 500 has fallen by 18%, TRGP shares outperformed. Even after falling from a June peak, the stock still registers a 19% gain year-to-date. That shouldn’t be surprising, as Targa’s revenues and cash flows have been strong.

The top line came in at $4.96 billion in 1Q22,up from $3.63 billion in the year-ago quarter – a gain of 37%. The company’s distributable cash flow grew 24% y/y to reach $494.6 million. The cash flow supported the dividend, which Targa has now declared at 35 cents per common share for Q2. This annualizes to $1.40, and gives a yield of 2.3%.

In an important announcement last month, Targa made public its agreement to acquire Lucid Energy, a natural gas processor in the Permian Basin. The acquisition will cost Targa $3.55 billion, in a cash transaction.

That last point was the key for Morgan Stanley analyst Robert Kad. He wrote, “The transaction builds scale for TRGP in the Delaware Basin to complement a dominant Midland footprint, adding gathering and processing assets under long-term, fixed fee contracts that increase TRGP’s overall fee based margin and provide opportunities for operational synergies as tailgate NGLs can be redirected to TRGP’s downstream assets over time.”

“Moreover,” the analyst added, “recent selling pressure has created a sharp dislocation in the stock that we believe will prove to be an attractive entry point for a multi-year Permian growth story with multiple touch points through vertically integrated assets.”

Kad is optimistic about Targa’s path forward, rating the stock an Overweight (i.e. Buy) and setting an aggressive $103 price target that suggests a high upside potential of 66%. (To watch Kad’s track record, click here)

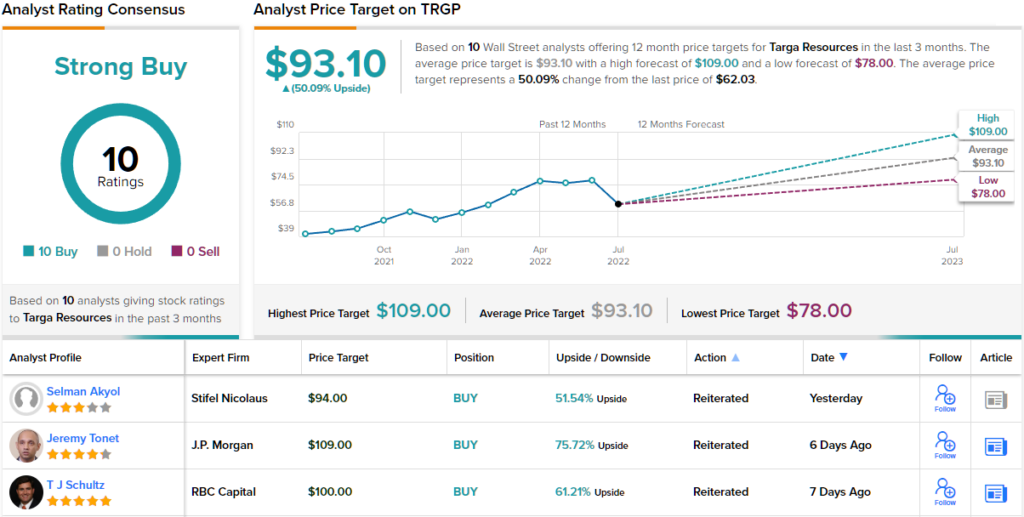

Overall, a full house of Buys – 10, in fact – provides the midstream company with a Strong Buy consensus rating from the Street. Targa’s shares are selling for $62.03 and their $93.10 average price target implies a one-year upside of 50%. (See Targa stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.