The S&P 500 plunged on Friday after a weak jobs report intensified concerns that the Federal Reserve’s decision to maintain rates at a two-decade high could lead to a deeper economic slowdown. Nevertheless, conventional wisdom anticipates that the Fed will begin cutting rates in September.

In fact, Fed-funds futures now suggest a 71.5% probability of a double rate cut (50 basis points) at the Federal Open Market Committee’s September meeting. This marks a significant increase from the 22% probability prior to the release of the jobs report.

A likely fall in interest rates promises cheaper money and easier borrowing, both of which would benefit the biotech sector. Biotech companies, which operate with high overhead costs, thrive in environments with more accessible credit.

Morgan Stanley’s equity strategist, Mike Wilson, elaborates on the quality of biotechs in a falling rate environment: “With rate cuts on the horizon, we recently discussed the case for Biotech to show relative outperformance as the Fed begins reducing the policy rate. Our analysis around prior cycles supports the notion that Biotech tends to outperform the market in periods of falling interest rates… We think this is driven by the sensitivity of biotech valuation to discount rates and the expectation for greater M&A activity on the back of falling yields, particularly around Fed cutting cycles.”

Wilson’s colleagues among the Morgan Stanley stock analysts are running with this outlook, and are advising investors to buy two biotech stocks in particular. Both have solid upside potential – as much as 230% in one case. According to the TipRanks databanks, both stocks get a ‘Strong Buy’ rating from the broader analyst consensus, too; let’s take a closer look and find out why they are primed for gains.

CervoMed (CRVO)

The first Morgan Stanley pick we’ll look at is CervoMed, a clinical-stage medical research firm specializing in neurodegenerative diseases and conditions. The company focuses on treating these conditions in their early stages, where intervention may be more manageable and effective. CervoMed has developed a leading drug candidate, neflamapimod, which targets inflammation in the synapses – the connections between nerve cells – that causes damage. Neflamapimod is currently undergoing clinical trials as a potential treatment for dementia with Lewy bodies, early-onset Alzheimer’s, and stroke recovery.

Neflamapimod inhibits the enzyme p38 alpha, which has been shown to be connected to the progression of neurological diseases. Excessive or chronic activation of this enzyme disrupts signal activity between neurons, causing synaptic dysfunction. This can lead to a wide range of symptoms, including memory loss, cognitive deficits, and impairment of motor function, with the eventual death of the damaged neurons. Neflamapimod is a small molecule compound, designed to penetrate the brain, and is administered orally.

In June of this year, CervoMed announced the completion of enrollment for the Phase 2b trial, RewinD-LB, evaluating neflamapimod. This trial aims to pave the way in a high-value potential market, with topline data expected to be released in December. Data from the earlier Phase 2a trial showed a positive impact of neflamapimod in patients with dementia with Lewy bodies.

The neflamapimod program is a pivotal aspect of this biotech stock and underpins Jeffrey Hung’s positive outlook on the shares. The 5-star Morgan Stanley analyst writes, “The data generated to date are supportive of the Phase 2b topline results expected in December 2024. Post-hoc analyses from the Phase 2a study showed significant improvements in pure dementia with Lewy bodies for key areas of focus including dementia severity, functional mobility, and cognitive tests of attention and working memory.”

Looking ahead, Hung outlines the risk-reward scenario for investors ahead of the upcoming catalyst in December: “We acknowledge that the upcoming readout will be a large binary event but have reason to believe neflamapimod will be able to target the underlying disease process to drive improvements across key measures. We think the risk/reward is skewed to the upside with potential for shares to trade up >100-150% with positive data or down 65-75% (to below cash) with disappointing results.”

Overall, the analyst expects positive clinical results and rates CRVO an Overweight (i.e., Buy). His $35 price target indicates a robust ~230% upside potential over the next 12 months. (To watch Hung’s track record, click here)

Overall, CervoMed has 4 recent analyst reviews on record, they are unanimously positive – and give the stock its Strong Buy consensus rating. The shares are priced at $10.63, and their $58.25 average price target suggests that CRVO could skyrocket ~448% in the year ahead. (See CRVO stock forecast)

Viking Therapeutics (VKTX)

Next under the Morgan Stanley microscope is Viking Therapeutics, a clinical-stage biopharmaceutical researcher dedicated to developing treatments for metabolic and endocrine disorders. The company is advancing a pipeline of novel, orally dosed small molecule compounds that have the potential to be first-in-class or best-in-class drug therapies.

