After sort of winning the World Cup with its first commercial offering, the Covid-19 vaccine Spikevax, questions have been raised on whether Moderna (MRNA) can follow up its success.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

That remains to be seen although the latest news out of Moderna HQ had investors thinking the odds might be quite good. On Tuesday, shares pushed higher after the company and its partner Merck announced excellent results from the mid-stage testing of its personalized cancer vaccine mRNA-4157.

In the Phase IIb KEYNOTE-942 study, in combination with Keytruda compared to Keytruda on its own, the vaccine improved recurrence-free survival (RFS) in melanoma (a serious form of skin cancer) patients by 44%. Having met the primary endpoint, the vaccine also provided PoC (proof of concept) for Moderna’s mRNA vaccine platform in cancer.

Pending the go-ahead from the regulators, the two companies now intend to move forward with a Phase 3 study next year.

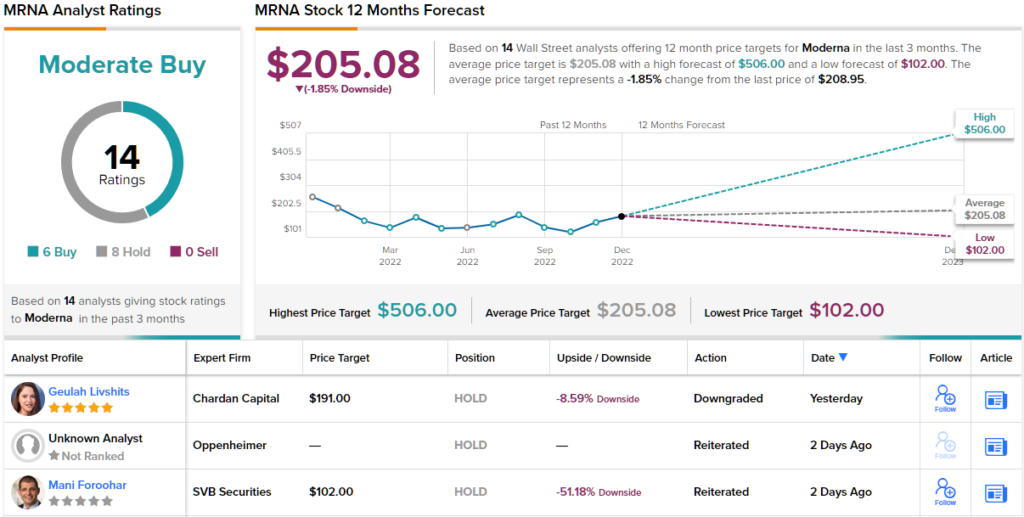

The results are “impressive,” says Chardan’s Geulah Livshitz. “The update represents the 1st demonstration of improvement in RFS over Keytruda in resected melanoma and the 1st demonstration of efficacy for an mRNA cancer treatment in a randomized study,” the 5-star analyst went on to say.

Apart from offering some “much-needed validation” for the cancer vaccine space, the results could also have positive implications for other “checkpoint combo programs.”

However, with the stock getting a nice 20% bump on the back of the results, the share price has “caught up” with Livshits’ valuation and that merits a reassessment of the analyst’s model.

“While we remain positive on the broad potential for mRNA in infectious disease vaccines as well as in oncology, autoimmune, and rare disease applications, the updates to our oncology franchise estimates bring our PT to $191, indicating to us the company is fairly valued at present,” the analyst summed up.

Accordingly, while Livshits has bumped the price target up from $186 to $191, “pending further details on the oncology strategy as well as updates on Covid/flu/RSV programs,” the rating is lowered from Buy to Neutral. (To watch Livshits’ track record, click here)

Looking at the consensus breakdown, based on 6 Buys vs. 8 Holds, the analysts’ view is that this stock is a Moderate Buy. The average target currently stands at $200.46, suggesting the shares will remain rangebound for the foreseeable future. (See Moderna stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.