Microstrategy (NASDAQ:MSTR) is among the most aggressive Bitcoin (BTC-USD) hoarders, but insider selling activity raises a red flag for prospective investors. There are aspects that I like about Microstrategy, but I am neutral on MSTR stock and prefer to watch it from the sidelines.

Microstrategy is an enterprise analytics and mobility software provider, but that’s not how most stock traders think about the company nowadays. Typically, people think of Microstrategy as a company that buys a lot of Bitcoin. They might also think about the company’s co-founder and executive chairman, Michael Saylor, who once described Bitcoin as a “swarm of cyberhornets serving the goddess of wisdom.”

Saylor’s a real character — no doubt about it. He’s a Bitcoin believer, or at least he seems to be – but then, what if we found out that he’s dumping his Microstrategy shares? This should certainly raise concerns among prudent investors, so let’s catch up on the latest headline news with Microstrategy.

Microstrategy Stock Rides on Bitcoin’s Coattails

Saylor once said that Bitcoin is a “bank in cyberspace.” If so, then that bank has made a lot of bank for Microstrategy’s shareholders. Today, as Bitcoin zoomed past $70,000, MSTR stock soared to an eye-watering $1,856.

That’s fine, I suppose, if you’re more interested in momentum than value. If you haven’t noticed, whenever Bitcoin blasts higher, suddenly, people announce sky-high price targets. For instance, ARK Investment Management CEO Cathie Wood now envisions Bitcoin hitting $3.8 million by 2030.

If you’re on board with that forecast, then I suppose it doesn’t matter what price you pay for Microstrategy stock. After all, the stock will very likely follow the Bitcoin price, as it has done in the recent past.

It makes sense that MSTR stock would follow Bitcoin, as the company holds a whole lot of the crypto coin. From March 11 to March 18, Microstrategy reportedly acquired approximately 9,245 Bitcoins. Consequently, Microstrategy and its subsidiaries held a total of around 214,246 Bitcoins.

The math on this is jaw-dropping. If there will only ever be 21 million Bitcoins in existence, then Microstrategy owns slightly more than 1% of that total. So, it’s fair to conclude that Microstrategy is all in on Bitcoin, and you should be as well if you intend to buy MSTR stock.

Why Are Microstrategy’s Insiders Selling Their Shares?

One thing I recommend for all traders and investors is to check TipRanks’ Insider Trading Activity page on any particular stock of interest. In the case of Microstrategy, this company’s Insider Trading Activity page reveals that Microstrategy’s Insider Confidence Signal is Very Negative.

Indeed, it’s a negative indicator when a company’s insiders are divesting shares of that company. It’s even more telling, though, in the case of Microstrategy because the company’s main cheerleader, Michael Saylor, is a repeated share seller.

I’ve come across multiple reports of Saylor selling thousands of Microstrategy shares in March. Just on March 20, Saylor reportedly sold $1,555,466 worth of MSTR stock shares.

Checking back on the Insider Trading Activity page, I was able to confirm multiple Microstrategy share sales initiated by Saylor. Separately, I discovered two separate reports of Director Jarrod Patten selling thousands of MSTR shares in March.

This, to me, at least, is a red flag for Microstrategy. Saylor, in particular, ought to be a net buyer of Microstrategy stock this year. Granted, it would make sense for Saylor to take profits after the stock’s wild rally that started in early February. On the other hand, if he really believes in his company’s future and sees Bitcoin as a high-conviction “bank in cyberspace,” then Saylor should lead by example and load up on Microstrategy shares in 2024.

I’m starting to wonder whether Saylor is actually apprehensive about Bitcoin – or, as he called it, the “swarm of cyberhornets.” His company is so fully loaded up on Bitcoin that there’s no going back now. If there’s a “crypto winter,” Saylor and other shareholders could lose a lot of money on MSTR stock.

Is MSTR Stock a Buy, According to Analysts?

On TipRanks, MSTR comes in as a Strong Buy based on four unanimous Buy ratings assigned by analysts in the past three months. Nonetheless, the average Microstrategy stock price target is $1,346.67, implying 27.4% downside potential.

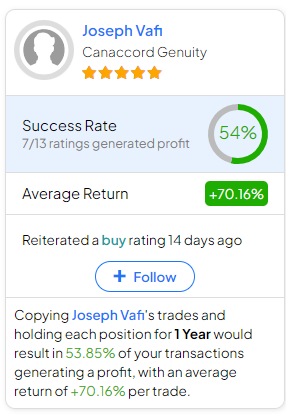

If you’re wondering which analyst you should follow if you want to buy and sell MSTR stock, the most profitable analyst covering the stock (on a one-year timeframe) is Joseph Vafi of Canaccord Genuity, with an average return of 70.16% per rating and a 54% success rate. Click on the image below to learn more.

Conclusion: Should You Consider MSTR Stock?

I actually like Microstrategy’s bold bet on Bitcoin and Saylor’s gumption. However, now that Microstrategy has followed Bitcoin on a vertical move higher, it’s not a bad idea for investors to take profits and/or sit on the sidelines.

More than anything else, I’m concerned about Saylor’s recent large-scale share sales. With all of that in mind, I’m watching from a distance and am not currently considering MSTR stock.