In the last couple of years, AI technology has become the ‘shiny new thing’ in the business world, the new tech that transforms industries with streamlined workflows, smarter applications, more satisfied customers, increased revenues – essentially, if there’s a challenge, AI is marketed as the solution. From optimizing operations to redefining customer experiences, its potential seems boundless, making it a cornerstone of modern business strategies.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The rapid expansion of AI into both the general economy and the stock markets has brought a mix of opportunities and risks. The opportunities are clear: AI is living up to its hype and proving capable of driving increased profits. The risks, however, are less defined. Some companies jumping on the AI bandwagon lack a genuine need for the technology but are still expending capital on it, potentially leading to inefficient resource allocation. Some analysts warn that the rush to invest in AI infrastructure may be driven more by “fear of missing out” than by actual demand.

For investors, the challenge lies in identifying AI stocks that can extract the most value from the technology. Fortunately, Wall Street’s stock analysts are on the job, picking out the equities that are ready to gain as genAI builds more momentum.

Analysts at Morgan Stanley have tagged two stocks in particular as prime candidates to lift higher on the AI expansion. Using the TipRanks database, we’ve looked into the broader Wall Street view on both of Morgan Stanley’s picks; let’s dive in and see if the hype is real.

Salesforce, Inc. (CRM)

We’ll start with Salesforce, a longtime leader in customer relationship management, or CRM. The company has been in business for 25 years, and today is a giant of the software world, with a $329 billion-plus market cap and nearly $35 billion in its last fiscal year, 2024, which ended last January. The company dominates the CRM niche, offering its customers an array of cloud-based software tools to cover a variety of business needs.

The company’s core product is its cloud-based platform, designed to streamline everything from sales calls and marketing outreach to customer service interactions and data retrieval. The Salesforce platform uses AI tech to provide intelligent automation, integrated across the company’s product line, so that users can unite their sales, service, marketing, commerce, and IT teams through a shared vista into customer information.

Salesforce has seen the value that AI can add to its data-based product offers, and recently has partnered with Google and Nvidia to create smarter and more capable software agents – powered by the latest generative AI technology. The addition of AI allows the Salesforce tools to operate independently, gathering a wider range of data from more applications and with less human supervision and intervention – in short, AI allows Salesforce to automate many of the dreary tasks of the digital back office.

All of this has undoubtedly brought the company success. In its most recent quarter, fiscal 3Q25, Salesforce reported strong financial results, driven by multi-cloud adoption, international expansion, early contract renewals, and robust transactional bookings. The company outperformed expectations with a $90 million top-line beat and demonstrated financial strength through a 30% year-over-year increase in free cash flow, reaching $1.78 billion.

Morgan Stanley’s Keith Weiss, who is rated by TipRanks among the top 1% of Wall Street’s analysts, recognizes Salesforce’s potential. While the company’s current achievements are notable, Weiss is particularly optimistic about its ability to capitalize on emerging shifts within the software landscape, positioning it for even greater value creation in the future.

“While Q3 results were solid, beating consensus and coming in line with buy-side expectations, the excitement in the shares does not come from numbers moving higher (although the FY25 guide does nudge up modestly), but the sense Salesforce is firmly participating in this shift towards Agentic Computing, and perhaps leading it… At 20X CY26 EV/FCF, a solid catalyst path to sustain the GenAI momentum and more room for margin expansion should continue to drive shares higher… With room for upside in both forward revenue and margin expectations, against a reasonable multiple, we remain OW this GenAI winner,” Weiss opined.

The Overweight (i.e. Buy) rating that Weiss puts here is complemented by a $405 price target that implies an upside potential of ~18% on the one-year horizon. (To watch Weiss’s track record, click here)

Overall, Salesforce’s stock holds a Moderate Buy consensus rating from the analysts, based on 41 recent reviews that include 31 Buys, 9 Holds, and a single Sell. The stock is trading for $343.65 and its $398.34 average target price suggests a one-year gain of 16%. (See CRM stock forecast)

Elastic (ESTC)

Elastic, a data search specialist, has also caught Morgan Stanley’s attention for its AI-driven platform tailored to streamline local data searches. By enabling swift and efficient database queries, Elastic empowers its clients to extract greater value from their data. The company addresses a core challenge of the digital age: the inability to efficiently navigate vast data volumes. Elastic’s innovative solution bridges this gap, offering a practical tool for modern data management.