The pipeline features three drug candidates targeting obesity, non-alcoholic steatohepatitis (NASH), and X-linked adrenoleukodystrophy (X-ALD). These candidates are currently undergoing four clinical trials, including two featuring the lead drug candidate VK2735 for the treatment of obesity.

VK2735 is being tested for both subcutaneous and oral dosing. The subcutaneous Phase 2 VENTURE trial has demonstrated significant weight reduction, comparing favorably to existing GLP-1 treatments. Based on these positive results, Viking is planning an end-of-Phase 2 meeting with the FDA and expects to reveal details about the upcoming Phase 3 trial afterward. Similarly, a Phase 1 study of the oral formulation of VK2735 showed promising weight reduction and an improved tolerability profile, supporting further dose escalation. Viking intends to start a Phase 2 trial of the oral VK2735 in the fourth quarter.

In addition to VK2735, Viking is optimistic about VK2809, its candidate for NASH. In June, the company reported positive results from the 52-week histologic data of the Phase 2b VOYAGE study, showing significant improvements in NASH resolution, fibrosis, and better tolerability compared to Madrigal’s newly approved Rezdiffra. Viking intends to meet with the FDA in the fourth quarter to discuss the future steps for VK2809.

Lastly, the company is working on VK0214, an orally available thyroid hormone receptor beta agonist, as a potential treatment for X-linked adrenoleukodystrophy (X-ALD). This rare neurodegenerative disease currently has no pharmacologic treatments. Viking has finished enrolling participants for the Phase 1b study of VK0214 and expects to announce the results by the end of the year.

These significant ‘shots on goal’ have caught the attention of analyst Michael Ulz. In his coverage of Viking for Morgan Stanley, Ulz lays out an optimistic stance: “The company’s lead asset, VK2735 (SC/oral), has shown promising early results, indicating a potential best-in-class profile in the large and growing obesity market. While obesity remains the focus, we believe recent data for VK2809 suggests potential in NASH, which represents another, potentially larger market opportunity. Overall, we believe early data de-risk both programs and we expect multiple catalysts in 2H24 to drive additional upside.”

These comments support Ulz’s Overweight (i.e. Buy) rating on VKTX, and he complements that with a $105 price target that shows his confidence in a 98% upside on the 12-month horizon. (To watch Ulz’s track record, click here)

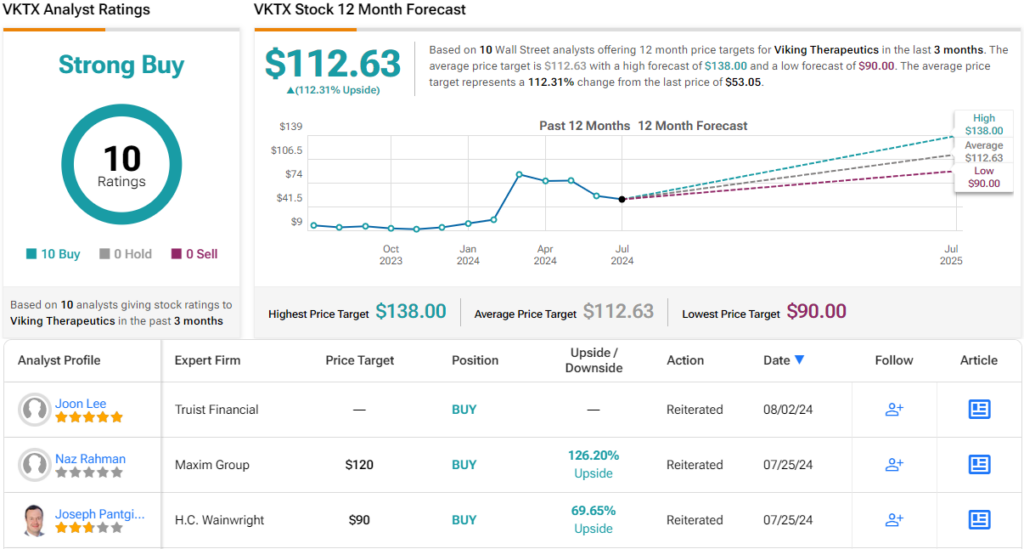

All in all, there are 10 positive reviews on record for VKTX, supporting the Strong Buy consensus rating. The shares are currently trading for $53.05 and the stock has a 112% upside for the coming year, based on its average price target of $112.63. (See VKTX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.