The solution is a cloud-based platform that leverages generative AI to create a seamless service for real-time data searching. This cloud-native approach eliminates the need for users to install or maintain AI-capable infrastructure. Furthermore, Elastic’s integration of AI allows users to interact with the platform through natural language prompts, simplifying data access and analysis. Elastic’s product suite extends beyond database search to include observability and security solutions, along with the innovative Search AI Lake – a serverless generative AI solution. This real-time tool boasts low latency, scalability, and adaptability, meeting the demands of enterprise customers across diverse industries.

The company’s platforms are in use across a wide range of industries, including retail, telecom, financial services, and government, and companies such as Land Rover, Cisco, Comcast, and Booking.com all make use of Elastic’s services.

Last month, Elastic’s stock got a solid boost from a strong fiscal 2Q25 earnings report. In that quarter, Elastic beat the forecasts on both revenues and earnings; the top line of $365 million was $10.7 million better than expected, as well as up more than 17% year-over-year, while the bottom line, non-GAAP EPS of 59 cents was 21 cents per share above the estimates.

Elastic’s potential and performance have caught the eye of analyst Sanjit Singh, who writes of the stock for Morgan Stanley: “We believe Elastic’s search end market is poised to accelerate as enterprises modernize their existing search workloads with the use of GenAI and vector search technology, which will enable a natural language search experience that will be more engaging and more relevant for end users. At a minimum, we think Elastic is well positioned to sustain market share, resulting in our upside to current consensus, given a supportive technology cycle driven by generative AI, our positive customers checks, our proprietary GitHub analysis, and a top-down market share analysis.”

Outlining a path forward for Elastic, Singh adds, “We think the prospect of sustained growth/market share is not reflected in shares today, which creates an attractive setup as we believe shares can appreciate on ‘sustained’ market share in its core end markets (search, observability, security). This represents a lower bar compared to other companies in our infrastructure software coverage.”

These comments support Singh’s Overweight (i.e. Buy) rating here, while his $130 price target shows his confidence in a 25% one-year upside. (To watch Singh’s track record, click here)

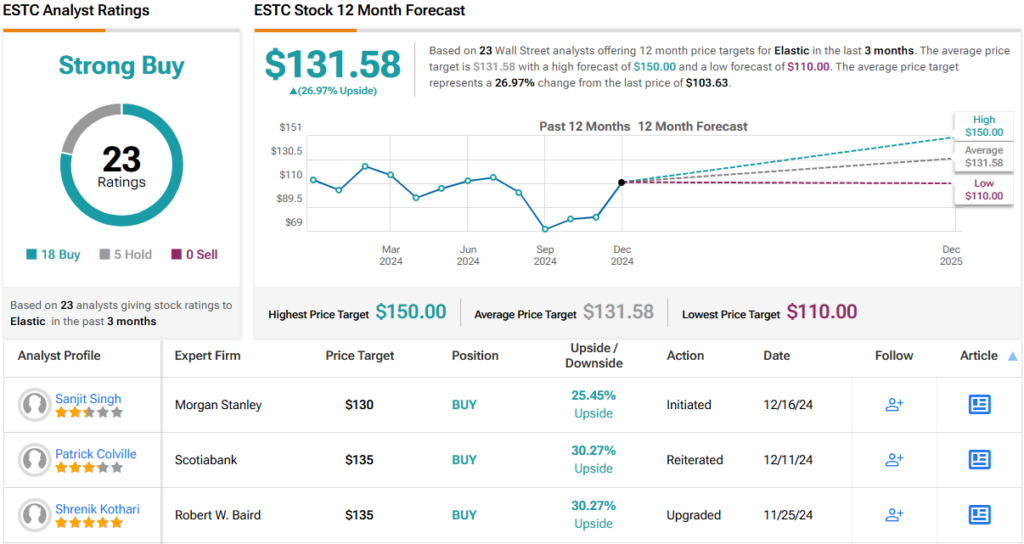

All in all, ESTC holds a Strong Buy consensus rating, based on 23 recent analyst recommendations that feature an 18 to 5 split favoring Buys over Holds. The stock’s $103.63 trading price and $131.58 average target price together imply a 12-month upside of nearly 27%. (See ESTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.